Top risk management strategies in forex trading

What is forex risk management?

Forex risk management refers to implementing a set of rules and measures to ensure any negative impact of a forex trade is manageable. An effective strategy requires proper planning from start to finish, because it is not a good idea to start trading and then try to manage your risk as you go.

What are the risks of forex trading?

- Exchange rate risk is the risk associated with changes to the prices for which you can buy or sell currencies. This risk increases if you are exposed to international forex markets, though you can also be exposed indirectly via shares and commodities

- Interest rate risk is the risk associated with the sudden increase or decrease of interest rates, which affects volatility. Interest rate changes affect FX prices because the level of spending and investment across an economy will increase or decrease, depending on the direction of the rate change

- Liquidity risk is the risk that you can’t buy or sell an asset quickly enough to prevent a loss. Even though forex is generally a high-liquidity market, there can be periods of illiquidity – depending on the currency, and government policies around foreign exchange

- Leverage risk is the risk of magnified losses when trading on margin. Because the initial outlay is smaller than the value of the FX trade, it’s important to check how much capital you are putting at risk

How to manage risk in forex trading

- Understand the forex market

- Get a grasp on leverage

- Build a trading plan

- Set a risk-reward ratio

- Use stops and limits

- Manage your emotions

- Keep an eye on news and events

- Start with a demo account

Understand the forex market

The forex market is made up of currencies from all over the world, such as GBP, USD, JPY, AUD, CHF and ZAR. Forex—also known as foreign exchange or FX—is primarily driven by the forces of supply and demand.

The first currency that appears in a forex pair quotation is called the base currency, and the second is called the quote currency. The price displayed on a chart will always be the quote currency – it represents the amount of the quote currency you will need to spend in order to purchase one unit of the base currency. For example, if the GBP/USD currency exchange rate is 1.25000, it means you’d have to spend $1.25 to buy £1.

There are three different types of forex market:

- Spot market: the physical exchange of a currency pair takes place at the exact point the trade is settled – ie ‘on the spot’

- Forward market: a contract is agreed to buy or sell a set amount of a currency at a specified price, at a set date in the future or within a range of future dates

- Futures market: a contract is agreed to buy or sell a set amount of a currency at a set price and date in the future. Unlike forwards, a futures contract is legally binding

Get a grasp on leverage

When you speculate on forex price movements with derivatives such as our rolling spot forex contracts, you will be trading on leverage. This enables you to get full market exposure for an initial deposit – known as margin.

Let’s say you decide to trade GBP/USD and the pair is trading at 1.22485, with a buy price of 1.22490 and a sell price of 1.22480. You think that the pound is set to gain value against the US dollar, so you decide to buy a standard GBP/USD contract at 1.22490.

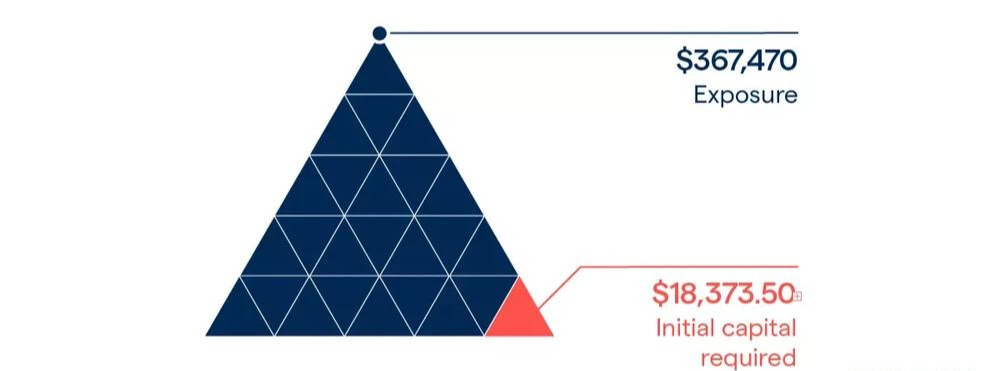

In this case, buying a single standard GBP/USD contract is the equivalent of trading £100,000 for $122,490. You decide to buy three contracts, giving you a total position size of $367,470 (£300,000). However, because our margin requirements for this forex pair are 5%, your initial outlay would be just $18,373.50 (£15,000).

While leverage will magnify any profits, losses will be magnified too. For this reason, it’s important to manage your risk using stops – which are covered in step five.

Build a trading plan

A trading plan can help make your FX trading easier by acting as your personal decision-making tool. It can also help you maintain discipline in the volatile forex market. The purpose of this plan is to answer important questions, such as what, when, why, and how much to trade.

It is extremely important for your forex trading plan to be personal to you. It's no good copying someone else's plan, because that person will very likely have different goals, attitudes and ideas. They will also almost certainly have a different amount of time and money to dedicate to trading.

A trading diary is another tool you can use to keep record of everything that happens when you trade – from your entry and exit points, to your emotional state at the time.

Set a risk-reward ratio

In every trade, the risk you take with your capital should be worthwhile. Ideally, you want your profit to outweigh your losses—making money in the long run, even if you lose on individual trades. As part of your forex trading plan, you should set your risk-reward ratio to quantify the worth of a trade.

To find the ratio, compare the amount of money you're risking on an FX trade to the potential gain. For example, if the maximum potential loss (risk) on a trade is $200 and the maximum potential gain is $600, the risk-reward ratio is 1:3. So, if you place ten trades with this ratio and you were successful on just three of those trades, you could have made $400, despite only being right 30% of the time.

Use stops and limits

Because the forex market is particularly volatile, it is very important to decide on the entry and exit points of your trade before you open a position. You can do this using various stops and limits:

- Stop orders will close your position automatically if the market moves against you. However, there is no guarantee against slippage

- Limit orders will follow your profit target and close your position when the price hits your chosen level

Manage your emotions

Volatility in the FX market can also wreak havoc on your emotions – and if there's one key component that affects the success of every trade you make, it’s you. Emotions such as fear, greed, temptation, doubt and anxiety could either entice you to trade or cloud your judgment. Either way, if your feelings get in the way of your decision-making, it could harm the outcome of your trades.

Keep an eye on news and events

Making predictions about the price movements of currency pairs can be difficult, as there are many factors that could cause the market to fluctuate. To make sure you’re not caught off guard, keep an eye on central bank decisions and announcements, political news and market sentiment.

Keep an eye on market-moving events with news and analysis from our experts

Start with a demo account

Our demo account aims to recreate the experience of ‘real’ trading as closely as possible, enabling you to get a feel for how the forex market works. The main difference between a demo and a live account is that with a demo, you won’t lose any real money – meaning you can build you trading confidence in a risk-free environment.

When you open a demo account with us, you’ll get immediate access to a version of our online platform, along with $10,000 in virtual funds.

Forex risk management in summary

If you have an effective risk management strategy, you will have greater control over your profits and losses. We offer a wide variety of tools to help you get geared for success. These include the educational resources at tastyfx Learn Center, via a demo account, through forex trade ideas, and much more.

This information has been prepared by tastyfx, a trading name of tastyfx LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. tastyfx accepts no responsibility for any use that may be made of these comments and for any consequences that result. See our Summary Conflicts Policy, available on our website.