Gold makes new high above $2,400. What it means for USD.

Key points

- Gold futures hit $2,450 intraday to mark a new all-time high

- Geopolitical tensions and institutional demand have spurred the gold rally in 2024

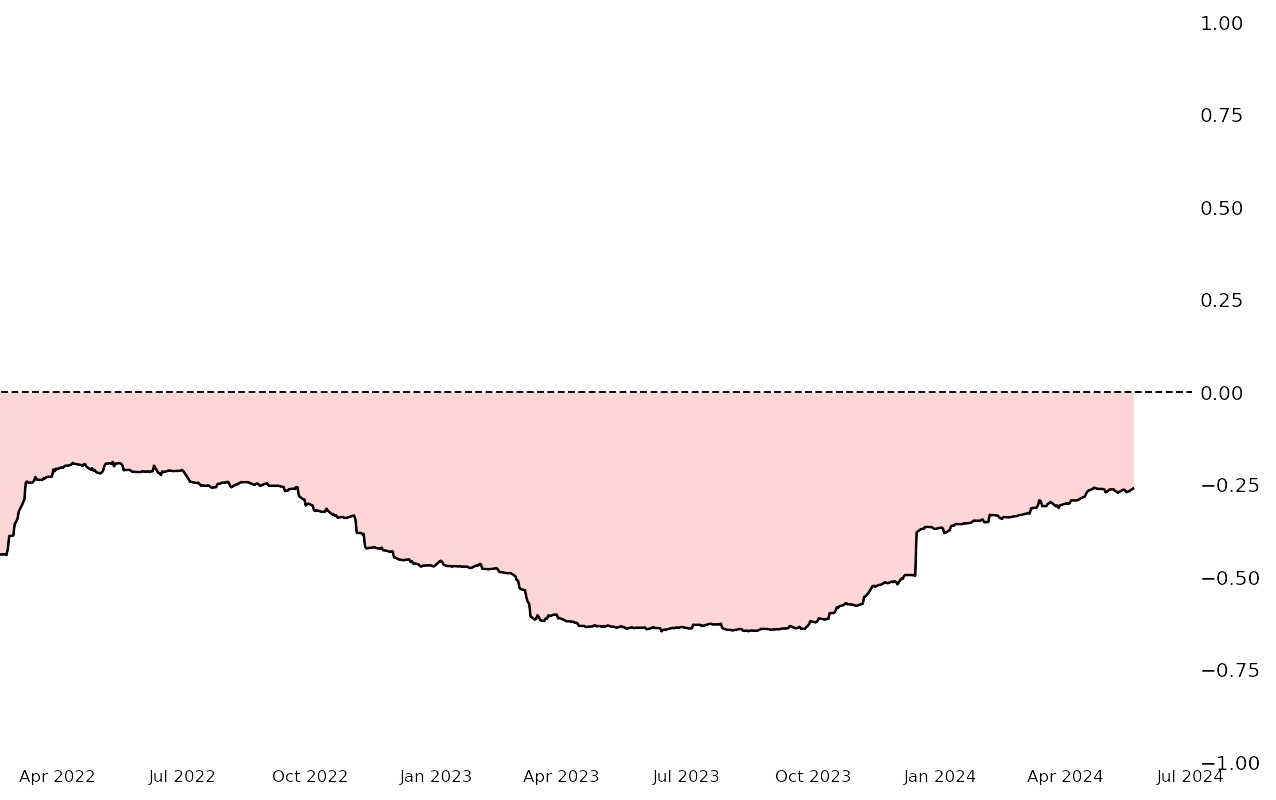

- The 12-month correlation between gold and US dollar has weakened to near -0.25

- the 3-month correlation is even weaker at -0.20

Gold futures hit $2,450 to start the week

Gold futures experienced a significant rise to open the trading week, quickly surpassing $2,450 on a Sunday night during the Asian trading session. This marked a new all-time high for gold, building on an already impressive 2024, which started the year around $2,000/oz.

How did gold get so expensive?

The surge in gold prices in recent years can be attributed to numerous factors of varying degree but the breakout story centers around geopolitical tensions and substantial acquisitions by central banks. The outbreak of war in the Middle East last fall, combined with the ongoing Russian-Ukraine war, spurred gold demand as investors pivoted into traditional flight-to-quality assets. In an added layer, the sanctions against Russia and the threat of further trade barriers have spurred many central banks to increase their allocations of gold in their portfolio in an attempt to diversify their exposure from any nation's currency. This trend is particularly pronounced in China, where the People's Bank of China led central banks in gold purchases in 2023 (Source: World Gold Council).

US dollar less correlated to gold in recent months

Historically, gold and the US dollar share an inverse relationship as investors must select a safe-haven asset to hold - trading in their US dollars for gold and vice versa. However, recent data suggest a shift. The three-month correlation shows a -0.20 compared to the twelve-month (shown below) slightly stronger than -0.25, indicating a less pronounced inverse correlation recently. This change might influence traders to reassess their strategies in hedging and trading these assets.

12-month rolling correlation: Gold - USD

Recently, both markets have hit historic highs

Despite a recent drawback in the US dollar, it reached year-to-date high in April—simultaneously, gold also surged to new highs. This concurrent rise challenges the traditional market dynamics where usually one rises as the other falls. Such trends could suggest a temporary decoupling or a broader economic shift affecting both assets.

Can both gold and USD continue to rise?

In the current nuanced market environment, it's conceivable that both the US dollar and gold might continue moving in tandem, either upwards or downwards. Potential rate cuts in the US stemming from lowering inflation could weaken the dollar, reducing its appeal, while lessening demand for gold as an inflation hedge. Meanwhile, persistent geopolitical tensions could maintain or increase demand for gold as a safety asset.

How to trade US dollar

- Open an account to get started, or practice on a demo account

- Choose your forex trading platform

- Open, monitor, and close positions on USD pairs

Trading forex requires an account with a forex provider like tastyfx. Many traders also watch major forex pairs like EUR/USD and USD/JPY for potential opportunities based on economic events such as inflation releases or interest rate decisions. Economic events can produce more volatility for forex pairs, which can mean greater potential profits and losses as risks can increase at these times.

You can help develop your forex trading strategies using resources like tastyfx’s YouTube channel. Once your strategy is developed, you can follow the above steps to opening an account and getting started trading forex.

Your profit or loss is calculated according to your full position size. Leverage will magnify both your profits and losses. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them. Trade using money you’re comfortable losing.

This information has been prepared by tastyfx, a trading name of tastyfx LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. tastyfx accepts no responsibility for any use that may be made of these comments and for any consequences that result. See our Summary Conflicts Policy, available on our website.