BTC nears $60k, is US dollar at risk?

Bitcoin soars to $57,000, up 29% YTD

Dollar's resilience against global currencies

Despite Bitcoin's compelling performance, the US dollar has showcased its resilience, especially against the Japanese yen. With the dollar holding strong above the 150.00 mark and nearing historic highs, it contrasts with the typical correlation observed between Bitcoin's rallies and the dollar's weakness. This scenario has sparked intrigue regarding the divergence between digital and traditional asset behaviors.

Exploring the dynamics between bitcoin and traditional assets

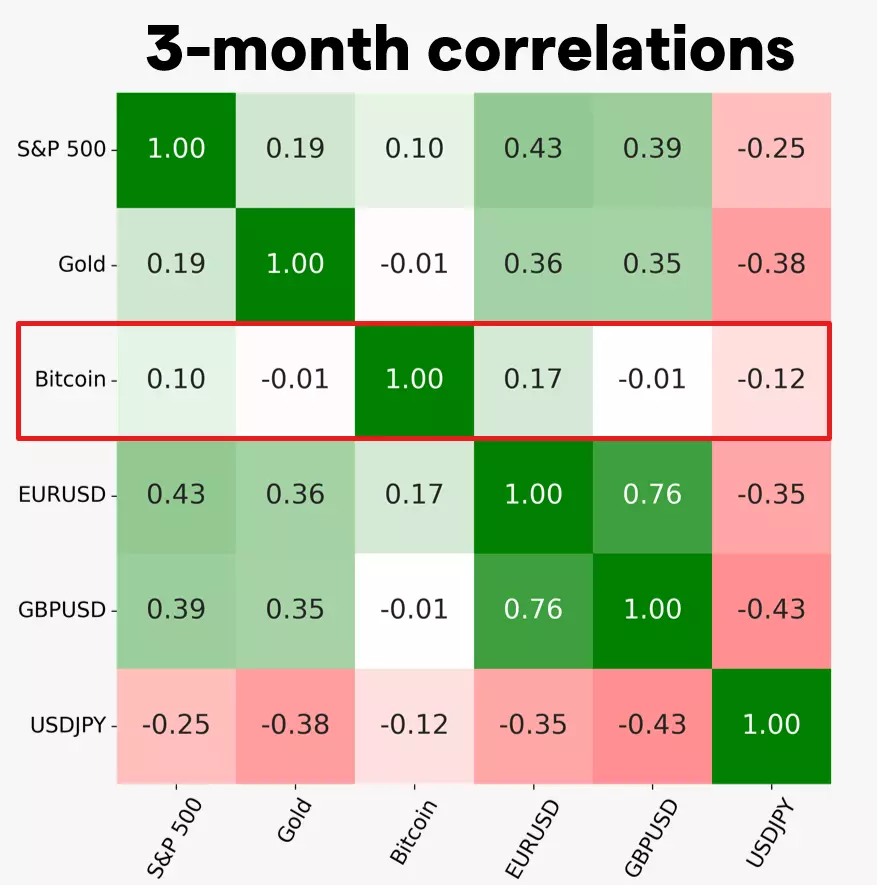

Contrary to historical patterns where Bitcoin rallies often signaled a weakening US dollar, the current landscape shows a decoupling of Bitcoin from not only the USD but also stocks and gold. Over the last three months, Bitcoin's price movements have been notably uncorrelated with these traditional assets, highlighting its potential as a diversification strategy amidst global economic uncertainty. Additionally, with 10-year treasury yields stabilizing above 4% during Bitcoin's ascent, it raises questions about the interplay between interest rates and cryptocurrency valuation.

In summary, Bitcoin's significant upswing amid stable interest rates and the US dollar's robust performance presents a unique moment for financial market observers. This decoupling from traditional assets may suggest a maturing market for cryptocurrencies, where Bitcoin marches to its own beat, offering both opportunities and challenges for investors navigating this digital frontier.

In summary, Bitcoin's significant upswing amid stable interest rates and the US dollar's robust performance presents a unique moment for financial market observers. This decoupling from traditional assets may suggest a maturing market for cryptocurrencies, where Bitcoin marches to its own beat, offering both opportunities and challenges for investors navigating this digital frontier.

How to trade US dollar

- Open an account to get started, or practice on a demo account

- Choose your forex trading platform

- Open, monitor, and close positions on USD pairs

Trading forex requires an account with a forex provider like tastyfx. Many traders also watch major forex pairs like EUR/USD and USD/JPY for potential opportunities based on economic events such as inflation releases or interest rate decisions. Economic events can produce more volatility for forex pairs, which can mean greater potential profits and losses as risks can increase at these times.

You can help develop your forex trading strategies using resources like tastyfx’s YouTube channel. Once your strategy is developed, you can follow the above steps to opening an account and getting started trading forex.

Your profit or loss is calculated according to your full position size. Leverage will magnify both your profits and losses. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them. Trade using money you’re comfortable losing.

This information has been prepared by tastyfx, a trading name of tastyfx LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. tastyfx accepts no responsibility for any use that may be made of these comments and for any consequences that result. See our Summary Conflicts Policy, available on our website.