Beginner's guide to the carry trade

What is the carry trade?

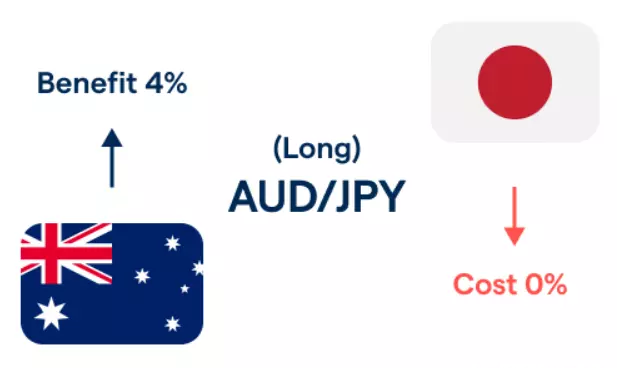

The carry trade is a popular strategy that attempts to profit from interest rate differentials between two regions by borrowing, or shorting, a currency with low interest rates to fund, or buy, a currency with a higher interest rate.

Carry trade example

Using leverage with the carry trade

Forex markets can offer relatively higher leverage than trading in other assets; this can have an amplifying effect on potential profits from the carry trade. Carry trading major pairs like EUR/USD with margin requirements of 2-5% could turn modest interest rate differentials into substantial potential returns by multiplying the carry profit 20-50 times; however, leverage can also magnify profits and losses from price action of the forex pair that could result in losses exceeding the account's initial deposit.

Using the above example, buying 1 lot of AUD/JPY (100,000 AUD) with a 5% margin requirement at price 91.200 would require ¥456,000, or about $3,350 USD, result in a ¥9,120,000 position, or about $67,000, and produce a daily profit of ¥1,000, or about $7.35.* This example trade would reflect a 0.2% daily return if all variables remained equal.

This strategy often incorporates forex pairs like EUR/USD, USD/JPY, and more while intending for little or no change to be made to the actual price or exchange rate as the carry trader profits from daily interest earned. There is considerable risk, however, in the price of the market going against the carry trader to the extent that profit from interest and then some is lost.

How the carry trade works

The carry trade can be simplified down to borrowing a currency in a region that has low interest rates for the use of buying a currency in a region that has high interest rates, effectively earning a high interest rate while paying a low one.

Most forex providers such as tastyfx will transfer the relevant amounts pertaining to the carry trade into or out of accounts, depending on whether the account holds positions with positive or negative carry values, on a daily basis as of that day’s close – 5pm ET at tastyfx.

Find out how margin, funding, and interest work at tastyfx

There is, however, considerable math behind the relatively simple process of carry trading including the following calculations:

- Number of nights held

- Trade size

- Tom-next rate

- Admin fee

These parameters can help traders arrive at the final overnight funding adjustment, or potential profits/losses from the carry trade:

[nights held] x [trade size] x [tom-next rate + admin fee]

1. Number of nights held

Forex usually settles on what is called a T+2 basis, which means that positions held overnight today actually reflect the number of nights two days from not. This can be particularly relevant when incorporating weekends or holidays.

For example, a position held overnight on a Wednesday of a normal trading week would actually reflect Friday’s overnight status of three days (Friday, Saturday, Sunday), and a position held overnight on a Tuesday of a week containing a Friday holiday would actually reflect Thursday’s overnight status of four days (Thursday, Friday, Saturday, Sunday).

2. Trade size

Trade size in forex is often measured in units of the second currency, or quote currency, of the forex pair, which is usually 10 units per pip for a 1 lot increment.

For example, 1 lot of EUR/USD would reflect a position of $10 USD per pip, and 3 lots of USD/CAD would reflect a position of $30 CAD per pip.

3. Tom-next rate

Tom-next is short for tomorrow-next day and the tom-next rate is the forex market’s swap price to roll a position from tomorrow or the next business day to the new spot date.

Essentially, tom-next is the part of the calculation that incorporates interest rates of the two currencies involved to adjust open positions by an interest payment for those long the currency with a higher interest rate or an interest cost for those long the currency with a lower interest rate.

4. Admin fee

Admin fees are often grouped in with tom-next fees affecting the forex market’s swap price, and they are only 0.5% per year, or 0.0014% per day, at tastyfx. Admin fees, unlike tom-next rates, are applied on a T+0 basis.

For example, a position held overnight on a Wednesday of a normal trading week would result in one day of admin fees – both sides of the trade being reduced by 0.0014%.

Where to find the carry trade

Carry trading is mostly done using forex products at a spot forex market provider like tastyfx. Daily estimated overnight funding rates for forex can be viewed in the platform under the term swap rates, whereby the swap bid applies to short positions and the swap offer applies to long positions.

Practice carry trading on a tastyfx demo account

Carry trade risks

Risks of carry trading include potential losses from price action of the forex pair and changes to interest rates in the two regions involved.

Price action risk

All things equal, a forex position with positive carry should produce consistent profits, however, the market is rarely equal for even a minute. While exchange rates can move in the trader’s favor producing more profits along with those from the carry trade, shifting prices for forex pairs can wipe out gains from the carry trade and significantly more given the leverage involved in trading forex.

For example, a short 1-lot EUR/USD position producing $7 per day in carry trade profits that has moved 100 pips against the trader over the course of a month would produce about $210 in carry trade profits and -$1,000 in losses from price action.†

Interest rate risk

Though interest rates in most major economies only tend to change once every month or so, changes to interest rates affecting the carry trade can occur at any moment. Traders might project out how much they stand to gain from the carry trade over the course of coming weeks and months, but interest rates should be monitored and potential changes factored into decision making.

For example, a long USD/JPY position might be producing positive carry profits one month given higher interest rates from the Federal Reserve relative to the Bank of Japan, but a hike from the BoJ or cut from the Fed could flip such a position to producing negative carry losses.

How to trade forex using the carry trade

- Choose the forex market with positive carry you’d like to trade

- Open an account to get started, or practice on a demo account

- Choose your forex trading platform

- Open, monitor, and close positions

Trading forex requires an account with a forex provider like tastyfx. Many traders also watch major forex pairs like EUR/USD and USD/JPY for potential opportunities based on economic events such as inflation releases or interest rate decisions. Economic events can produce more volatility for forex pairs, which can mean greater potential profits and losses as risks can increase at these times.

You can help develop your forex trading strategies using resources like tastyfx’s YouTube channel. Once your strategy is developed, you can follow the above steps to opening an account and getting started trading forex.

Your profit or loss is calculated according to your full position size. Leverage will magnify both your profits and losses. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them. Trade using money you’re comfortable losing.

*All information in example was taken from tastyfx on 5/15/2023 and does not account for fees

†Example does not incorporate other potential fees to position

This information has been prepared by tastyfx, a trading name of tastyfx LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. tastyfx accepts no responsibility for any use that may be made of these comments and for any consequences that result. See our Summary Conflicts Policy, available on our website.