What is a trailing stop and how do I use it?

A trailing stop is a stop that automatically adjusts to market movement. This means it will follow your position when the market moves in your favor. This will allow you to manage profits and losses in fast moving markets.

You set a trailing stop via the trade ticket in the same way as you set a normal stop. When setting a trailing stop you need to set the stop distance, as with a normal stop, and the trailing stop. The trailing stop is the number of pips the market needs to move in your favor before your trailing stop will move with it.

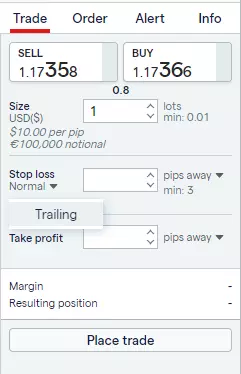

Adding a trailing stop on the trade ticket

- Click on the drop-down menu under ‘stop’

- Select ’trailing’

- Enter your stop loss and trailing stop where prompted

Note: The trailing stop option will not be available on the order ticket if you are placing a working order.

A trailing stop in action

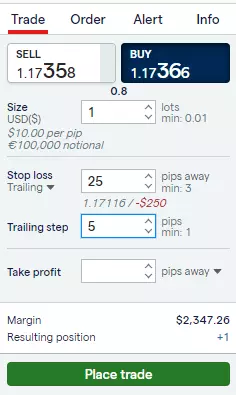

Say you have a long position on EURUSD at 1.17366. You set your stop distance at 25 pips away from the current market level, and your trailing stop at a distance of 5 points.

EURUSD moves in your favor by 5 points to 1.17416. This move of 5 pips will have your trailing stop triggered, adjusting your stop level to 1.17166 – maintaining a distance of 25 points from your new position. Your stop level will continue to be adjusted every time EURUSD moves a further five points past 1.17416.

If EURUSD were to hit a high of 1.18066 before retracing by 70 points, your trailing stop will have been fixed at 1.17816 and your position closed out, earning you a profit.

With a normal stop your position would have closed at 1.17116, earning you a loss.

Please bear in mind that trailing stops are not guaranteed, and so can be subject to slippage. This means that they may not be executed exactly at the level you’ve specified.