Forex trading for beginners

Forex trading doesn’t have to be intimidating. Equip yourself with the skills needed to start your forex trading journey—using an award-winning* online forex trading provider.

WHAT YOU NEED TO KNOW TO START TRADING FOREX

Forex trading is slightly different than that of stocks and bonds, but those differences can afford traders diversification as well as new opportunities. Learn how the forex market works, how its products are priced, and how trading works in this large marketplace.

WHAT'S ON THIS PAGE?

1. What is the forex market?

The forex market is not a centralized place or physical place, it's an abstract concept related to the buying and selling of foreign exchange. It’s made up of transactions from various organizations such as banks, institutions, private individuals and governments. On average, the forex market sees trillions of dollars' worth of trades daily.

The forex markets are extremely liquid, and often quite volatile, depending on the currency pair you’d like to trade. Some of the most well-known currency pairs include:

- GBP/USD: The British pound against the US dollar

- EUR/USD: The European Union’s euro currency against the US dollar

- USD/JPY: the US dollar against the Japanese yen currency pair

- USD/CHF: The US dollar against Swiss franc

2. How do forex pairs work?

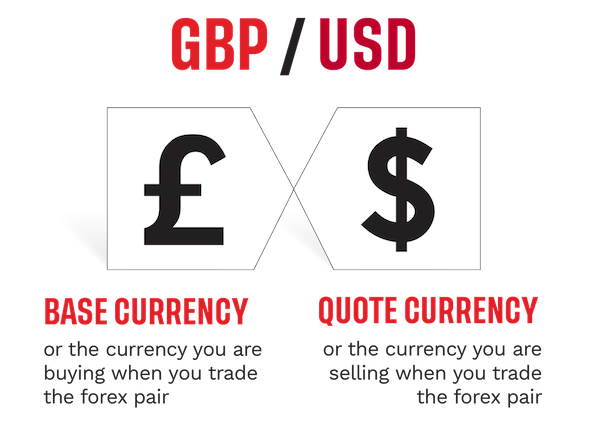

A forex pair consists of two currencies that are being exchanged (or traded for each other). Forex pairs are composed of a base and quote currency. A base currency is the first currency that is quoted against the other.

For instance, the GBP/USD currency pair has the British pound as the base currency and the US dollar as the quote currency. The price represents how many dollars you'd need to spend to buy one British pound. If the price of GBP/USD is 1.21, it means that you would need $1.21 to buy a single British pound.

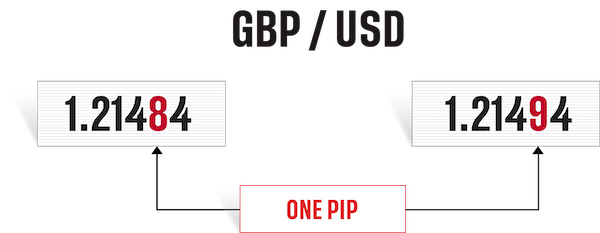

WHAT IS A 'PIP' IN FOREX?

‘Pip’ is an acronym for ‘point in percentage’ representing a movement that’s equivalent to a hundredth of one percent (1%). For example, GBP/USD with the quote currency equivalent to 1.21494 means a pip movement would be seen on the fourth decimal point, which is the 9 in this case, while the last 4 is a ‘baby pip’.

3. What factors affect exchange rates?

Ultimately, exchange rates are set by supply and demand. When demand for one currency outstrips that of the other in the pair, the price of that currency goes up. For instance, in the case of USD/EUR pair, this will take place when more people want to buy US dollars than euros at one time.

Whatever affects these market forces will have an impact. These never work in isolation from each other or other economic variables. Below are some factors that affect the exchange rate:

- Global economic health. Strong, stable economies with no political risk and conflict are likely to attract a healthy amount of foreign direct investment, increasing the country’s wealth.

- Domestic interest rates. When a country’s central bank changes interest rates, this has a direct impact on the inflation and exchange rates. Higher interest rates mean higher returns for the lender.

- Inflation. A relatively lower inflation rate results in a stronger currency value, increasing a country’s purchasing power against other currencies.

- Changes in domestic stock prices. A rise in the domestic stock market price increases investor confidence as it indicates the strengthening of a country’s economy. This is likely to attract foreign investors and increase demand for the domestic currency.

- Changes in commodity markets like oil and gold. The price fluctuations of highly valued commodities like oil and gold have a strong influence on the exchange rate movements. Oil and gold prices have an influence on a country’s currency and volatility.

- Domestic or national economic health and events. A country’s domestic events have an influence on market sentiment. Positive economic events attract investment into a country, while negative ones are likely to result in disinvestment.

- Balance of payments (BOPs). These are transactions a country makes with other economies across the globe within a specified timeline. BOPs can result in fluctuations in domestic and foreign exchange rates, depending on the supply and demand of the stronger currency.

4. How do you trade forex pairs?

Forex is traded in ‘lots’, which are often very large, equivalent to 100,000 units of the base currency. You’ll likely want to buy the currency you believe will strengthen and then try to sell it later for a profit.

Alternatively, you’d sell the currency you believe will weaken and then try to buy it back later at a lower price, thereby making a profit.

Learn more about how to trade forex

GOING LONG VS. GOING SHORT IN FOREX

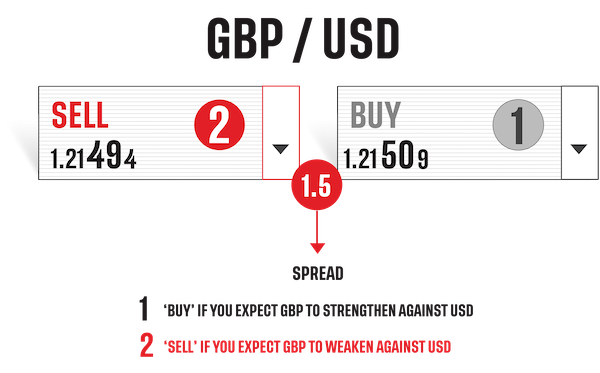

You’ll buy a currency pair to go long and sell it to go short. When you ‘go long’ it means you’re buying the base currency and selling the quote currency. For example, in the case of GBP/USD, you go long if you expect the pound to strengthen against the dollar. You’ll earn a profit if your long position on the currency pair increases in price.

If you short (‘sell’) a currency pair, you’d be expecting the base currency to depreciate against the quote currency. Using the same GBP/USD as an example, you could short pounds for dollars. If the dollar strengthens, the price of the pound would have dropped.

This means you can buy more pounds for your dollars than you originally spent, earning you a profit.

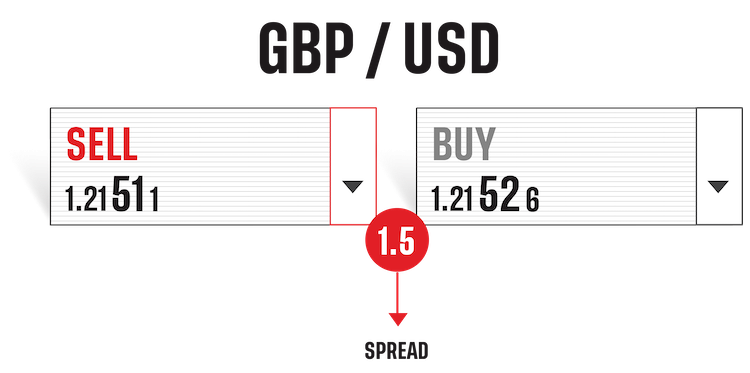

WHAT IS THE SPREAD?

In forex, a spread is a small fee (quoted in pips) built into the buy (bid) and sell (ask) price of every currency pair you trade. This is seen on a deal ticket as a difference between the buy and sell prices quoted for a currency pair.

5. Example of a forex pairs trade

Below are two examples of opening a position in the GBP/USD currency pair, depending on which currency you expect to appreciate—relative to the other.

BUYING ON THE SPOT FOREX MARKET

You’ll go long (‘buy’) on the spot price of a forex pair, if you expect the base currency’s value to rise against the quote. For example, if GBP/USD is trading at 1.2200, with a 1.2210 buy price and a 1.2190 sell price, you’d buy at 1.2210 since you expect GBP to rise in value against USD. You can also set a stop-loss to manage your risk.

SELLING A SPOT FOREX MARKET

You’ll short a forex pair on its spot price if you expect the quote currency to rise in value against the base. For example, if GBP/USD is trading at 1.2200, with a 1.2210 buy price and a 1.2190 sell price, you’d sell at 1.2190 since you expect USD will rise in value against GBP.

6. How to practice forex trading

You can open a demo account to practice your forex pairs trading. It’s free. Known as paper trading, the demo lets you build your confidence and gain deeper insight into how FX markets work. You’ll get $10,000 in virtual funds, and you’ll be able to take positions on spot forex markets.

7. What are the advantages and risks of forex trading?

| Advantage | Risk | |

|---|---|---|

Market volatility | Means that large movements can happen very quickly, which could result in sizeable returns | Means that large movements can happen very quickly. This could result in sudden and unexpected losses. |

Leverage | Trading on margin ‘gears’ your exposure. If you only put down a 3.3% deposit to open a larger position, this means your leverage ratio is 1:30. Every 1% rise in the market will mean a 30% profit on your deposit amount. | When you trade on margin, it’ll increase your exposure. If you only put down a 3.3% deposit to open a larger position, this means your leverage ratio is 1:30. Every 1% drop in the market will mean a 30% loss to your deposit amount. Losses can exceed deposits. |

Market liquidity | Less complex to buy or sell, so you can exit or open trades quickly | Less complicated to buy or sell, which may contribute to market volatility |

Learn more about the benefits of forex trading

8. How do you open a forex trading account?

Here are a few simple steps on how to open a forex trading account with us:

1. Fill in a form

Fill in an application form and review required documentation to open a live account with us. We’ll ask you about your trading knowledge to ensure you get the best experience.

2. Wait for verification

Verifying your identity usually takes a couple of days.

3. Fund your account and start trading

You can easily withdraw your money from your funded account, whenever you like.

* #1 Overall Broker, #1 Mobile App, #1 Trust Score, #1 Education, #1 Web Platform are accolades presented to IG, parent company of tastyfx, on January 28, 2025, during the ForexBrokers.com 2025 Annual Awards. Accolades were awarded by the ForexBrokers.com research team based on demonstrated excellence in categories considered important to investors, traders, and consumers. Click here to learn about how they rate brokers.