What is a stop order?

Discover everything you need to know about stop orders, including what they are, how to place one, and their benefits and risks.

Forex Order Types: Stop Order

Stop orders are slightly more complex than the more traditional market and limit order types most traders use to open and close positions, but they can be useful in specific situations.

Stop orders include stop-loss and stop-entry. Stop-loss orders tend to be more popular than stop-entry as traders will use them to close open positions if the price action goes against the position by a certain price increment or percentage change. Learn the different stop orders and how to use them in your trading strategy.

1. What is a stop order?

A stop order is an instruction to your broker to enter or exit a trade if the market price hits a certain predetermined level, which is less favorable than the current price.

You’ll determine the level at which stop losses will be triggered, within certain parameters—it also depends on whether you’re going long, short and entering or exiting a trade. It is important to note that stop orders do not guarantee order execution at the predetermined price. They trigger a market order when that predetermined price is hit, which can be vulnerable to slippage.

There are two main stop orders: stop-loss and stop-entry.

1. STOP-LOSS ORDER

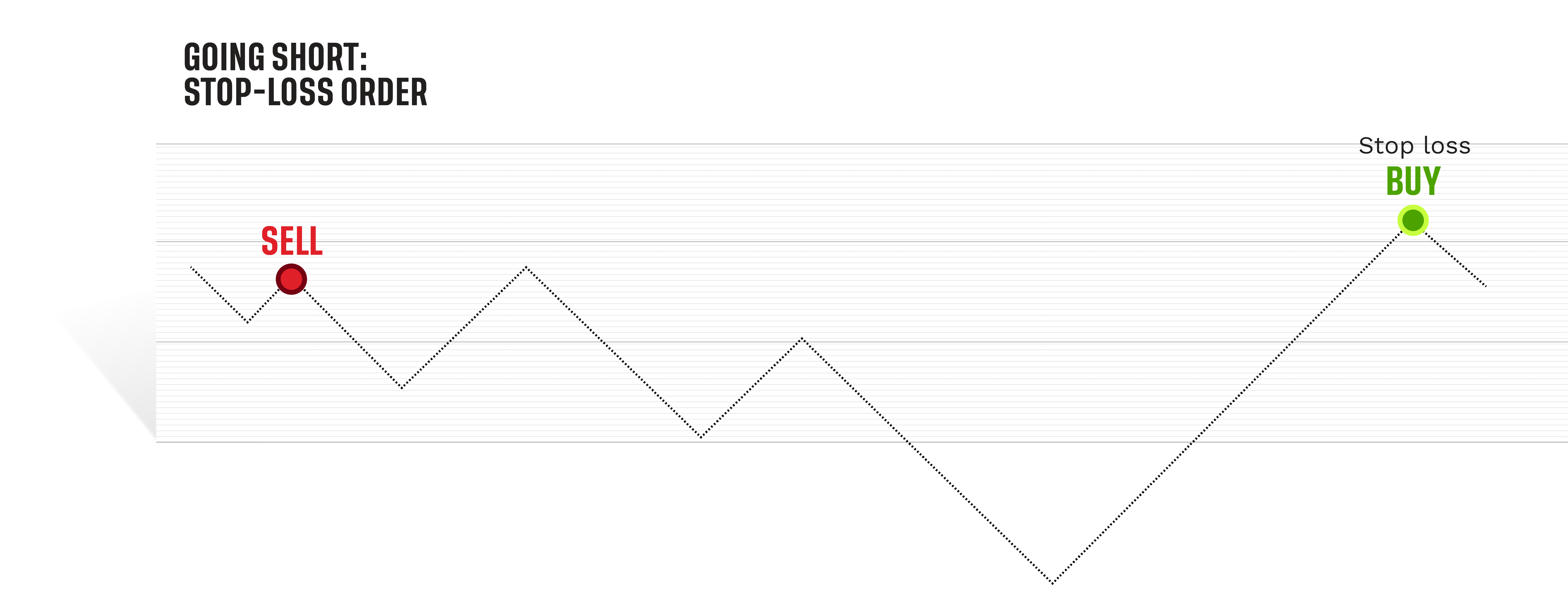

This is when you exit a trade when a price moves against you and hits a certain level of loss—limiting future losses for you. Stop-loss orders can also potentially result in profit if set above the opening level (in the case of a long position, or below it in the case of going short). When the predetermined price limit is reached, your stop-loss order triggers and the position is closed using a market order at the current market prices.

Stop-loss orders are often used as risk management tools set at a certain price lower than your opening position, and it’ll be determined by whatever the amount of loss is that you feel comfortable with in the individual trade. This way, you limit the opportunity that you will lose more than you’re prepared to, if a trade doesn’t work out as expected.

- If you’re buying (going long), the stop order will be set below the market price

- If you’re selling (going short), the stop order will be set above the market price

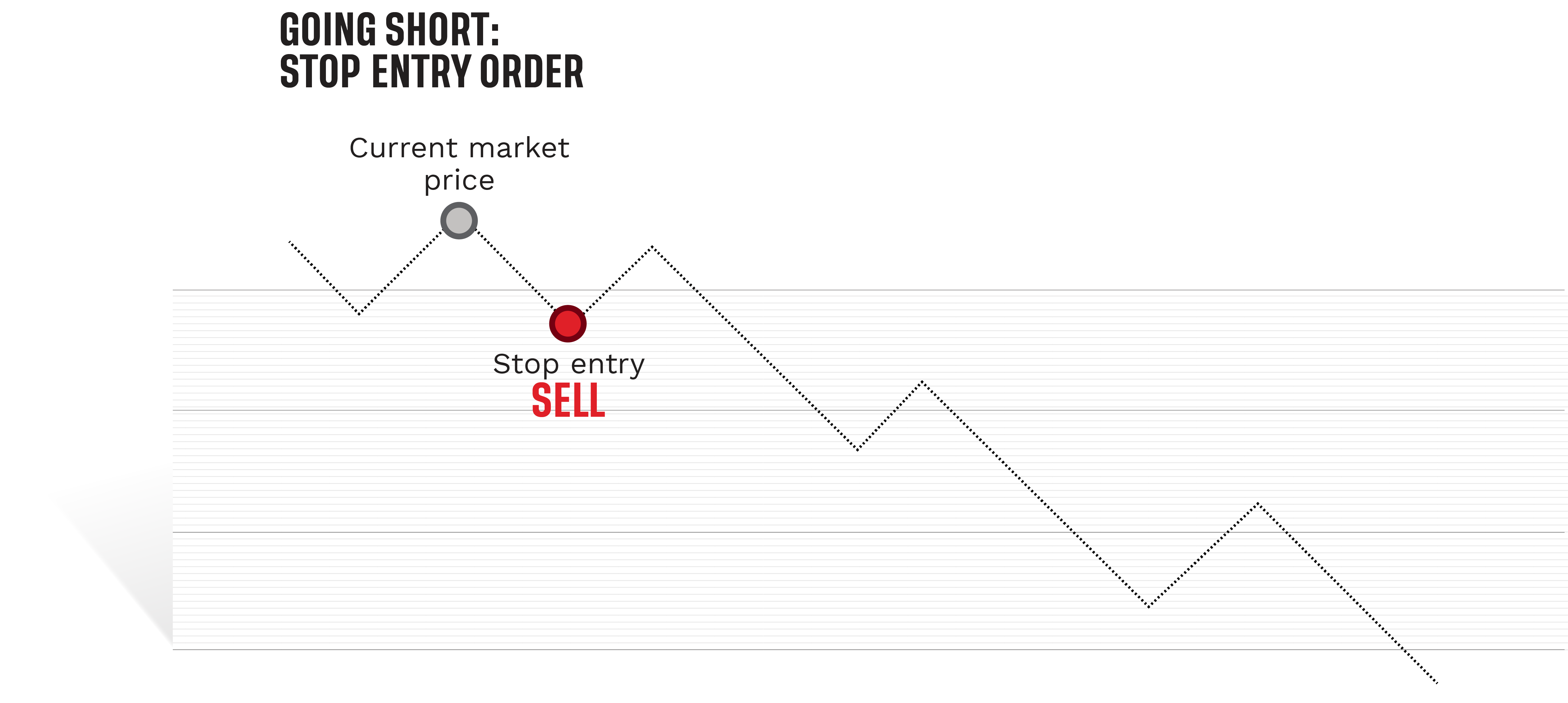

2. STOP-ENTRY ORDER

The opposite of a stop-loss order, stop-entry order is used to open a position when the market hits a predetermined level.

- If you’re buying (going long), your stop-entry order level will be above the current price

- If you’re selling (going short), your stop-entry order will be below the current price

Opening a stop-entry order position once the market is moving against you can actually be a valuable strategy for hedging or potentially trading a sudden market spike or downturn. For example, let’s say you believe that, should EUR/USD drop to a certain level, it will rebound significantly and rapidly. So, you set a stop-entry order to capitalize on this, opening a long position should your prediction come true.

2. How do stop orders work?

Stop orders are designed to work automatically, so you don’t have to watch the market constantly to check whether prices will move against you. This could be especially useful in volatile markets when prices change suddenly and you don’t have time to manually close out a trade that’s turned against you (in the case of stop-loss orders) or open one during a short window of opportunity (in the case of stop-entry orders).

HOW STOP-LOSS ORDERS WORK

When you open your position, you’ll manually set your stop-loss order parameters. If the market moves against you once your position is opened, your stop order is automatically triggered when the price is reached that you’ve set as your stop amount. At this point, the trade is closed with a market order at current prices to limit further loss. Again, remember that this order is at risk of slippage.

TYPES OF STOP-LOSS ORDERS

There are two types of stop-loss order. Here are the ones you can use with us:

- Normal stop-loss order: This is the type of stop-loss order we’ve explained above; it kicks in when the price limit you’ve set has been reached.

- Trailing stop-loss order: Rather than kicking in at a certain price point, a trailing stop loss is predetermined by how far away from your opening position it is. For example, if you don’t have a specific amount of loss you’re comfortable with in mind but instead would rather not lose more than 20 pips’ unfavorable movement, you can set a trailing stop order that will move with your position as it moves favorably then closing your trade if the market moves 20 pips against you from the favorable movement seen.

HOW STOP-ENTRY ORDERS WORK

A stop-entry order involves you manually setting the level at which you want to open a position, if the market moves in your favor.

As in our previous stop-entry example, this may be because you believe that, should the price of EUR/USD hit a certain ‘low’, the price will rally. So, you’d set a stop entry order around the level that you’ve predicted.

If that price level is reached, your stop-entry order automatically opens a long position for you without you having to do anything, enabling you to have the potential to ride the EUR/USD price rally (if your prediction happens to be correct) thanks to your stop-entry order. Losses will accrue the same as any position if prices do not move in the favorable direction.

HOW STOP ORDERS WORK FOR FOREX TRADING

You’d enter your amount of forex lots to buy or sell and your stop amount. The order will be filled when your stop level has been met, using a market order at the best available price. This market order will attempt to execute at your predetermined price, but the risk of slippage exists especially in volatile periods. Your stop order could execute at less favorable prices.

3. How to Place a Stop Order

How you place your stop order will depend on what type of stop order you’re after.

- Open a trading account to get started, or practice on a free demo account

- Conduct technical or fundamental analysis on the market you want to trade

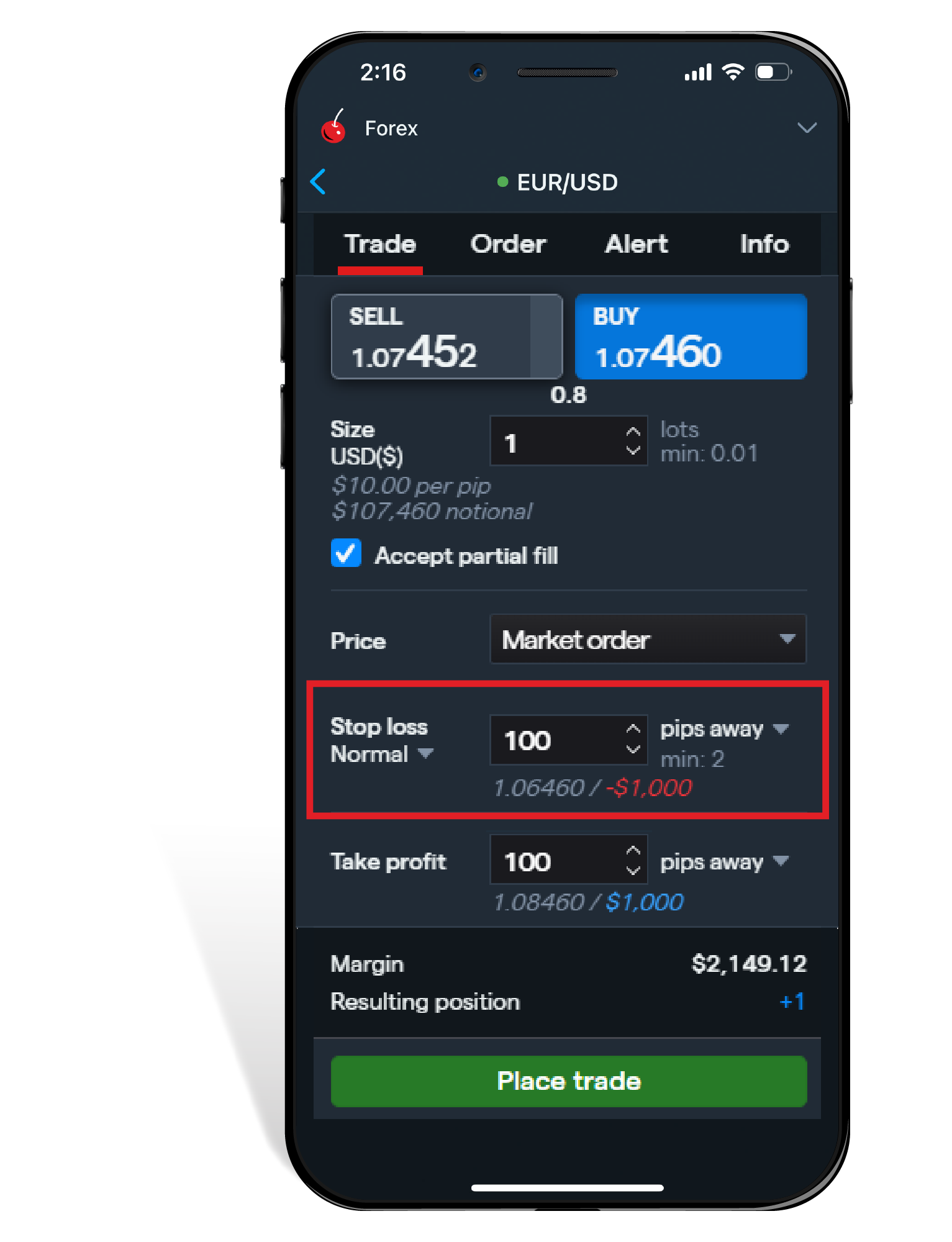

- Select the 'Order' tab on the deal ticket of the forex pair you're trading on our web platform or app

- Choose whether to place a normal or trailing stop

- Pick your stop level—the amount at which you want your stop-loss to be triggered

Your position will be opened at the level you set your 'price level' at, and closed if the price reaches the level you set your stop at. You can also set limit orders to close your position at a higher level than the opening price.

You'll be able to edit or add stop-loss orders after opening a position too. You can do this directly from 'Positions', where it's possible to add or change the price that your stop-loss will be triggered.

- Open a trading account to get started, or practice on a free demo account

- Conduct technical or fundamental analysis on the market you want to trade

- Select the 'Order' tab on the deal ticket of the forex pair you're trading on our web platform or app

- Your position will open automatically when the market hits your price level

Your position will be opened at the level you set your 'price level' at and closed if the price reaches the level you set your stop at. You can also set limit orders to close your position at a higher level than the opening price.

You'll be able to edit stop-entry orders after sending them if they have not been hit already. You can do this directly from the ‘Orders’ tab.

4. What are the benefits and risks of using stop orders?

There are pros and cons to using stop orders. Understanding them is key to determining whether or not you should be using stops:

BENEFITS OF USING STOP ORDERS

- Stop orders can help limit your risk of loss without limiting your potential for profit.

- Because stop orders are triggered automatically, you don’t have to constantly monitor your open positions (in the case of stop-loss orders) or the market (in the case of stop-entry orders) to check if prices are moving against you. You should not solely depend on stop orders, however, as checking in regularly on positions, orders, and fills can be helpful.

- They can also help you limit the risk of emotional influences, as setting your stop-loss essentially automates when you’ll exit an unfavorable trade.

RISKS OF USING STOP ORDERS

- If an unfavorable market movement is temporary—say, for instance, a ‘dead cat bounce’ occurs for an asset you’ve gone short on—you can lose future profits when the temporary unfavorable movement triggers your stop loss.

- Setting a normal stop-loss is no guarantee that your stop loss will be executed at that exact level. If the market moves suddenly past the point at which your stop loss has been set, it could be fulfilled at a worse price than your stop loss amount due to slippage.

5. Stop order example

Let’s say you want to go long 1 lot on EUR/USD with an attached stop-loss order to close the position if the market falls 100 pips. You’ve conducted your own analysis and believe that EUR/USD will go up by 100 pips, where you want to take profits, but you do not want to lose more than you would potentially profit if your analysis is incorrect.

If you enter the position at 1.0745, then the stop-loss order will trigger a market order to close the position if EUR/USD falls 100 pips to 1.0645. However, if EUR/USD does not trade down to 1.0645 or lower, then the position will continue to fluctuate in your account until you close it.

If EUR/USD rises to 1.0845 before trading down to 1.0645, then you can close the position for your predetermined profit amount—100 pips. You can also set a take-profit amount on the order ticket for 100 pips that will trigger a market order to close the position if the market trades up to 1.0845.

Depending on the movement in the market, the resulting profit or loss will take effect in your account automatically if the stop-loss and take-profit orders are set. If 1.0645 is hit first and the triggered order closes the position for exactly 100 pips in losses on the 1-lot position, then a -$1,000 loss will display in your account. If 1.0845 is hit first and the triggered order closes the position for exactly 100 pips in profits on the 1-lot position, then a +$1,000 profit will display in your account.

(Example excludes potential fluctuations due to overnight funding rates or fees.)

Open your forex trading account today

It’s free to open an account and there’s no obligation to fund or trade.

Open your forex trading account today

It’s free to open an account and there’s no obligation to fund or trade.