JOIN THE #1 FOREX TRADING PLATFORM AND EARN UP TO $10K*

Open, fund, trade, and get rewarded with the #1 US Forex Broker1

MORE THAN A FOREX TRADING PLATFORM

We support you at every stage of your FX trading journey, whether you are an ambitious beginner investing in forex or an advanced trader

80+ forex pairs and $0 commissions2

Gain the ability to trade on over 80 FX pairs and take advantage of spreads from 0.8 pips, always commission-free.2

Comprehensive FX trading support

Available 24/5 from 3am Saturday to 5pm Friday EST. Access phone, email or live chat with designated support team members.

All forex. All the time.

Stay informed of news and price action critical to forex trading, including FX market commentary on YouTube.

BONUS UP TO $10,000 TO START TRADING FOREX

New forex trading accounts at tastyfx are eligible for cash bonuses based on qualifying tiers. To qualify for a cash bonus, you will need to open a new forex trading account using one of the CREATE LIVE ACCOUNT links on this page, then fund and trade the account.*

*Terms and conditions apply. ZAR/JPY SEK/JPY NOK/SEK NOK/JPY MXN/JPY TRY/JPY PLN/JPY CNH/JPY excluded from promotion. Maximum bonus amount $10,000.

TRADE FOREX IN JUST 3 SIMPLE STEPS

Open a free account, with no hidden costs

Fill in our simple online form

Provide required documentation

Get verified, instantly

We can usually verify your identity immediately

Fund and start trading

Withdraw money easily, whenever you like

AWARD-WINNING US FOREX BROKER

Start trading FX with the #1 US broker for Trust Score, Web Platform, Mobile App…need we say more?1

Trade 80+ Currency Pairs Commision-Free

Trade 80+ forex markets including major pairs (GBP/USD, USD/JPY), minor pairs (USD/ZAR, USD/SGD), and exotic pairs (USD/MXN, USD/CNH).

Major currencies

| Markets | Sell | Buy | Change |

|---|---|---|---|

| GBP/USD | - | - | - |

| EUR/USD | - | - | - |

| USD/JPY | - | - | - |

| USD/CAD | - | - | - |

| AUD/USD | - | - | - |

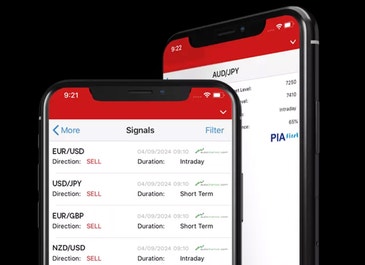

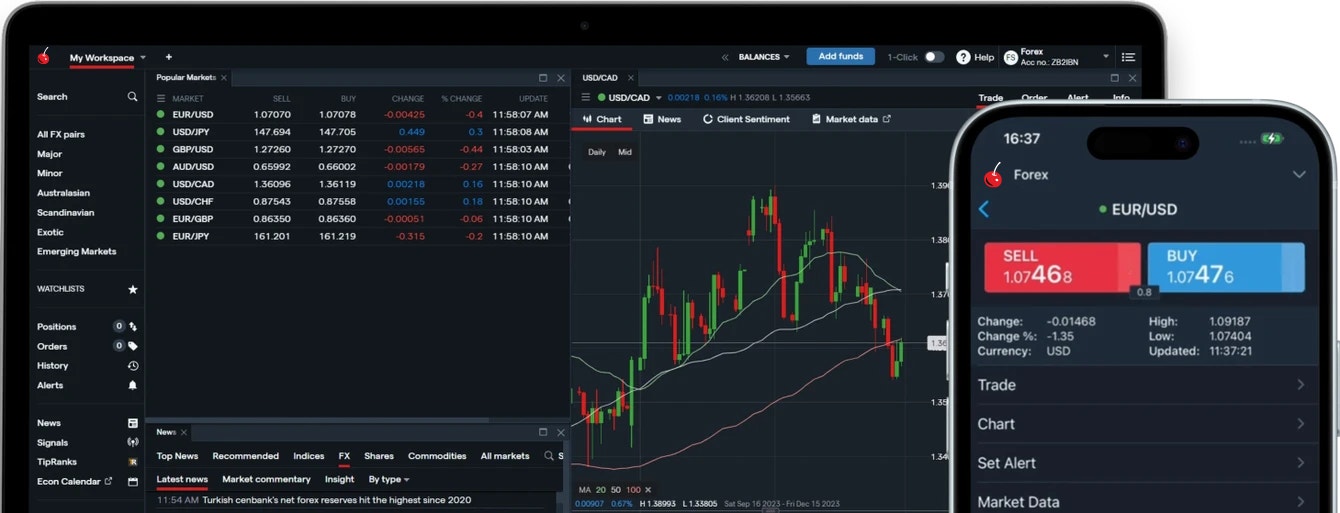

SEAMLESS FX TRADING

On our user-friendly and intuitive platforms

Our comprehensive online forex platform keeps you in control with forex alerts, trading signals, and analytics supplementing your strategy.

All the features you need to easily trade forex, whenever and wherever you need them.

Using MetaTrader or TradingView? Looking for advanced charting or automated trading? Trade forex with tastyfx and enjoy exclusive add-ons.

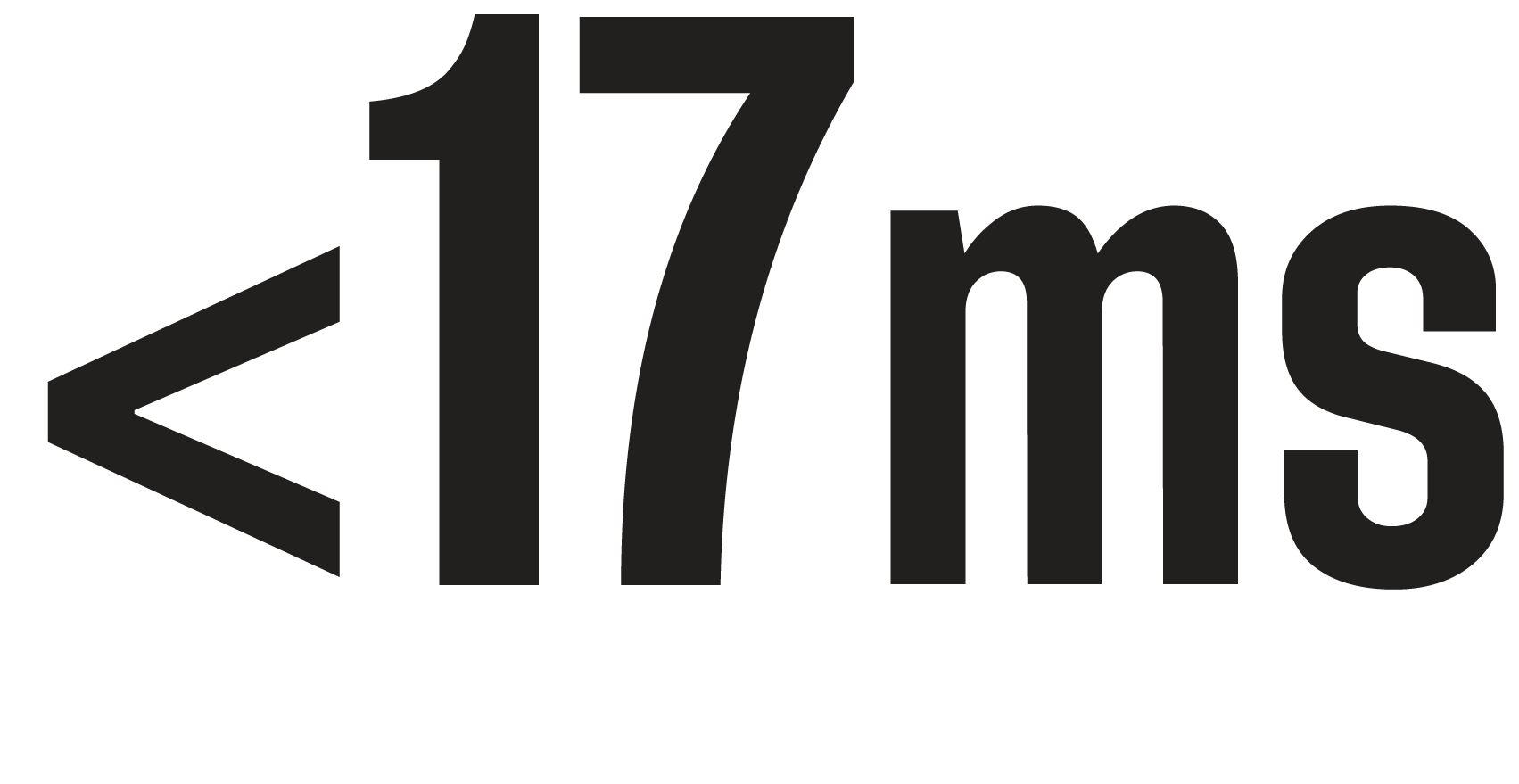

OUR NUMBERS DO THE TALKING

Our focus is on your trading experience—starting with fast execution and tight spreads.

Trades executed in less than 1 second

of trades executed in less than one second in percentage3

Average execution speed

(0.0164 secs) time between order ticket and execution3

Minimum spreads

pips on major pairs like EUR/USD

.jpg?format=pjpg&auto=webp&quality=90)

TRY OUR ONLINE TRADING PLATFORM

Get started with a live account, or take our online trading platform for a test drive. Open a free tastyfx demo account and you’ll get $10,000 in virtual funds to practice with.

.jpg?format=pjpg&auto=webp&quality=90)

TRY OUR ONLINE TRADING PLATFORM

Get started with a live account, or take our online trading platform for a test drive. Open a free tastyfx demo account and you’ll get $10,000 in virtual funds to practice with.

Major Forex Pairs

EUR/USD

$10

0.8

2%

USD/JPY

JPY 1000

0.8

5%

GBP/USD

USD 10

1

5%

AUD/USD

USD 10

1

3%

USD/CAD

C$10

1.5

2%

Minor Forex Pairs

GBP/JPY

Y1000

2.5

5%

CHF/JPY

Y1000

2

5%

CAD/JPY

Y1000

3

5%

GBP/CAD

C$10

4

5%

GBP/CHF

CHF10

3.2

5%

FREQUENTLY ASKED QUESTIONS

Investing in forex can be done by buying one currency in exchange for another based on your long-term opinion of where currencies are likely to move in price. For example, if you think the euro will appreciate at the expense of the US dollar (or, rather, that the euro-dollar exchange rate will increase), you can forex invest by buying the EUR/USD forex pair.

Trading platforms are always a matter of preference, so the best forex trading platform is the one you, the trader, likes using the most. That said, tastyfx is currently the #1 Web Platform and #1 Mobile App award winner by ForexBrokers.com.1

Forex trading works by simultaneously buying one currency while selling another. If the currency you have bought increases in value against the currency you have sold, you can close your position for a profit. If not, you make a loss.

Forex markets are always quoted in pairs—EUR/USD, for example—because you’ll always be trading one currency for another. The exchange rate is how much one unit of the first (‘base’) currency costs in the second (‘quote’) currency Say the EUR/USD exchange rate is quoted as 1.1700. This means that it would cost 1.17 dollars to buy a single euro.

Pips are a forex-specific synonym for basis points or ‘points’—the smallest amounts by which a market price can change. For major currencies, a pip is a standardized unit of 1/100th of 1%, or 0.0001, except for pairs including the Japanese yen. For these pairs, a pip is equal to 0.01. At tastyfx, we tend to use the term ‘pips’, but you may see ‘points’ used interchangeably by other brokers.

Major currency pairs are those that trade in the highest volume on a daily basis. These pairs tend to be incredibly liquid and trade 24 hours a day, usually with very narrow spreads. Some examples include EUR/USD, USD/JPY, GBP/USD and USD/CHF.

Minor currency pairs can vary depending on where you look. Some brokers stipulate that a minor pair can’t include the US dollar, for example, and as such refer to them as ‘crosses’.

More generally, a minor pair is any currency pair that’s traded less frequently than the majors, even if one or both constituent pairs also appear in a major currency pair. Some of the more popular include CHF/JPY, GBP/CAD and EUR/SGD.

Exotic currency pairs, or ‘exotics’ for short, are made up of one major currency along with another from a small or emerging economy. Examples include GBP/MXN (sterling and the Mexican peso) or USD/PLN (the US dollar and the Polish zloty).

Retail Foreign Exchange Dealers that offer rolling spot FX to U.S. customers, are regulated by the Commodity Futures Trade Commission (CFTC) and the National Futures Association.

Gaps are points in a market when there is a sharp movement up or down with little or no trading in between, resulting in a ‘gap’ in the normal price pattern. Gaps do occur in the forex market, but they are less common than in other markets because forex is traded 24 hours a day, five days a week.

However, gapping can occur when economic data is released that comes as a surprise to markets, or when trading resumes after the weekend or a holiday. Although the forex market is closed to speculative trading over the weekend, the market is still open to central banks and related organizations. So, it is possible that the opening price on a Monday morning will be different from the closing price on the previous Saturday morning – resulting in a gap.

The cost of trading forex depends on which currency pairs you choose to buy or sell. With tastyfx, you’ll trade forex on margin , which means you need a small percentage of the full value of the trade to open and maintain your position. Margin isn’t a direct cost to you, but it has a significant impact on the affordability of your trade.

Other than the margin, you also pay a spread, which is the difference between the ‘buy’ and the ‘sell’ price of an asset. To open a long position, you’d trade slightly above the market price (buy price) and to open a short position, you’d trade slightly below the market price (sell price). Lastly, if you do not close your position before the end of the trading day, you will pay overnight funding charges.

The best time to trade forex will depend on your personal risk preference, as high liquidity and volatility can affect forex prices. When the London session opens at 3am (EST), liquidity and volatility will likely be high as traders begin interacting with each other. Trading will usually become less liquid a few hours later, and it will pick up again after the American session opens at around 9:30am (EST).

The foreign exchange market is open 24 hours a day, five days a week—from 3am Sunday to 5pm Friday (EST). So, you can trade at a time that suits you and take advantage of different active sessions.

Remember: the forex market’s opening hours will change when certain countries shift to daylight savings time.

To start trading forex, you’ll need to make sure there is enough capital in your trading account. There is no enforced minimum, but it is often suggested that traders shouldn’t risk more than 1% of their account on each trade. For example, if your account contains $10,000, then you may decide not to risk more than $100 on a single trade.

Whether you’re completely new to trading or have traded other markets before, the volatility of the forex market is a unique environment that takes time to understand. Developing trading knowledge, building a forex trading strategy and gaining experience trading the market are essential for anyone seeking to trade forex. An tastyfx demo account is an ideal place to start trading forex and practice your strategy without any risk to your capital.

A forex trading strategy should take into account the style of trading that best suits your goals and available time. For example, day trading is a strategy that involves opening and closing positions within a single trading day, taking advantage of small movements in the price of a currency pair. On the other hand, position trading is the strategy of holding positions open for a longer amount of time to take advantage of major price movements. Both have different time commitments and different techniques needed for success.

The nature of the forex market is extremely volatile, so a currency pair that moves a lot one week might show very little price movement the next. However, the majority of forex trading volume is found on a handful of forex pairs, including EUR/USD, USD/JPY, GBP/USD, AUD/USD and USD/CHF.

1 #1 Overall Broker, #1 Mobile App, #1 Trust Score, #1 Education, #1 Web Platform are accolades presented to IG, parent company of tastyfx, on January 28, 2025, during the ForexBrokers.com 2025 Annual Awards. Accolades were awarded by the ForexBrokers.com research team based on demonstrated excellence in categories considered important to investors, traders, and consumers. Click here to learn about how they rate brokers.

2 tastyfx does not charge commissions. tastyfx is compensated through a hedging arrangement with IG Markets Ltd.

3 Average execution speed calculated using a 3-month average ending 12/31/2024.