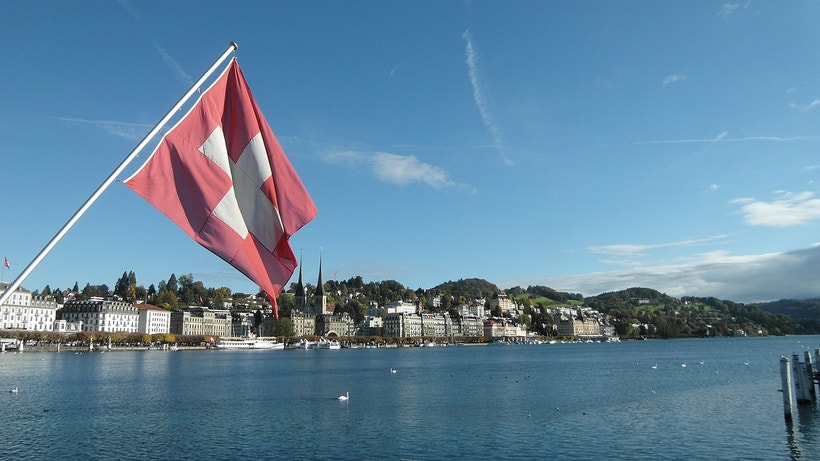

USD/CHF price action: bullish momentum after SNB decision

The SNB's unexpected 50bps rate cut to 0.5% has weakened the Swiss franc, boosting USD/CHF. Fed's cautious optimism on inflation and rate cuts supports dollar strength.

Key points

- SNB cuts interest rates by 50bps to 0.5%, largest since January 2015

- USD/CHF rises as Swiss franc hits lowest value since November 2022

- SNB aims to boost economic activity amid rising unemployment

- Fed optimism and stable US inflation support dollar strength

- Market watches for central bank policy shifts impacting USD/CHF

Swiss National Bank unexpectedly cuts interest rates

Despite the market’s expectations of a 25-basis points (bps) cut by the Swiss National Bank (SNB), Switzerland’s interest rates were cut by 50 bps to 0.5%. This is Switzerland’s largest cut since January 2015, and its fourth straight rate reduction, putting borrowing costs at their lowest since November 2022. This decision stemmed from rising unemployment, global uncertainties, and slower production. The SNB rate cut aims to stimulate economic activity by making borrowing cheaper for businesses and consumers, thereby encouraging investment and spending to counteract these economic headwinds.

USD/CHF jumps above 0.0890

The Swiss franc depreciated against the US dollar to 0.89019 this morning, its lowest value since November 2022. This comes after staggering rate cuts from the SNB, as well as dovish commentary from SNB Chairman Martin Schlegel in late November regarding lower interest rates being “not excluded from our toolbox.” Despite the US dollar trading slightly lower today, the overall sentiment towards the greenback and US economy is more positive after stable inflation data, pushing the pair in a bullish momentum with dollar domination and a weaker franc.

USD/CHF price history

Fed officials express optimism ahead of FOMC meeting

The Federal Reserve's November meeting revealed that officials are optimistic about US inflation and a strong labor market, potentially allowing for further interest rate cuts at a slower pace. They emphasized that monetary policy should be responsive to present economic conditions, warning against rushing into rate cuts prematurely due to recent data volatility and uncertainties over the neutral interest rate's effects. Some officials recommended maintaining higher rates if inflation remains, while others favored quicker cuts if the labor market were to weaken.

What’s next for USD/CHF?

The current uptrend for USD/CHF is further supported by the general optimism surrounding the US dollar, driven by positive sentiment about the US economy. Despite a slight dip in the dollar today, the overall outlook remains favorable, contrasting with the SNB's dovish stance and recent rate cuts. Additionally, the Federal Reserve's optimism, backed by a strong labor market and stable inflation, suggests a slower pace of US rate cuts, potentially maintaining a stronger dollar relative to the franc.

In the short-term, the USD/CHF pair may continue its upward trajectory if the SNB persists with its accommodative policies and the Fed maintains a cautious approach to its rate decision; however, any unexpected shifts in economic data or policy stances could introduce volatility and potentially alter this trend. Traders should monitor upcoming economic data and central bank communications for further insights into potential shifts in monetary policy and their effects on the USD/CHF exchange rate.

More where that came from: check out what’s new in forex today on our YouTube channel:

How to trade USD/CHF?

- Open an account to get started, or practice on a demo account

- Choose your forex trading platform

- Open, monitor, and close positions on USD/CHF

Trading forex requires an account with a forex provider like tastyfx. Many traders also watch major forex pairs like EUR/USD and USD/JPY for potential opportunities based on economic events such as inflation releases or interest rate decisions. Economic events can produce more volatility for forex pairs, which can mean greater potential profits and losses as risks can increase at these times.

You can help develop your forex trading strategies using resources like tastyfx’s YouTube channel. Our curated playlists can help you stay up to date on current markets and understanding key terms. Once your strategy is developed, you can follow the above steps to opening an account and getting started trading forex.

Your profit or loss is calculated according to your full position size. Leverage will magnify both your profits and losses. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them. Trade using money you’re comfortable losing. Past performance is not indicative of future results.