What are the major currency pairs?

The major currency pairs are some of the most popular currency combinations in the forex market. Learn more about what influences major forex pairs and how to trade them.

TRADING FOREX USING MAJOR PAIRS

Most trading in forex's high-volume marketplace is done in the major pairs since they tend to be liquid (tight bid-offer spreads) and more accessible (low margin rates). Learn what the major pairs are as well as how and why you might trade them when getting started with forex trading.

WHAT'S ON THIS PAGE?

1. What are the major forex pairs?

There are four major forex pairs, namely EUR/USD, USD/JPY, GBP/USD and USD/CHF. While opinions may differ somewhat over a definitive list of major currencies, almost all will include these traditional ‘four majors’, as well as the three most-traded ‘commodity currencies’ against the US dollar, which are AUD/USD, USD/CAD and NZD/USD.

Although many lists only include these seven majors, some traders would also include key currency pairings that don’t feature the US dollar at all—otherwise known as ‘cross currencies’—in their list of major currencies. Some of the most traded of these are GBP/EUR, EUR/CHF and EUR/JPY.

The table below gives more details about the majors, as well as their nicknames on the market.

LIST OF MAJOR CURRENCY PAIRS

| Symbol | Currencies in the pair | Nickname |

|---|---|---|

EUR/USD | Euro and US dollar | Fiber |

USD/JPY | US dollar and Japanese yen | Gopher |

GBP/USD | British pound and US dollar | Cable |

USD/CHF | US dollar and Swiss franc | Swissie |

AUD/USD | Australian dollar and US dollar | Aussie |

USD/CAD | US dollar and Canadian dollar | Loonie |

NZD/USD | New Zealand dollar and US dollar | Kiwi |

GBP/EUR | Euro and British pound | Chunnel |

EUR/CHF | Euro and Swiss franc | Euro-swissie |

EUR/JPY | Euro and Japanese yen | Yuppy |

2. The four traditional majors explained

Below is a profile on each of the four traditional major currencies, as well as what affects their price movements. It’s worth mentioning that the most popular currency pairs in terms of trading volume aren’t always considered majors. As an example, AUD/USD is currently the fourth most traded currency pair in the world, but it isn’t counted among the four traditional majors.1

The four traditional majors are:

- EUR/USD

- USD/JPY

- GBP/USD

- USD/CHF

TRADING EUR/USD

EUR/USD is the most traded forex pair in the world. It holds the euro as the base currency and the US dollar as the quote currency, so the price represents how many dollars you’d need to spend to buy one euro. For example, if the price quoted for EUR/USD was 1.1800, you’d have to spend $1.18 to buy €1.

The popularity of EUR/USD as a currency pair means that it’s highly liquid and that brokers often offer tight spreads. It tends to be less volatile than other currency pairs because the US dollar and the euro are backed by the world’s two largest economies.

But, this doesn’t mean that there’s no volatility in the pair—and there’s still an opportunity for traders to realize a profit or incur a loss. This was particularly true with the uncertainty surrounding the dedollarization of global trades that started to take shape in 2023.

For a long time, the default currency for international trades was the US dollar. The shift away from the US dollar by countries such as China and Russia has reduced its demand globally, which has had a negative effect.

A look at the above price chart highlights the degree of volatility that can be found in even relatively stable currency pairs over a period of five years.

TRADING USD/JPY

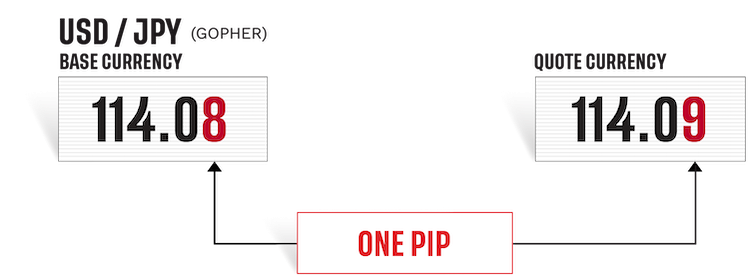

The first thing that many traders will notice about USD/JPY is that the value of a single pip is much larger than that of the majority of other currencies—often only being quoted to two decimal places. This is the case for any currency pair in which the yen appears as the quote currency, and it occurs because of the relatively low value of the yen against the dollar.

The yen’s low value relative to the dollar is due in part to the quantitative easing and low interest rate policies of the Bank of Japan (BoJ). The low interest rates are an attempt by the BoJ to combat low inflation and slow growth, which has resulted in near-zero or even negative interest rates in Japan at many points in the last 20 years.

The yen is often used as one half of a carry trade, which is where a trader borrows money in a country that has low interest rates and invests in a country that has higher ones. Additionally, the yen is widely recognized as a ‘safe haven’, which can see it rise in times of economic uncertainty. This also leads the value of the USD/JPY pair to be correlated with the USD/CHF pair—because CHF is also seen as a safe haven, which is explained in section four.

TRADING GBP/USD

GBP/USD has the pound as the base currency and the US dollar as the quote currency, meaning it shows how many dollars you’d need to spend in order to buy one pound. GBP/USD is colloquially called ‘cable’ on account of the deep-sea cables that used to transfer price information between London and New York.

Generally speaking, 9am (EST) is when liquidity is most concentrated in this pair, due in part to the fact that this is the time that sees the most overlap in activity for traders in both London and New York.

Learn more about stock market trading hours around the world

TRADING USD/CHF

The presence of the Swiss franc among the top four currencies can look a little odd at first glance. After all, Switzerland isn’t a major global economy—unlike America, Europe, Japan or the UK.

But—similar to the yen—the Swiss franc owes much of its popularity to its status as a safe-haven currency. This has made the franc a popular currency in times of economic uncertainty or market turmoil, as traders seek markets that are perceived as lower risk—similar to the USD/JPY pair.

Switzerland’s long-held reputation for financial stability, safety and neutrality ensures that its reputation as a safe haven is all but solidified. Equally, when market volatility is low, the Swiss franc usually tends to follow the market movements of the euro, due to the close economic relationship that Switzerland has with the Eurozone.

3. Commodity currencies

Commodity currencies are individual currencies or forex pairs in which the price is determined largely by the value of a certain commodity whereby that currency’s economy is heavily dependent.

The three commodity currencies that most traders will include on a list of the ‘majors’ are:

- AUD/USD

- USD/CAD

- NZD/USD

TRADING AUD/USD

If you want to start trading AUD/USD, it’s important to keep an eye on the value of gold and coal on the commodities market, as well as the value of other metals such as copper. This is because any fluctuation in the value of these commodities will likely cause a reciprocal fluctuation in the value of the Australian dollar relative to the US dollar.

As with other commodity currencies, the value of the US dollar greatly affects the pricing of the AUD/USD pair. This is because a stronger US dollar often means that Australian exports will be cheaper, which can reduce the value of the Australian dollar.

TRADING USD/CAD

The value of the Canadian dollar is largely tied to the price of oil because oil is the country’s main export. As a result, if the price of oil changes—perhaps because of a change in the Organization of the Petroleum Exporting Countries (OPEC) production quotas—then the price of the Canadian dollar will likely be affected.

For example, if the supply of oil was increased by OPEC, oil’s price would likely fall and, in turn, could bring down the value of the Canadian dollar. Similarly, since oil is priced in US dollars, any fall in the value of oil will likely see a reciprocal strengthening of the US dollar.

Just like with the AUD/USD pair, this means that Canadian oil exporters will receive less money for their oil.

TRADING NZD/USD

The final commodity currency that appears on most major currency lists is the NZD/USD pair. This is the New Zealand dollar against the US dollar—otherwise known as the ‘kiwi’. Agriculture—as well as international trade and tourism—is key to the New Zealand economy, so the price movements of soft commodities will often play out on NZD/USD.

As with all currency pairs, the role of each country’s central bank shouldn’t be underestimated. In this case, the Reserve Bank of New Zealand sets interest rates that can have a major impact on NZD/USD, especially when they don’t line up with what the US Federal Reserve (Fed) is doing.

As a result, traders should keep themselves informed on the different monetary policies of both central banks before opening a position on the NZD/USD pair.

4. Cross currencies

Cross currency pairs are those which don’t contain the US dollar. Some traders won’t include these pairs in a collection of major currencies. We will briefly explore some of the cross currencies, which are sometimes included as majors. Examples of highly-traded cross currency pairs include:

- EUR/GBP

- EUR/CHF

- EUR/JPY

These three are the cross currency pairs with the most liquidity because they all contain a different combination of the traditional majors.

TRADING EUR/GBP

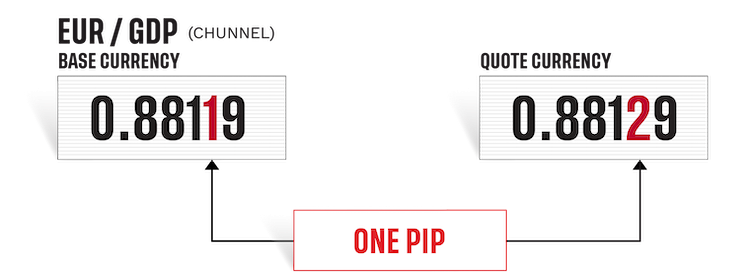

EUR/GBP is a key currency pair that explores the relationship between the euro and the British pound. The nickname for this pair is ‘chunnel’, representing the connection between Britain and Europe via the Channel Tunnel that runs from Dover to Calais.

The pair's most notable periods of volatility since Brexit were when Covid-19 practically shut down global economies, and when the UK switched prime ministers.

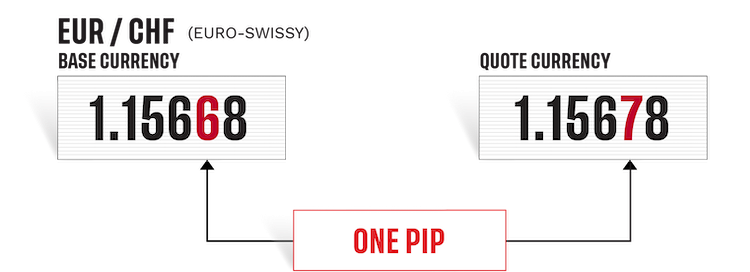

TRADING EUR/CHF

Similar to EUR/GBP or USD/CAD, EUR/CHF sees two closely-tied economies pitted against each other—the Swiss economy against the eurozone. Like other CHF pairs in this article, EUR/CHF can be seen as a relatively stable pair due to Switzerland’s safe-haven status.

An example of the franc’s stability in relation to the euro can be seen during the European debt crisis of 2008—after which the franc strengthened as investors turned to it as a safeguard for their capital.

For four years after 2011, the value of the franc was pegged to the euro by the Swiss National Bank. Nowadays, the franc operates under a floating exchange rate—but this hasn’t affected its reputation as one of the most stable currencies on the market.

TRADING EUR/JPY

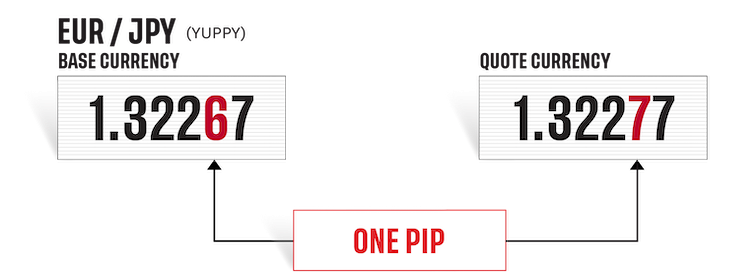

As the world’s second biggest currency, the euro is another key pairing with the Japanese yen. It’s heavily influenced by the volume of JPY carry trades, as well as market sentiment.

Liquidity in the EUR/JPY pair is often concentrated between 3am and 10am (EST). EUR/JPY is not as volatile as some of the other pairs on this list, but it still offers ample room for a trader to realize a profit or incur a loss.

5. What affects the price of forex pairs?

There are a number of factors that affect the price movements of every forex pair. These include interest rates, geopolitical instability, the strength of their country’s economy and the level of foreign direct investment (FDI) in the domestic market.

Interest rates are controlled by the monetary policy of that currency’s respective central bank. For example, if the US Federal Reserve (Fed) raises interest rates, it will often cause the US dollar to strengthen against the euro, making the price of EUR/USD drop.

This is because investors tend to favor countries with higher interest rates when they are deciding where to store their money. Essentially, an investor will receive a better return on their initial capital in an environment with higher interest rates.

Geopolitical instability could mean that investors and traders lose confidence in a country’s ability to govern, or expect that there’ll be difficult times ahead for the economy. This might lead to the currency stagnating or becoming too volatile to trade.

Trading a volatile market all depends on an individual trader’s appetite for risk, with some traders preferring markets with frequent movements as an opportunity to realize a quick profit. However, volatile markets are also higher risk and losses can happen just as quickly.

With forex majors, such movements are less frequent—although important political events can still affect the price of sterling and euro currency pairs.

FDI can affect the price of a currency pair because an increase in FDI is indicative of greater investor confidence in that country’s economy and infrastructure. This can increase demand for that country’s currency, which will cause the price to rise.

For example, if there was a significant increase in FDI in the American economy, it would be expected that the value of the US dollar would strengthen relative to other currencies that it is paired with.

The strength of a country’s economy and the level of FDI are often directly correlated.

6. How to trade the major forex pairs

- Open an account to get started, or practice on a demo account

- Choose your forex trading platform

- Choose your trading strategy and research currency pairs

- Open, monitor, and close positions on major forex pairs

FREQUENTLY ASKED QUESTIONS

Forex trading means exchanging one currency for another. Forex is always traded in pairs which means that you’re selling one to buy another.

There is no difference between forex trading and currency trading, as both mean that you’re exchanging one currency for another. When forex trading or currency trading, you’re attempting to earn a profit by speculating on whether the price of a currency pair will rise or fall.

You can make money from forex trading by correctly predicting a currency pair’s price movements and opening a position that stands to profit. For example, if you think that a pair will decline in value, you could go short and profit from a market falling.

Alternatively, if you think a pair will increase in value, you can go long and profit from an increasing market.

You can get started trading FX with a forex trading account. Plus, you’ll also need to be familiar with what moves the forex market—like central bank announcements, news reports and market sentiment—and take steps to manage your risk accordingly.

The costs and fees you pay when trading currency will vary from broker to broker. But, you should bear in mind that you’ll often be trading currency with leverage, which will reduce the initial amount of money that you’ll need to open a position. Be aware though that leverage can increase both your profits and your losses.

Approximately $7.5 trillion worth of forex transactions take place daily, which is an average of $250 billion per hour.3 The market is largely made up of institutions, corporations, governments and currency speculators—speculation makes up roughly 90% of trading volume and a large majority of this is concentrated on the US dollar, euro and yen.

In the US, forex is regulated by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). The global forex market is vast and is regulated primarily on the national level, similarly to how it's regulated in the US.

Gaps are points in a market when there is a sharp movement up or down with little or no trading in between, resulting in a ‘gap’ in the normal price pattern. Gaps do occur in the forex market, but they are significantly less common than in other markets because it is traded 24 hours a day, five days a week.

However, gapping can occur when economic data is released that comes as a surprise to markets, or when trading resumes after the weekend or a holiday. Although the forex market is closed to speculative trading over the weekend, the market is still open to central banks and related organizations. So, it is possible that the opening price on a Sunday evening will be different from the closing price on the previous Friday night—resulting in a gap.

1 Bank for International Settlements, 2023.

2 #1 Overall Broker, #1 Mobile App, #1 Trust Score, #1 Education, #1 Web Platform are accolades presented to IG, parent company of tastyfx, on January 28, 2025, during the ForexBrokers.com 2025 Annual Awards. Accolades were awarded by the ForexBrokers.com research team based on demonstrated excellence in categories considered important to investors, traders, and consumers. Click here to learn about how they rate brokers.

3 The greater foreign exchange marketplace reached $7.5 trillion per day in 2022, however, tastyfx LLC is the counterparty to the FX transactions of its client base and therefore serves as the liquidity provider in this much smaller subsection of this marketplace. Source: Bank for International Settlements Triennial Central Bank Survey (2022).