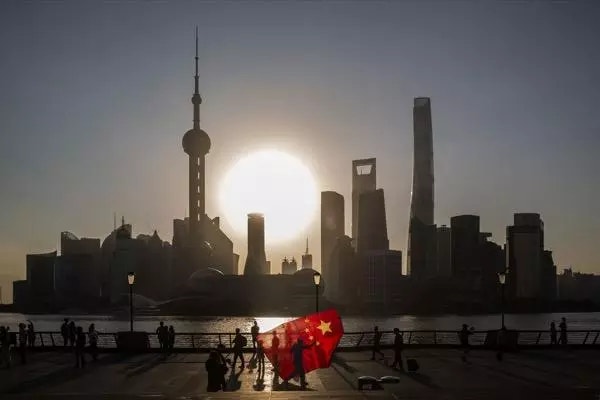

Bad Chinese data lifts US dollar, again

Key points

- Chinese Trade Balance for October was the lowest since February

- US stocks (QQQ) are outperforming Chinese stocks (FXI) by 50%

- USD traded higher against AUD and JPY following data

China's Trade Balance worsens

Monday night, China reported a Trade Balance of $56.53B for the month of October to mark its lowest balance since February. Looking further, exports YoY declined 6.4% - nearly double the expected 3.3% decline. While often a mid-tier data point for other countries, China's position as the world's leading exporter caused markets to react strongly to the Trade Balance report.

Zooming out, Chinese stocks (FXI) are down 10% year-to-date while US stocks (QQQ) are up 40% over the same time. US dollar has seen a rise both this week and throughout the year as Chinese stocks are generally negatively correlated with USD. Over a 3-month period there is a -0.3 correlation between the two (FXI/UUP).

How to trade US dollar

- Open an account to get started, or practice on a demo account

- Choose your forex trading platform

- Open, monitor, and close positions on USD pairs

Trading forex requires an account with a forex provider like tastyfx. USD pairs can be found in tastyfx's platform under the 'USD Pairs' pairs tab. Many traders also watch major forex pairs like GBP/USD and USD/JPY for potential opportunities based on economic events such as inflation releases or interest rate decisions. Economic events can produce more volatility for forex pairs, which can mean greater potential profits and losses as risks can increase at these times.

You can help develop your forex trading strategies using resources like tastyfx’s Learn Center. Once your strategy is developed, you can follow the above steps to opening an account and getting started trading forex.

Your profit or loss is calculated according to your full position size. Leverage will magnify both your profits and losses. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them. Trade using money you’re comfortable losing.

Why are economic events important to forex traders?

Economic events can produce more volatility for forex pairs, which can mean greater potential profits and losses as risks can increase at these times. Potentially influential events include inflation releases and interest rate decisions.

This information has been prepared by tastyfx, a trading name of tastyfx LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. tastyfx accepts no responsibility for any use that may be made of these comments and for any consequences that result. See our Summary Conflicts Policy, available on our website.