Interest rates are falling. What does it mean for the US dollar?

Explore how declining interest rates impact the US dollar, yen, and franc dynamics, revealing forex strategies influenced by rate shifts and economic uncertainties.

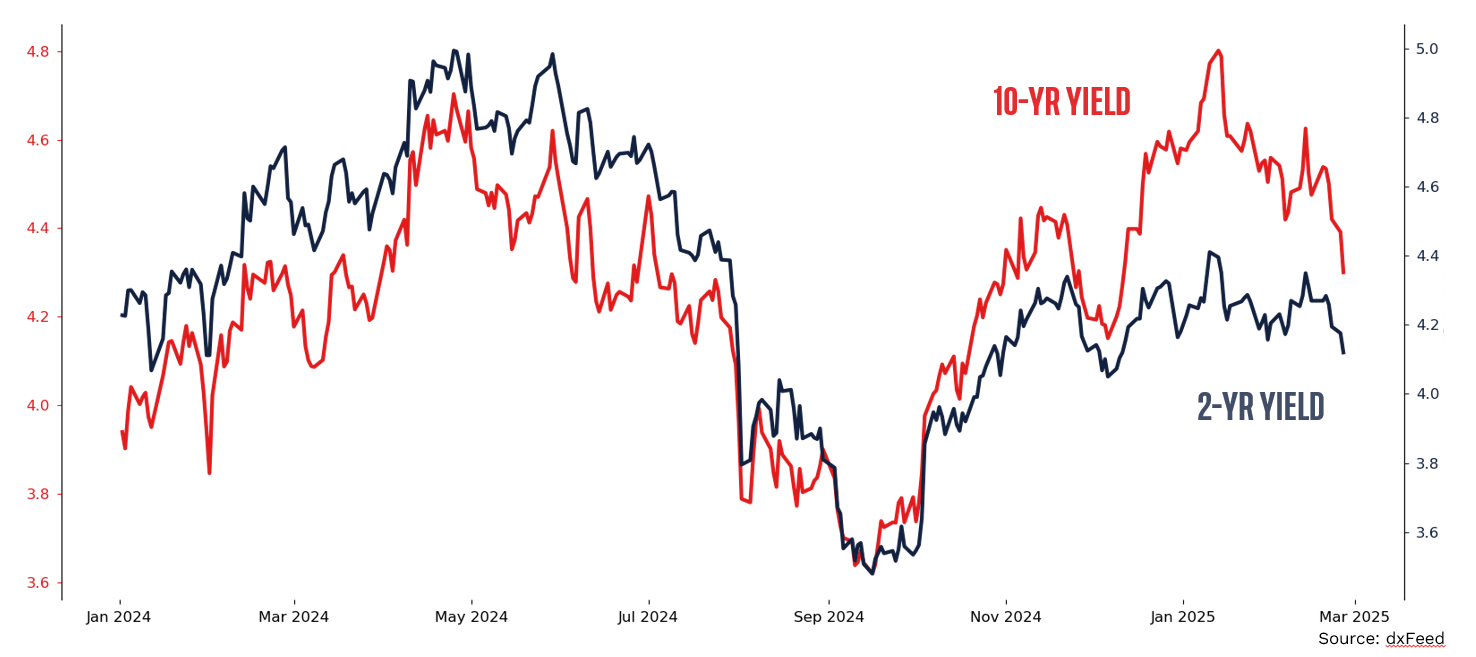

TREASURY YIELDS SINK AMID UNCERTAINTY

Amid rising recession fears, Treasury yields have been in decline, reversing from their multi-year highs in January. This downward trend in yields indicates a shift towards safer assets, as investors reassess their portfolios in light of potential economic instability. The current environment sees long-term rates, such as the 10-year yield, dropping more significantly than short-term rates. Two-year yields have not dropped to the same magnitude since expected rate cuts from the Fed are relatively unchanged for the year ahead, though long-term expectations may be lower. Recently, bonds have not attracted many buyers with other safe haven assets getting more bids, but now that appears to be changing as investors are willing to lock up their capital, potentially signaling a renewed interest in Treasuries as a safe haven investment.

US DOLLAR CORRELATIONS TO US RATES

The US dollar has a natural positive correlation to US interest rates, at least in theory, as high interest rates provide a greater incentive for holding US dollars. In practice, US dollar is highly correlated to US rates, but to a varying degree against other currencies. When looking against USD over the past 3 months, the Japanese yen (JPY) and Swiss franc (CHF) display the most significant correlations with long-term US interest rates, both over +0.6. As the yield curve shifts, these currencies often experience corresponding movements, providing traders insights into currency pair dynamics. The strong correlation with longer-term rates suggests these currencies respond more to broader economic trends than to short-term rate changes, giving traders a strategic lens through which to anticipate currency fluctuations based on interest rate movements.

SAFE-HAVEN? OR CONVERGING RATES

Recent gains in the yen and franc raise questions about their roles as safe-haven currencies versus their potential benefits in carry-based strategies. The interest rate differential between the US and these countries has been substantial, opening the carry trade—a strategy where investors borrow in low-yielding currencies to invest in higher-yielding ones, profiting from the rate difference—as a favorable approach. With US rates now trending downward, this established dynamic is shifting, creating key distinctions between these currencies: the yen's strength appears to be partly due to the unwinding of carry trades as Japan hikes rates while US rates decline, making this strategy yield progressively less for USD/JPY traders. In contrast, the franc's appreciation must be more purely safe-haven driven, since both US and Swiss rates are heading lower in tandem, which should theoretically maintain the carry trade appeal between these currencies. Yet the franc continues to gain strength, suggesting genuine risk-aversion rather than interest rate considerations. Traders must recognize this fundamental difference when evaluating these currency movements, as the yen responds to shifting interest rate dynamics while the franc reflects predominantly safety-seeking behavior—a critical distinction that should inform strategic decisions in forex trading.

YEN STRONGER THAN SWISS FRANC IN 2025

In 2025, the yen outperforms the Swiss franc, underscoring the importance of analyzing currency crosses to validate fundamental analysis. A quick glance at CHF/JPY can help traders isolate the relative performance of the two nations by removing the US dollar component. A possible conclusion from this analysis would be the yen's strength is attributed to Japan's rising interest rates, contrasting with Switzerland's more aggressive rate cuts. Even for USD/CHF or USD/JPY traders, this exercise can help inform trading strategies by gaining a clearer understanding of the underlying economic forces at play.

CHF/JPY price history

How to trade USD

- Open an account to get started, or practice on a demo account

- Choose your forex trading platform

- Open, monitor, and close positions on USD pairs

Trading forex requires an account with a forex provider like tastyfx. Many traders also watch major forex pairs like EUR/USD and USD/JPY for potential opportunities based on economic events such as inflation releases or interest rate decisions. Economic events can produce more volatility for forex pairs, which can mean greater potential profits and losses as risks can increase at these times.

You can help develop your forex trading strategies using resources like tastyfx’s YouTube channel. Our curated playlists can help you stay up to date on current markets and understanding key terms. Once your strategy is developed, you can follow the above steps to opening an account and getting started trading forex.

Your profit or loss is calculated according to your full position size. Leverage will magnify both your profits and losses. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them. Trade using money you’re comfortable losing. Past performance is not indicative of future results.