Why Trade Forex

Foreign exchange (forex, or FX for short) is the marketplace for trading all the world’s currencies and is the largest financial market in the world.1 Learn more about eight of the biggest advantages of forex trading below.

Benefits of Forex Trading

There are many benefits of trading forex, which include convenient market hours, high liquidity, and the ability to trade on margin.

When traders choose which market to trade, they are looking for optimal trading conditions and the best chance of taking a profit. There are many reasons why millions of traders across the world think that the forex market fits these criteria, but we are going to focus on the top eight benefits of forex trading:

1. Ability to go long or go short

While you can go short on other markets by using derivative products, short selling is an inherent part of trading forex. This is because you are always selling one currency (the quote currency) to buy another (the base currency). The price of a forex pair is how much one unit of the base currency is worth in the quote currency.

For example, in the forex pair GBP/EUR, GBP is the base currency and EUR is the quote currency. If GBP/EUR is trading at 1.12156, then one pound is worth 1.12156 euros. If you think that the pound is going to increase against the euro, you would buy the pair (going long). If you think that the pound will decrease in value against the euro, you would sell the pair (going short). Your profit or loss will depend on the extent to which you get your prediction right, meaning it is possible to profit and lose whichever way the market moves.

2. Forex market hours

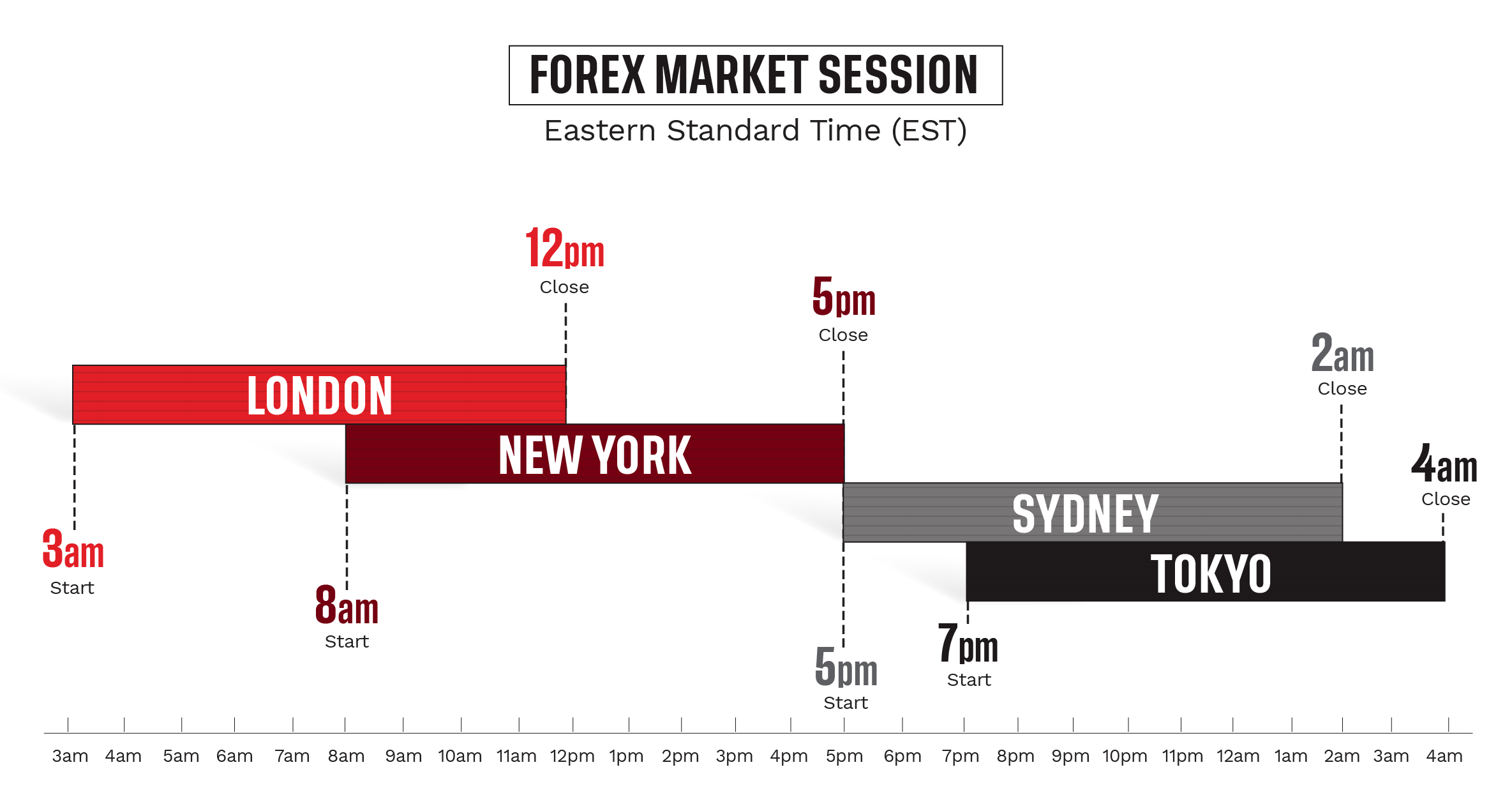

The foreign exchange (FX) market is open 24 hours a day, five days a week—from 5pm EST Sunday to 4pm EST Friday.

These long hours are because forex transactions are completed between parties directly, over-the-counter (OTC), rather than through a central exchange. As forex is a truly global market, you can always take advantage of different active session’s forex trading hours.

There are four major trading sessions each day, matching the opening hours of banks in London, New York, Sydney and Tokyo. There is a high volume of trades throughout each of these sessions, and especially when sessions overlap.

It is important to remember that the forex market’s opening hours will vary in March, April, October and November, as countries shift to daylight savings on different days.

Does forex trade on weekends?

The forex market closes on Friday afternoon at 4pm EST and does not open again until 5pm EST on Sunday afternoon. However, because the market is only closed to retail traders (not central banks and related organizations), forex trading actually does take place over the weekend. This means that there can be a difference in price between Friday close and Sunday open—known as a gap.

Traders need to be highly aware of the weekend forex trading hours and alter their positions accordingly. If you do not want to expose your position to the risk of gapping, you may want to consider closing your position on Friday evening or placing stop-losses and take-profits to manage this risk.

3. High liquidity in forex

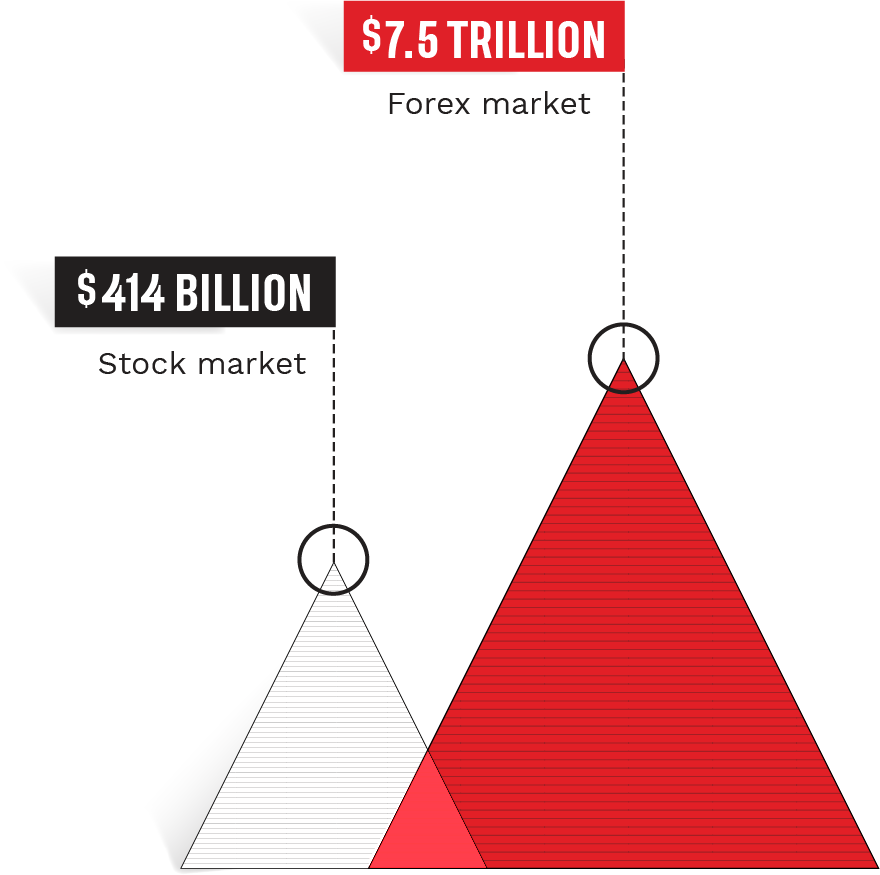

The forex market witnesses some of the greatest daily volume of any asset in the world. High trading volumes can often mean high liquidity for everyday people entering and exiting the market, as high liquidity usually reflects tighter spreads and thus lower costs to trade.

The graph depicts the volume of the greater foreign exchange marketplace; however, tastyfx LLC is the counterparty to the FX transactions of its client base and therefore serves as the liquidity provider.1

Sources: Bank for International Settlements Triennial Central Bank Survey (2022) and World Bank (2022).

4. Volatility creates trading opportunity

The high volume of currency trades each day translates to billions of dollars every minute, which makes the price movements of some currencies extremely volatile. You can potentially reap large profits by speculating on price movements in either direction.

However, volatility is a double-edged sword—the market can quickly turn against you, so it’s important to limit your exposure with risk-management tools.

5. Leverage can make your money go further

With tastyfx, trading foreign exchange pairs is leveraged, which can make your money go further. Leverage in forex enables you to open a position on the currency market by paying just a small proportion of the full value of the position up front. For example, opening a trade on EUR/USD might require a deposit worth just 2% of the total value of the position. This initial deposit is referred to as margin.

The profit or loss you make will reflect the full value of the position at the point it is closed, so trading on margin offers an opportunity to make large profits from a relatively small investment. However, it can also amplify any losses, meaning losses could exceed your initial deposit. For this reason, it’s important to consider the total value of the leveraged forex position before trading.

6. Trade a wide range of currency pairs

Forex trading gives you the opportunity to trade a wide variety of currency pairs, speculating on global events and the relative strength of major and minor economies.

With tastyfx you can choose from over 80 currency pairs, including:

- Major currency pairs, such as GBP/USD, EUR/USD, and USD/JPY

- Minor pairs, such as USD/ZAR, SGB/JPY, CAD/CHF

- Emerging currency pairs, such as USD/CNH, EUR/RUB and AUD/CNH

- Exotic pairs, such as EUR/CZK, TRY/JPY, USD/MXN

These pairs are all available to trade from the same account via a single login.

7. Hedge with forex

Hedging is a technique that can be used to reduce the risk of unwanted moves in the forex market, by opening multiple strategic positions. Although volatility is part of what makes forex so exciting, hedging can be a good way of mitigating loss or limiting it to a known amount.

There are a variety of strategies you can use to hedge forex, but one of the most common is hedging with multiple currency pairs. By choosing forex pairs that are positively correlated, such as GBP/USD and EUR/USD, but taking positions in opposite directions, you can limit your downside risk. For example, a loss on a short EUR/USD position could be mitigated by a long position on GBP/USD.

Correlations can change causing risk of significant losses in hedged positions. Also, it should be noted that hedging does not take risk completely out of trading as you still have open positions in the market.

8. Access tools to help you trade

tastyfx offers a range of trading platforms on web, mobile, and tablet, as well as specialist platforms for those looking to take their trading to the next level. You can get access to a range of features designed to help improve your trading, including risk management tools—like stops and limits—as well as interactive charts and integrated news feeds.

Our free demo account allows you to trade in a risk-free environment with USD$10,000 in virtual funds, so you can try forex trading and our technology without committing any capital.

Why Trade Forex vs Stocks?

Forex markets are open 24 hours a day, 5 days a week from Sunday night to Friday afternoon, in the US, offering greater accessibility than the majority of stock markets that are only open for a fraction of the day Monday through Friday.

Increased accessibility in forex markets can allow traders more opportunities to open and close trades when global news events come up or individual strategic levels are triggered.

The vast amounts of exposure that large institutions and individual people have in currency markets creates a massive ecosystem for forex trading. Though retail trading only accounts for a fraction of the overall volume, daily forex volumes average higher than $5 trillion (see graphic in section 3 above) compared to less than $1 trillion in stock volumes.

Greater volume often coincides with higher liquidity, which is hugely important to forex markets whose main cost to trade is the spread between the bid and offer.

Market volatility is unpredictable; some years can see extremely high stock market volatility, while others can be exceedingly slow—same goes for forex. However, lower margin rates and higher leverage in some forex markets relative to stocks can create great volatility and thus large opportunities for both profit and loss. Many traders gravitate toward forex markets because a 1% move can have large implications to traders' positions.

Though you cannot create or predict volatility, leverage in forex markets can help enhance market volatility when prices start to move.

FREQUENTLY ASKED QUESTIONS

Although there are multiple benefits of forex trading, the volatility of the market and the leveraged trading instruments do come with increased risk. However, there are a variety of ways that you can manage your currency risk, such as attaching stops and limits to your position, setting price alerts and using a trading style that matches your attitude to risk.

tastyfx facilitates and acts as the counterparty to your forex pair trades. This enables you to take a speculative position on the future direction of a forex pair’s price, without having to take ownership or delivery of the physical currency.

The most traded currency pairs are the major crosses, including EUR/USD, USD/JPY, GBP/USD, and USD/CHF. For those just starting to trade the forex market, it is important to understand that the majority of forex trading is concentrated across these combinations, which can make them easier to trade as they have higher liquidity.

The cost of trading forex depends on which currency pairs you choose to buy or sell. With tastyfx, you’ll trade forex on margin, which means you need a small percentage of the full value of the trade to open and maintain your position.

Other than the margin, you also pay a spread, which is the difference between the ‘buy’ and the ‘sell’ price of an asset. To open a long position, you’d trade slightly above the market price (buy price) and to open a short position, you’d trade slightly below the market price (sell price).

Lastly, if you do not close your position before the end of the trading day, you will pay overnight funding charges.

The best time to trade forex will depend on your personal risk preference, as high liquidity and volatility can affect forex prices. When the London session opens at 3:00 am (EST), liquidity and volatility will likely be high as traders begin interacting with each other. Trading will usually become less liquid a few hours later, and it will pick up again after the American session opens at around 9:30 am (EST).

The foreign exchange market is open 24 hours a day, five days a week—from 3am Sunday to 5pm Friday (EST). So, you can trade at a time that suits you and take advantage of different active sessions.

Remember: The forex market’s opening hours will change when certain countries shift to daylight savings time.

With tastyfx, you can open a forex trading account online, call (312) 981-0498, or email helpdesk.us@tastyfx.com. It only takes a few minutes to create an account, and there’s no obligation to add funds until you want to place a trade.

Alternatively, you can open a demo account to experience our award-winning platform2 and develop your forex trading skills.

Discover forex trading with tastyfx

Follow the market's price action across 80+ major and minor forex pairs and find out how to get started with tastyfx.

Discover forex trading with tastyfx

Follow the market's price action across 80+ major and minor forex pairs and find out how to get started with tastyfx.

1 The greater foreign exchange marketplace reached $7.5 trillion per day in 2022; however, tastyfx LLC is the counterparty to the FX transactions of its client base and therefore serves as the liquidity provider in this much smaller subsection of this marketplace. Source: Bank for International Settlements Triennial Central Bank Survey (2022).

2 #1 Overall Broker, #1 Mobile App, #1 Trust Score, #1 Education, #1 Web Platform are accolades presented to IG, parent company of tastyfx, on January 28, 2025, during the ForexBrokers.com 2025 Annual Awards. Accolades were awarded by the ForexBrokers.com research team based on demonstrated excellence in categories considered important to investors, traders, and consumers. Click here to learn about how they rate brokers.