What are support and resistance levels in forex trading?

What is support and resistance in forex?

Support is the area on the price chart that indicates traders’ willingness to buy - usually near the lowest levels of a recent trading range. Resistance, on the other hand, is the price level traders might associate with selling - usually near the highest levels of a recent trading range.

Support happens when there’s a fall in the forex market that results in a downward trend when lower prices increase the likelihood of traders taking a long or ‘buy’ position. Once the demand rises and becomes equivalent to the level of supply in the market, the forex price could discontinue falling.

You can think of support as the floor and resistance as the ceiling of the forex price. Historical prices are the most reliable sources of support and resistance in forex. Notable levels typically come from significant peaks or troughs collected over time on the price charts. These are identified as zonal areas on the vertical axis.

As market prices reach the previous support or resistance in forex, they can either continue in the same price levels as before or move away from them until these ‘ceilings’ and ‘bottoms’ occur again.

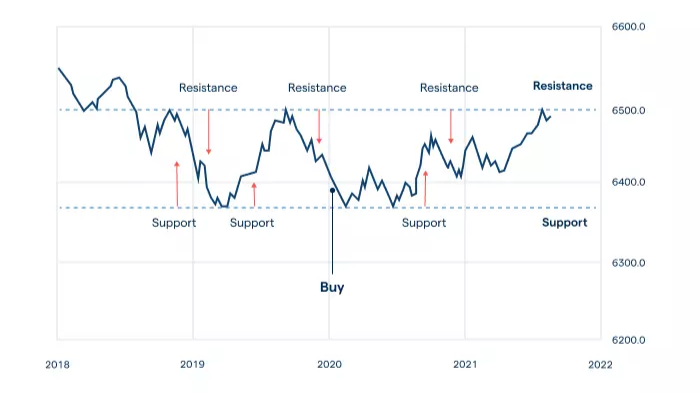

When a price level breaks through support, resistance forms. To get the bigger picture of the forex price movement, it’s important to look at the overall trends over time. For example, the chart shows historical trends from 2019 to 2022 with a resistance level or ‘ceiling’ of 6500 and a support or ‘bottom’ price of 6375.

Practice trading forex on a demo account

Understanding the role of support and resistance is crucial to being able to recognize where you may want to place your stop losses, which is key to successful trading. Being able to gauge which levels should be of importance and the reaction of price to those levels will tell you a lot about how strong the trend is and what market sentiment is for the forex market.

It’s important to keep in mind that support and resistance in forex are the building blocks in technical analysis. Technical analysis is the use of chart patterns, trends in market movement and historical data to make some assumptions on trading.

Other than specific horizontal price points, technical indicators and trendlines can provide moving support or resistance levels that show how the forex chart moves over time.

How to identify and trade trendlines

Trendlines can be identified by monitoring the opening and closing price of the underlying asset as well as the trading range of individual candlesticks. Trendlines are used by traders in technical analysis. This is done by drawing lines that link together prices on a chart, which can either give an upward or downward pattern that’s indicative of market sentiment.

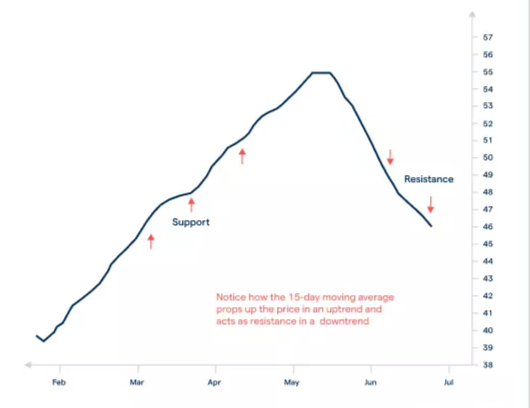

Resistance levels occur when there’s an upward trend in the market and the price decreases and moves towards the trendline. On the hand, support levels form when there’s a downward trend in the market and the prices move towards the trendline.

There are three trend trading strategies – upward, downward and sideways trendlines. These can provide some foresight that can help you identify trends early-on so you can exit the forex market before it heads on a reverse trajectory.

Upward trendline

When you see an upward trendline, the price of the forex pair is increasing in value. This means that the highs and lows of the individual candlesticks are relatively higher along the forex price movement’s trendline. When trading, you could open a long position as the market price levels keep reaching higher heights, though the market can reverse course producing losses.

Downward trendline

A downward trendline is when there’s a decrease in the price of the forex pair. These would occur when the candlesticks highs and lows are relatively lower along the forex price movement’s trendline. In an instance like this, you could open a short position when the forex market price falls to lower levels; similar to the upward trendline, the market can reverse producing losses.

Sideways trendline

A sideways trendline is when the forex market price isn’t reaching higher or lower price points. This will tend to interest scalpers seeking back-and-forth opportunities as this would result in short-term market movements vs the long-term trends, which are preferred by active day and swing traders.

How to use round numbers and moving averages

You can use round numbers and moving averages to help you understand the technical analysis used to read price charts when trading forex.

Round numbers

Round numbers are a common feature of support and resistance in the forex market. This is because the forex market price will likely have a challenge moving below or above a round number.

Round numbers tend to create strong barriers to the forex price. Many banks and retail investors prefer to use round numbers, they also place those types of orders in large amounts, creating resistance in the forex market.

Moving averages

Moving averages (MAs) are delayed indicators, meaning they move slower than the forex market price. They would therefore be considered as historic data since they’d inform you on past trends instead of future ones. You’d use MAs if you’re a trend trader, since they’d inform you on the likelihood of the forex market heading either upwards, downwards or sideways.

If you’re looking at a single MA, you’d focus on whether the price is above or below the delayed indicators. If the price is above the MA, it indicates an uptrend and if below, it’s likely a downtrend. You can also use the crossover between two MAs as a sign of the direction change in the forex pair’s price.

These usually present as two exponential moving averages (EMAs) where one is fast and another slow. Trend traders might take a long position when the fast EMA crosses the slow one from below. Alternatively, they could take a short position when the fast EMA crosses the slow one from above.

How to trade forex using support and resistance

- Choose the forex market you’d like to trade

- Open an account to get started, or practice on a demo account

- Choose your forex trading platform

- Open, monitor, and close positions

Trading forex using support and resistance requires an account with a forex provider like tastyfx and a strategy. Most strategies applicable to trading in other markets can be used to trade forex as well, including technical and fundamental analysis. You can also develop your forex trading strategies using resources like tastyfx’s Learn Center.

Once your strategy is developed, you can follow the above steps to opening an account and getting started trading forex.

Your profit or loss is calculated according to your full position size. Leverage will magnify both your profits and losses. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them. Trade using money you’re comfortable losing.

Spot forex

With us, you can buy or sell spot forex. The forex exchange will occur at the same time that the trade is settled. Spot prices reflect the underlying forex market and have no fixed expiry.

What are support and resistance levels in forex trading summed up

- Support is the area on the price chart that indicates traders’ willingness to buy; resistance, on the other hand, is when the demand levels on the price chart exceed the supply

- Trade trendlines can be identified by monitoring the opening and closing price of the underlying asset as well as the trading range of individual candlesticks

- Round numbers tend to create strong barriers to the forex price, ultimately causing resistance in the forex price movement

- Moving averages (MAs) are delayed indicators, meaning they move slower than the forex market price

This information has been prepared by tastyfx, a trading name of tastyfx LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. tastyfx accepts no responsibility for any use that may be made of these comments and for any consequences that result. See our Summary Conflicts Policy, available on our website.