Learn how to short a currency

What does it mean to go short on a currency?

Going short, or short-selling, means that you are betting against the market. In this scenario, you are selling an asset on the assumption that its price will fall, and the more the price falls, the greater your profit.

Going short is the opposite of going long, where you anticipate the market will rise and would open a buy position. Typically, traders open a short position in a bearish market, and they open a long position in a bullish market.

How does forex shorting work?

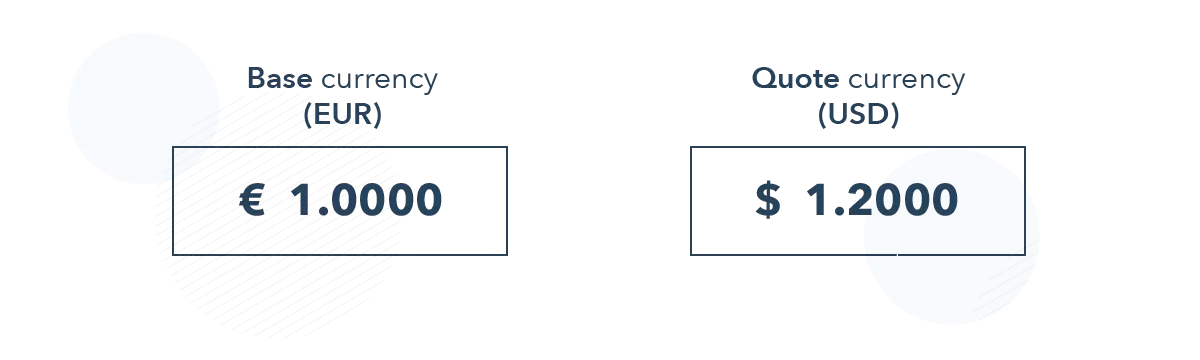

If you went short on a currency pair, it means that you expect the base currency to weaken against the quote currency. All currency pairs have a base currency and a quote, with the cost of the pair being how much of the quote currency you'd have to sell in order to buy one of the base.

In the image below, you'd go short on the EUR/USD currency pair if you believed that the euro would depreciate relative to the dollar, meaning it would cost fewer dollars to buy one euro – perhaps $1.1000 instead of the current $1.2000.

In doing so, you'd effectively be selling euros in the expectation that they would decrease in value over time.

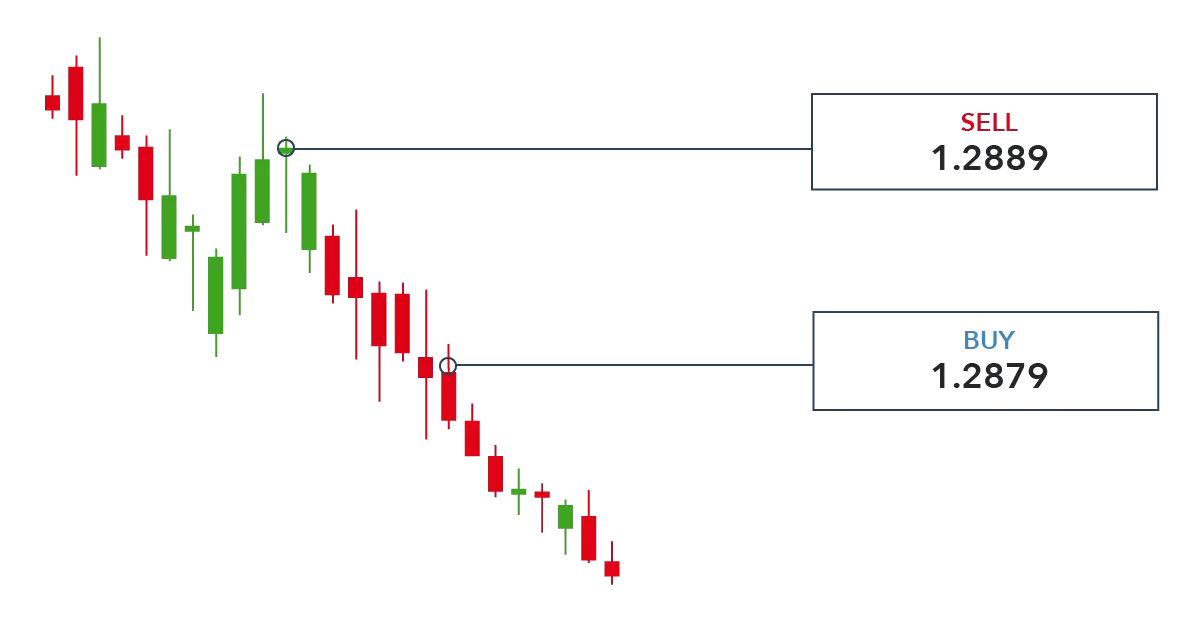

When trading forex, you'll be quoted the price as a bid and an offer – or a sell and buy. For example, the price for EUR/USD could be $1.2345, with a bid of $1.2335 and an offer of $1.2355.

In this case, you'd open a short position for the sell price of $1.2335 in the hope that the value of the pair will fall.

If the price of the pair does fall, then you’ll have made a profit. However, going short carries a unique set of risks in that, theoretically, an asset’s price can rise indefinitely. That’s why you should mitigate your exposure to risk with stops and limits, which can reduce losses and lock in profits.

Learn more about how to manage your risk

How to short a currency

The five following simple steps will help you to short a currency:

- Research which forex pair you want to trade

- Carry out analysis on that forex pair, both technical and fundamental

- Choose a forex trading strategy and check you’re comfortable with your exposure to risk

- Create a tastyfx account and deposit funds

- Open, monitor and close your first position

Research which forex pair you want to trade

Researching the different forex pairs available to you means that you'll be better informed on which pairs are the most volatile or have the most liquidity.

These two factors can be crucial for traders, with those with a higher appetite for risk choosing pairs that are more volatile; or those that are after quick opportunities for profit – such as scalpers – choosing the pairs with higher liquidity.

Carry out analysis

Once you have chosen a pair, it's important to carry out both technical and fundamental analysis before opening a trade. This is because analysis can show you whether a trade has the potential to yield a profit or not.

Technical indicators such as Bollinger bands, and Fibonacci retracements can help you to identify whether a forex pair is currently oversold or underbought and they are also good indicators for volatility. This means they can highlight whether a forex pair is about to experience a bearish reversal – a perfect opportunity to open a short position.

Choose a forex trading strategy

There are a whole host of trading strategies that you can use to your advantage during your time on the markets. For example, you could take up a short position on the EUR/USD pair with a scalping strategy, which relies heavily on quick and constant price movements during a single trading session.

Create a trading account

If you want to trade spot forex, you’ll need a trading account. You can open an account with us in minutes, and there’s no obligation to add funds until you want to place a trade.

Open, monitor and close your first position

Once you have chosen your pair, carried out your analysis and selected a strategy, you are ready to start trading. To open a trade, go to the deal ticket for your chosen market. To go short – select the ‘sell’ option. Alternatively, if you wanted to go long, you'd select ‘buy’.

From this window you can also select whether you wish to add any stops or limits to your trades, which can help to mitigate losses and lock-in profits. If you wish to close your position, you'd simply go to your open positions, and select ‘close’.

Currency shorting example: how to short GBP/USD

As another example, let’s suppose that GBP/USD is currently trading at $1.2890, with a buy price of $1.2891 and a sell price of $1.2889. You think that the price of this pair will fall, so you open a short spot forex position at a sell price of $1.2889.

In this case, you’d realize a profit if the price of GBP/USD fell after you had opened your short position – meaning that USD is becoming stronger than GBP because fewer US dollars are needed to buy a single British pound. So, in this example you’re shorting the British pound.

Whenever you’re shorting currencies, you can use a stop order to protect yourself from rising market prices.

Shorting currencies summed up

- Going short means that you are betting against the currency

- Betting against the currency carries unique risks because your losses (in theory) could be unlimited if an asset’s price continues to rise

- As a result, it's important to use stops and limits to mitigate your exposure to risk when shorting currencies

This information has been prepared by tastyfx, a trading name of tastyfx LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. tastyfx accepts no responsibility for any use that may be made of these comments and for any consequences that result. See our Summary Conflicts Policy, available on our website.