USD and Oil: Are Dollar and Oil Prices Correlated?

Are USD and oil prices correlated? Understand the relationship between the price of the US Dollar, why oil is traded in dollar and how the prices are impacted.

What is correlation in the financial markets?

In the financial markets, correlation refers to the statistical relationship between two assets and the degree to which their prices move relative to each other. In simple terms, correlation helps investors and traders understand how different asset prices are related, allowing them to make more informed decisions. Positive correlation means that the assets tend to move in the same direction—when one goes up, the other tends to go up as well. Conversely, negative correlation means the assets move in opposite directions—when one rises, the other falls. A correlation coefficient between -1 and 1 is typically used to measure this relationship, with -1 indicating a perfect inverse relationship, +1 indicating a perfect direct relationship, and 0 indicating no discernible correlation.

Understanding the correlations between assets is crucial because it can help with decision-making in the financial markets. For example, if two assets are positively correlated, adding each of them to the portfolio may not be advised, because it's akin to adding more of the same exposure to the portfolio. On the other hand, if they are negatively correlated, adding both assets to the portfolio may reduce overall portfolio volatility, because one asset's gains might offset the other's losses (to varying degrees). As one can see, an understanding of correlation can be crucial to managing risk, not only for assessing new positions, but also for overall portfolio management.

Why is oil traded in dollars?

The practice of trading oil in U.S. dollars, known as the "petrodollar system," began in the 1970s as part of an agreement between the United States and key oil-producing nations, especially Saudi Arabia. In return for military protection and security guarantees, these countries agreed to price their oil exports exclusively in U.S. dollars. This deal significantly boosted global demand for the dollar, as nations had to convert their currencies into dollars to purchase oil.

Today, oil transactions are still mainly conducted in U.S. dollars, solidifying the dollar's status as the world's primary reserve currency. This long-standing practice has fostered a strong connection between oil and the dollar, often resulting in a negative correlation between the two. However, as with any market relationship, this correlation can shift or even break down over time, meaning the link between oil prices and the dollar is not fixed, and is ever-changing.

What is the relationship between oil and the U.S. dollar?

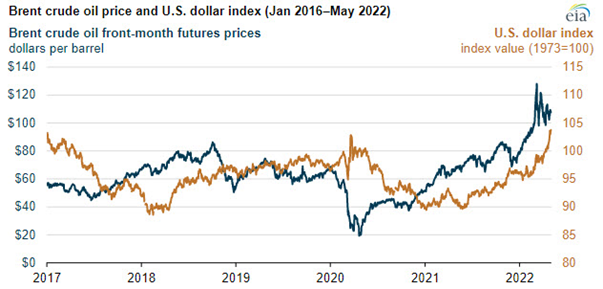

The relationship between oil and the U.S. dollar (USD) provides further insight into how correlations work in the financial markets. Historically, the price of oil and the value of the U.S. dollar tend to be negatively correlated. That means when the value of the U.S. dollar rises, the price of oil tends to fall, and when the U.S. dollar weakens, oil prices often increase. However, this relationship shifts over time, and can vary considerably in strength. That means one can't assume that the two will exhibit strong negative correlation, only that it has been observed in the past.

One of the reasons these two assets share a negative correlation is because oil, like many other commodities, is priced in U.S. dollars. That means when the dollar strengthens in value, oil becomes relatively more expensive for holders of other currencies, which generally leads to a decrease in demand, and can weigh negatively on oil prices. Conversely, when the dollar weakens in value, oil becomes relatively less expensive for foreign buyers, which can drive up demand and push oil prices higher.

The negative correlation between oil and the U.S. dollar is also influenced by other factors, including interest rates and inflation expectations. For example, when the Federal Reserve raises interest rates to combat inflation, the U.S. dollar tends to strengthen. This, in turn, can put downward pressure on oil prices. On the other hand, when the Fed cuts rates or maintains a loose monetary policy, the U.S. dollar may weaken, potentially boosting the price of oil. Understanding these relationships is critical for investors and traders, because movements in any of the aforementioned markets may create new opportunities, or prompt a shift in one's strategy or outlook.

The importance of "commodity currencies"

Commodity currencies are the currencies of countries whose economies rely heavily on the export of natural resources or commodities, such as oil, metals, and agricultural products. These currencies often move in tandem with the prices of the commodities they are tied to, because fluctuations in commodity prices can directly impact a nation's economic health and trade balance.

For example, countries like Canada, Australia, and Russia have commodity currencies, with the Canadian dollar (CAD) being particularly sensitive to changes in crude oil prices. Since Canada is one of the world's largest oil exporters, fluctuations in oil prices can lead to corresponding movements in the value of the Canadian dollar. When oil prices rise, the Canadian economy benefits from increased revenues, strengthening the CAD. Conversely, when oil prices fall, Canada's oil exports become less profitable, often leading to a weakening of the Canadian dollar.

To illustrate, let's assume that the USD/CAD exchange rate is approximately 1 USD = 1.4440 CAD. If global oil prices rise by 10%, Canada's oil exports become more lucrative, which typically strengthens the CAD. In response, the USD/CAD exchange rate might shift from 1.4440 to 1.4200, meaning that 1 USD would now be equivalent to 1.42 CAD. Conversely, if oil prices decrease by 10%, Canada's oil revenues decline, and the CAD may weaken. The USD/CAD rate might then rise to 1.4600, meaning 1 USD equals 1.46 CAD.

The relationship between oil and these commodity currencies highlights the interconnectedness of the global financial system. While the U.S. dollar remains the dominant global reserve currency, commodity currencies like the Canadian dollar can serve as a barometer for the health of global commodity markets. Movements in oil prices, typically traded in U.S. dollars, can ripple through the currencies of oil-producing nations, influencing financial markets in various ways and impacting trading strategies worldwide.

Tracking and trading the shifting relationships of commodity currencies

The relationship between oil and the U.S. dollar has often been most evident when examining the Canadian dollar (CAD), given Canada's significant dependence on oil exports. Oil prices and the CAD have historically moved in tandem, with fluctuations in oil directly affecting Canada's economic health and, by extension, the strength of the CAD. This dynamic has made the USD/CAD pair a popular tool for trading both oil and broader economic trends in Canada. However, as global financial markets evolve, so too do these correlations.

In recent years, this relationship has evolved, with the correlation between the Canadian dollar and oil prices weakening. While oil prices still exert some influence on the CAD, other factors—such as global risk sentiment, shifting U.S.-Canada trade dynamics, and diverging economic performance between the two nations—have become more significant in driving the CAD's value. Analyzing recent trends in the correlation between USD/CAD and crude oil (/CL) further highlights this shift. For example, the 3-year correlation has decreased to -0.29, and the 1-year correlation has dropped to -0.11. Meanwhile, the 3-month correlation has nearly disappeared, recently registering at +0.01 (as of March 2025).

This evolving trend suggests that while oil still has a notable influence on the Canadian dollar, it is no longer the dominant driver of CAD movements. Interestingly, when analyzing other dollar pairs, the Swiss franc (USD/CHF) has emerged as a stronger proxy for oil, with a 3-month correlation of +0.36. Traditionally viewed as a safe-haven currency during periods of market volatility, the Swiss franc now shows a closer alignment with oil prices. As these dynamics continue to shift, traders and investors must stay agile, constantly monitoring these evolving relationships and adjusting their strategies accordingly.

What affects the price of the U.S. dollar?

The value of the U.S. dollar is influenced by a variety of factors that are often interconnected and can fluctuate quickly due to changes in market conditions, geopolitical events, and economic developments. Key drivers include interest rates, Federal Reserve policies, and the overall health of the U.S. economy.

Interest rates are a major factor in determining the dollar's value, with the Federal Reserve playing a crucial role in setting these rates. When the Fed raises interest rates, the dollar typically strengthens, as higher yields attract investment in U.S. assets. Conversely, when the Fed cuts rates, the dollar often weakens. Inflation also plays a significant role—higher inflation reduces the dollar's purchasing power, causing its value to decline. Strong economic growth in the U.S. tends to bolster the dollar by increasing investor confidence, while slower growth may have the opposite effect.

Geopolitical events and market sentiment also play a significant role in shaping the value of the dollar. During periods of global instability, the dollar is often considered a "safe haven," attracting investors seeking stability, which drives up its value. On the other hand, political uncertainty—such as trade wars, government shutdowns, or geopolitical tensions—can undermine confidence in the dollar, causing its value to decline.

Given the complexity of the factors that influence the dollar, pinpointing exactly what drives its movements at any given moment can be difficult. At times, the cause is clear—such as a change in interest rates or a significant geopolitical event—but more often, the drivers are less obvious. This makes it crucial for investors and traders to gather as much information as possible to understand what's affecting the dollar, how long these factors may last, and the potential consequences for its value. A thoughtful, methodical approach is key to navigating the complexities of the global markets.

What affects the price of oil?

Like the U.S. dollar, oil prices are influenced by a wide range of factors, with supply and demand dynamics being the most significant. These dynamics are shaped by geopolitical events, economic trends, and even weather conditions. On the demand side, global oil consumption is closely tied to industrial activity and energy needs. When the economy grows, demand for energy increases, which in turn tends to push oil prices higher. On the supply side, oil production levels, especially those controlled by key players like OPEC (Organization of the Petroleum Exporting Countries), have a substantial impact on prices. When production is constrained, prices generally rise, whereas an expansion in production can weigh on prices.

Geopolitical factors are another major driver of oil prices. As a globally traded commodity, oil is highly sensitive to tensions in key oil-producing regions, such as the Middle East. Any signs of instability in these areas can raise concerns about potential supply disruptions, often causing oil prices to surge. Additionally, oil inventories, including those reported by organizations like the U.S. Energy Information Administration (EIA), offer valuable insight into supply and demand conditions. When inventories are high, it typically indicates an oversupply, which can push prices down. Conversely, low inventories signal tighter supply, often leading to higher prices.

Although these factors provide valuable insight into the oil market, pinpointing the exact cause of a price move can often be challenging. Oil prices are influenced by a complex mix of tangible elements—like supply and demand shifts—and more abstract forces, such as market sentiment, speculative trading, and broader financial trends. The interaction of these variables can create a tangled web, making it difficult to identify the primary driver behind a given price change. As a result, investors and traders need to remain vigilant, monitoring a broad range of indicators to better navigate this complex market.

What would happen if oil wasn't traded in U.S. dollars?

If oil were no longer traded in U.S. dollars, it could trigger significant changes in the global financial system, but the exact effects are difficult to predict. That's because such a shift would likely be accompanied by other changes that are hard to foresee, including adjustments in other global trade practices. That said, there are several theories about the potential consequences of this hypothetical shift.

One likely outcome is a reduction in global demand for the U.S. dollar, as oil transactions have historically been a key driver of that demand. The petrodollar system has created a constant need for dollars, with countries around the world holding them to facilitate oil purchases. Without this demand, the dollar could lose value, potentially leading to higher inflation in the U.S. Additionally, the U.S.'s ability to sustain its trade deficit could be impacted, as the global demand for dollars has allowed the country to borrow at relatively low interest rates.

Another theory is that if oil were priced in a different currency—such as the euro or a basket of currencies—it could shift global power dynamics. Countries that control this new oil pricing system would likely gain more geopolitical influence, as they would hold greater sway over global trade. This could diminish the U.S.'s dominance in international finance and reduce its leverage in economic negotiations.

Additionally, oil producers themselves might stand to benefit from pricing oil in an alternative currency, as it would lessen their dependence on the U.S. dollar. Under this scenario, the producers' local currency could gain more influence in trade transactions related to oil. However, such a shift would be complex, and many oil-exporting countries may hesitate to abandon the dollar due to the well-established infrastructure and stability it offers in global commerce.

U.S. Dollar and oil relationship key takeaways

- Correlation measures how two variables move in relation to each other. A positive correlation means they move in the same direction (to varying degrees), while a negative correlation means they move in opposite directions (to varying degrees).

- The price of oil is heavily influenced by supply and demand dynamics, geopolitical events, market sentiment, and global financial trends.

- The petrodollar system, established in the 1970s, made oil transactions globally denominated in U.S. dollars, creating increased demand for the dollar.

- The petrodollar system reinforced the U.S. dollar's position as the world's primary reserve currency, providing the United States with certain economic advantages.

- Oil and the U.S. dollar have historically had a negative correlation. When oil prices rise, the value of the dollar tends to fall, and vice versa.

- Commodity currencies are currencies of countries that rely heavily on the export of natural resources, such as oil, metals, and agricultural products. These currencies often move in tandem with the prices of the commodities they are tied to, as fluctuations in commodity prices directly impact the nation's economic health and trade balance.

- The Canadian dollar (CAD) is particularly sensitive to changes in crude oil prices due to Canada's large oil export market.

- In recent years, the Canadian dollar's correlation with oil has weakened. As a result, the link between oil and the CAD is no longer as pronounced.

- The Swiss franc (CHF) has recently emerged (March 2025) as a stronger proxy for oil prices compared to the Canadian dollar.

- Tracking these evolving dynamics and understanding the shifting correlations is essential for adjusting trading strategies. As correlations change over time, staying informed about these developments can help investors and traders adapt their approach.

- The value of the U.S. dollar is heavily influenced by interest rates, inflation, economic growth, and geopolitical events, with the Federal Reserve playing a critical role in the value of the dollar.

- The widespread use of the dollar in the global oil markets allows the U.S. to maintain a trade deficit without facing the usual pressures that other countries might experience.

- If oil were no longer traded in dollars, demand for the U.S. dollar could weaken, potentially leading to a weaker dollar, as well as other negatives for the U.S. economy.

- A shift away from the U.S. dollar in oil transactions could reshape the global financial landscape, influencing other currencies and altering the broader dynamics of international trade.

- Ultimately, it's hard to predict how the global financial system would change if oil were no longer traded in U.S. dollars. This shift would likely bring broader changes to currency systems, global trade practices, and financial markets.