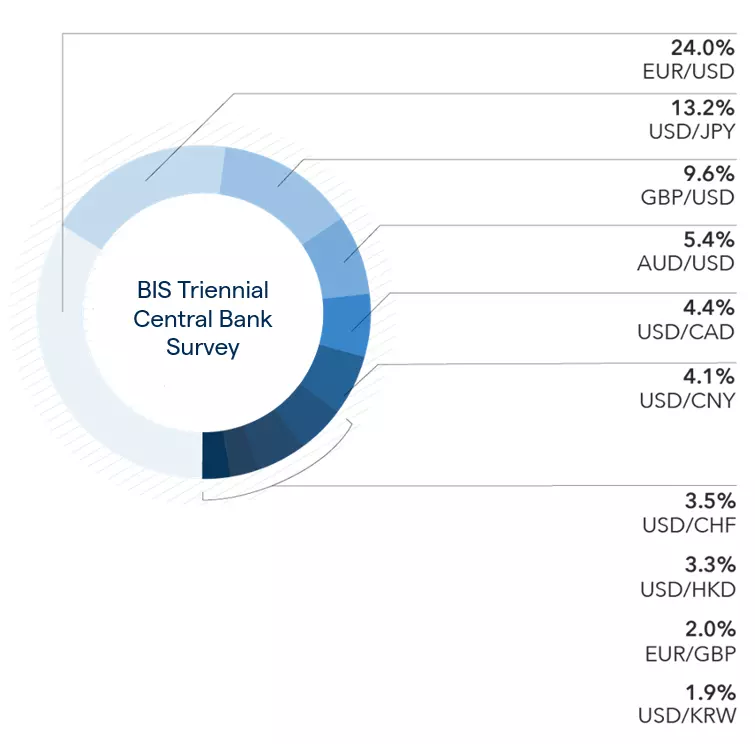

Top 10 most traded currency pairs

What are the most traded forex pairs in the world?

- EUR/USD (euro/US dollar)

- USD/JPY (US dollar/Japanese yen)

- GBP/USD (British pound/US dollar)

- AUD/USD (Australian dollar/US dollar)

- USD/CAD (US dollar/Canadian dollar)

- USD/CNY (US dollar/Chinese renminbi)

- USD/CHF (US dollar/Swiss franc)

- USD/HKD (US dollar/Hong Kong dollar)

- EUR/GBP (euro/British pound sterling)

- USD/KRW (US dollar/South Korean won)1

The figures in this article are from the Bank of International Settlements (BIS) triennial survey, which was last taken in April 2019.

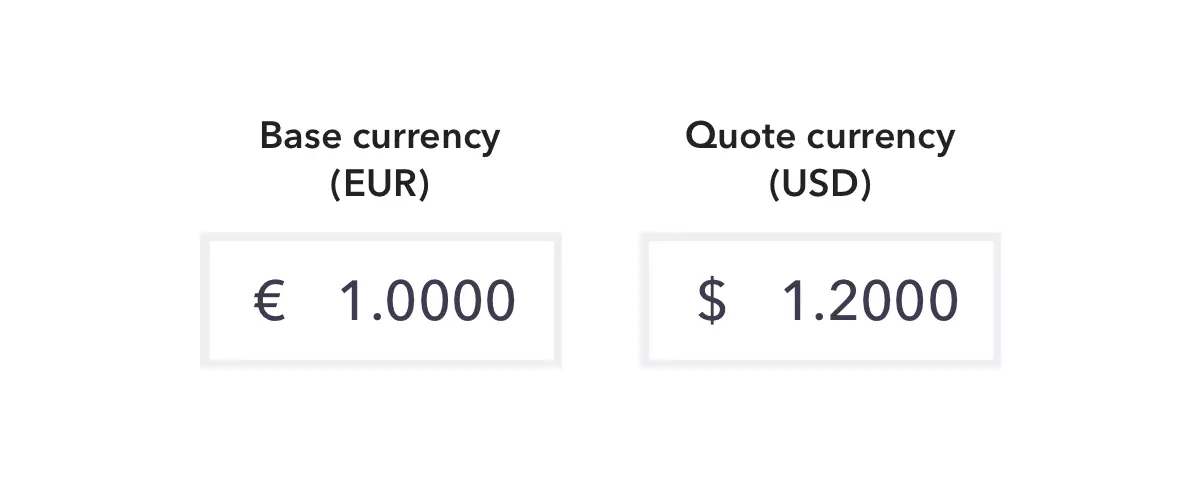

Forex pairs explained

Currencies are always traded in pairs because when you buy or sell one currency, you automatically sell or buy another. In every currency pair, there is a base currency and a quote currency – the base currency appears first, and the quote currency is to the right of it.

For example, in the EUR/USD currency pair, EUR is the base currency and USD is the quote currency. If the quote price was 1.2000, it means that one euro is worth 1.20 US dollars.

Different types of forex pairs

Broadly speaking, forex pairs can be separated into three categories. These are the majors, the commodity currencies, and the cross currencies:

- Major currencies are those that are most traded on the markets. Opinions differ as to how many major currency pairs there are, but most lists will include EUR/USD, USD/JPY, GBP/USD and USD/CHF

- Commodity currencies constitute currency pairs which have a value closely tied to a commodity such as oil, coal or iron ore. The commodity currencies included in this list are AUD/USD and USD/CAD

- Cross currencies are currency pairs which do not include the US dollar. Two cross currency pairs have made it into this top ten, EUR/GBP and EUR/JPY

EUR/USD

EUR/USD is the most traded currency pair on the market, with EUR/USD transactions making up 24.0% of daily forex trades in 2019.1 The popularity of the EUR/USD pair comes from the fact that it is representative of the world’s two biggest economies: the European single market and the US.

The high daily volume of EUR/USD transactions ensures that the pair has a lot of liquidity which generally results in tight spreads. Liquidity and tight spreads are enticing for traders because they mean that large trades can be made with little impact on the market.

The exchange rate of EUR/USD is determined by a number of factors, not least of which are the interest rates set by the European Central Bank (ECB) and the US Federal Reserve (Fed). This is because the currency with the higher interest rates will generally be in higher demand because higher interest rates give a better return on their initial investment. If for instance, the ECB had set higher interest rates than the Fed, it is likely that the euro would appreciate relative to the dollar.

USD/JPY

Also known as ‘the gopher’, the USD/JPY currency pair is made up of the US dollar and the Japanese yen. It is the second most traded forex pair on the market, representing 13.2% of all daily forex transactions in 2019.1

Similar to EUR/USD, USD/JPY is known for its high liquidity, something it gets from the fact that the yen is the most heavily traded currency in Asia, and the US dollar is the most commonly traded currency in the world.

Much in the same way as the Fed and ECB, the Bank of Japan (BoJ) sets the interest rates for the Japanese economy which, in turn, affects the value of the yen relative to the US dollar.

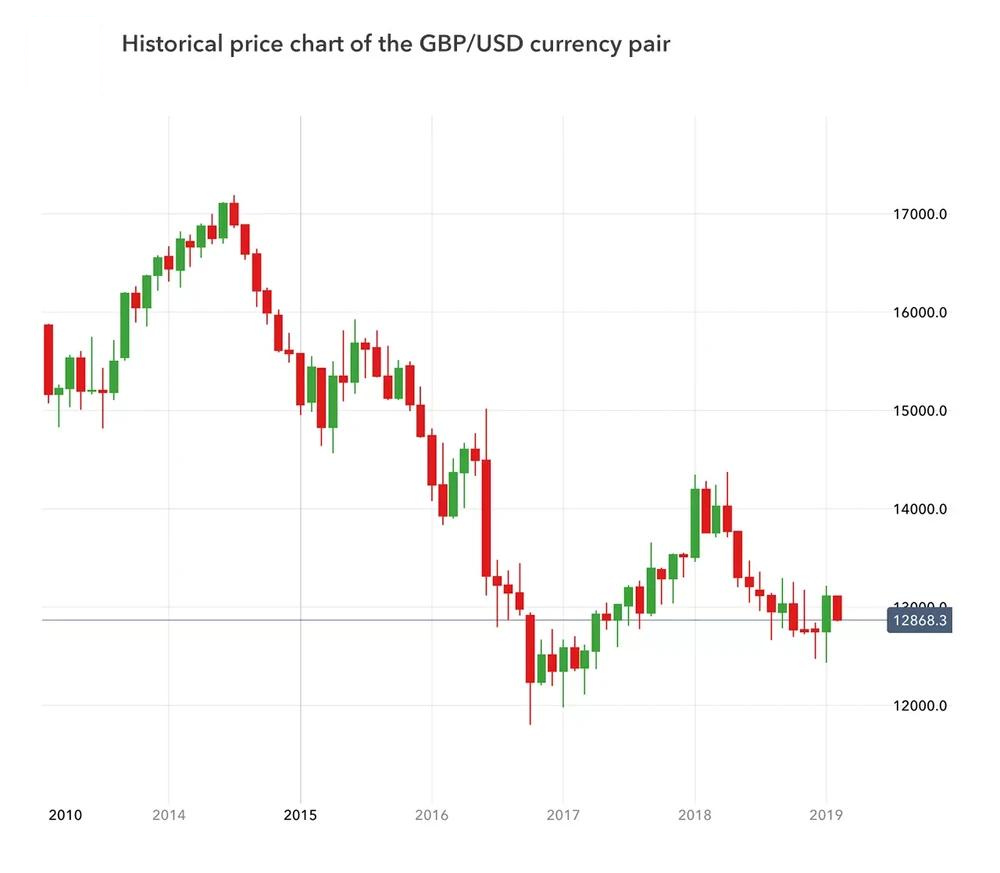

GBP/USD

The currencies in this pair are the pound sterling and the US dollar. GBP/USD is colloquially called ‘cable’ on account of the deep-sea cables that used to deliver the bid and ask quotes between London and New York. In 2019, the GBP/USD pair made up 9.6% of all daily forex transactions.1

Like with most other currency pairs, the strength of GBP/USD comes from the respective strength of the British and American economies. If the British economy is growing at a faster rate than that of America, it is likely the pound will strengthen against the dollar. However, if the American economy is doing better than the British economy, the reverse is true.

Just like the first two most popular currency pairs on this list, the quote price of GBP/USD is affected by the respective interest rates set by the Bank of England (BoE) and the Fed. The subsequent differential between the interest rates on the pound and the dollar can have a great effect on the price of the GBP/USD currency pair.

AUD/USD

AUD/USD, sometimes referred to as the ‘Aussie’, represents the Australian dollar against the US dollar. It made up 5.4% of daily forex trades in 2019.1 The value of the Australian dollar is tied closely to the value of its exports, with metal and mineral exports such as iron ore and coal accounting for a large proportion of the country’s gross domestic product (GDP).2

A slump in the value of these commodities on the world market would likely cause a reciprocal slump in the value of the Australian dollar. In the case of the AUD/USD currency pair, this means the US dollar would become stronger, so it would cost fewer US dollars to buy one Australian dollar.

Much in the same way as the previously mentioned currency pairs, the AUD/USD exchange rate is also affected by the interest rate differential between the Reserve Bank of Australia (RBA) and the US Federal Reserve. For example, if American interest rates are low, USD would probably weaken against AUD and it would cost more US dollars to buy one Australian dollar.

USD/CAD

USD/CAD is commonly called the ‘loonie’ on account of the loon bird which appears on Canadian dollar coins, and it represents the pairing of the US dollar and the Canadian dollar. In 2019, USD/CAD transactions made up 4.4% of daily forex trades.1 The strength of the Canadian dollar is closely linked to the price of oil because oil is Canada’s main export.

Since oil is priced in US dollars on the world markets, Canada can earn a large supply of US dollars through its oil exports. As such, if the price of oil rises, it is likely that the value of the Canadian dollar will strengthen compared to the US dollar.

It is a general rule that the US dollar normally weakens when the price of oil increases, because if the dollar is weaker, more US dollars must be converted into other currencies to buy the same amount of oil as before. In turn, expensive oil means that the Canadian dollar will likely strengthen due to the close ties between the Canadian dollar and the price of oil.

As such, traders should keep an eye on the price of both Brent crude and US crude when trading USD/CAD, as any fluctuations in the oil market will likely reverberate in the exchange rate of this forex pair.

USD/CNY

The USD/CNY currency pair is the partnership of the US dollar and the Chinese renminbi – commonly known as the yuan – which represented 4.1% of daily forex trades in 2019.1

The yuan has largely been decreasing relative to the US dollar since the start of the US-China trade war. This has been due in part to the Chinese government, which has let the yuan depreciate in the knowledge that this will make the country’s exports cheaper and increase their already sizable market share in countries other than the US.

With tastyfx, you can trade the USD/CNH currency pair – CNH being the offshore version of the yuan that is traded outside of mainland China. Yuan is referred to as CNY only when it is traded in the onshore Chinese market. CNH has traditionally not been as tightly controlled as CNY by the Chinese government, which means it can be more volatile. This volatility can make it a better choice for speculative trading.

Traders should keep an eye on the US-China trade war as any developments are likely to affect the price of this currency pair.

USD/CHF

The USD/CHF currency pair is made up of the US dollar and the Swiss franc and is commonly known as the ‘Swissie’. USD/CHF is a popular currency pair because the Swiss financial system has historically been a safe haven for investors and their capital.

As a result, traders often turn to CHF during times of increasing market volatility, but the Swiss franc will typically see less interest from traders during times of greater market stability. During times of increased volatility, it is likely the price of this pair would drop as CHF strengthens against the USD after experiencing increased investment.

Since CHF is turned to primarily during times of economic volatility or as a safe haven, it is not as actively traded as the six preceding currency pairs on this list. However, USD/CHF still accounted for 3.6% of all daily forex transactions in 2019.1

USD/HKD

USD/HKD puts the Hong Kong dollar against the US dollar. This pair’s trading volume more than doubled between 2016 and 2019 – going from 1.5% to 3.3% of all daily forex transactions.1

The rise could have been due to the Hong Kong protests which dominated 2019. The protests were a result of the attempted implementation of the Fugitive Offenders amendment bill, as well as allegations of police brutality against the people of Hong Kong.

The protests began a month or so before the data was collected, and so it is likely that they had an effect on the trading volume of USD/HKD. In part, this could be because the increased media buzz caused many traders and speculators to focus their attention on the Hong Kong dollar, with the assumption that its value would be affected by any news from the city.

The value of the Hong Kong dollar is pegged to the US dollar in a unique system known as a linked exchanged rate. The Hong Kong dollar is allowed to fluctuate within a band of HK$7.75 to HK$7.85 to US$1, and traders can take advantage of any price movements within this band.

EUR/GBP

The pairing of the euro and the British pound in the EUR/GBP pair is often seen as one of the most difficult pairs to make accurate price predictions for. This is because EUR and GBP have had a historical link given the proximity of the UK to Europe and the subsequent strong trade ties between these two economies.

Despite the supposed difficulties in predicting its movements, EUR/GBP transactions still made up 2.0% of daily trades in 2019, making it the ninth most traded currency pair on our list.1

As with the other currency pairs on this list, traders should keep an eye on any ECB and BoE announcements which could affect the exchange rates of the euro and the pound, which would increase volatility further.

In recent years, this currency pair has fluctuated in price quite unpredictably – primarily due to the uncertainty surrounding Brexit. The high level of volatility can be attractive to traders, but it is important to have a risk management strategy in place before opening a position in a volatile market.

To keep up to date with any Brexit news that may have affected the price of the EUR/GBP currency pair, visit tastyfx’s Brexit events page.

USD/KRW

USD/KRW is the tenth pair on this list, and it puts the US dollar against the South Korean won. This forex pair made up 1.9% of daily forex transactions in 2019 – the first year that USD/KRW has made it into a list of the top ten most traded currencies.1

The South Korean economy has grown during the turn of this century to become the fourth largest in Asia and the eleventh in the world as of November 2019. This could be a reason for the increased activity that USD/KRW has experienced, as traders and speculators seek exposure to another key Asian market, besides those of Japan, China and Hong Kong.

Economic growth in South Korea has been so impressive – especially since the end of the Korean war in 1953 – that people often refer to it as the Miracle on the Han River. This growth is now being capitalized on, and South Korea enjoys membership of the United Nations, the Organisation for Economic Co-operation and Development (OECD) and the G20, making the country and its currency an exciting opportunity for many market participants.

Conclusion

While EUR/USD leads the way in terms of daily traded volume in forex pairs, there are a number of other viable currency pairs with high liquidity that traders can choose from in an attempt to realize a profit. Traders should take a number of factors into consideration before choosing a currency pair to trade, and they should carry out their own technical and fundamental analysis to assess whether the currency pair is a viable trading option at that particular point in time, depending on announcements from central banks or ongoing trade disputes.

This information has been prepared by tastyfx, a trading name of tastyfx LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. tastyfx accepts no responsibility for any use that may be made of these comments and for any consequences that result. See our Summary Conflicts Policy, available on our website.