What is a lot in forex trading?

Discover the essentials of forex trading, focusing on the significance of lot sizes, pip values, and leverage to optimize your strategy and manage risk across various trading scenarios.

What is a lot in forex and how are lot sizes calculated?

Forex trading is a domain where precision and strategy converge, making it essential for traders to understand the building blocks of a trade—one of which is the concept of a "lot." In forex, a lot serves as a standardized unit size of a transaction, allowing traders to effectively gauge and manage their trade sizes. The market offers various lot sizes, such as standard, mini, micro, and even nano lots, each catering to different trading strategies, available capital, and risk appetites. By comprehending how lot sizes are calculated and the role they play in determining pip value and leveraging capital, traders can make informed decisions, optimize their trading plans, and align their positions with their financial goals.

What is a lot in forex?

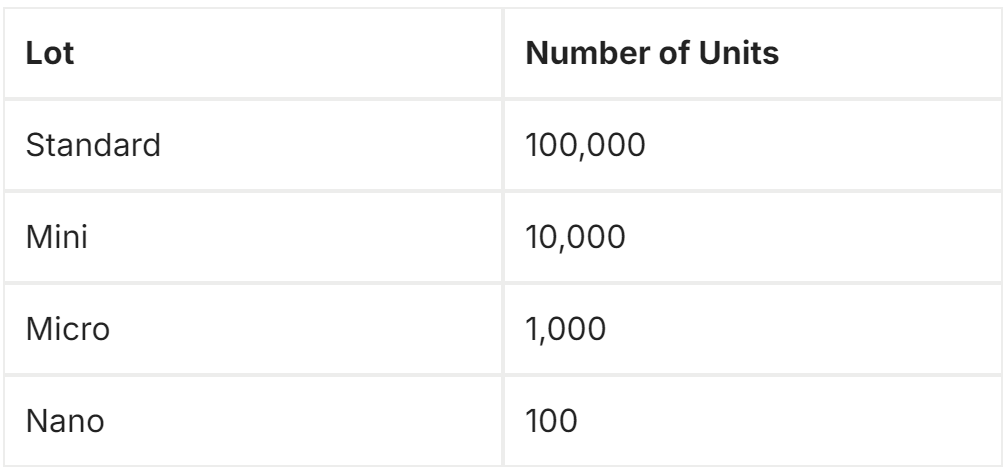

In forex trading, a "lot" is a standardized unit size of a forex transaction, which is used to measure and manage trade sizes efficiently. There are typically three types of lot sizes: Standard, Mini, and Micro, with the occasional unit of the Nano lot.

Forex lot sizes are calculated based on the amount of currency being traded. For instance, if you are trading one lot of EUR/USD, it means you are trading €100,000 against the equivalent amount in US dollar. The lot size determines the pip value, which is important for calculating potential profits or losses.

Forex trading often involves leverage, allowing traders to control larger positions with a smaller amount of capital, which is known as the margin. This means traders can open positions of standard lots with a fraction of the total trade value held as margin, making forex trading accessible without needing to have the full amount of the trade's value upfront.

Standard lot

A standard lot size in forex trading refers to a trading lot size of 100,000 units of the base currency being traded. It is the largest common lot size used in forex transactions and is used to determine the size of a trade and to calculate the pip value, which affects the potential profit or loss of the trade.

Mini lot

A mini lot in forex trading represents a trading lot size of 10,000 units of the base currency. It is smaller than a standard lot and is often used by traders who want to take smaller positions or are managing smaller account sizes. Trading with mini lots allows for more precise control over trade sizes and risk management.

Micro lot

A micro lot in forex trading is a trading lot size that represents 1,000 units of the base currency. It is smaller than both the standard and mini lots and is often used by traders who wish to trade smaller amounts or who are new to forex trading. Micro lots allow for fine-grained control over trade sizes and risk, making them a popular choice for beginners and those trading with smaller account balances.

Nano lot

A nano lot in forex trading represents a lot size of just 100 units of the base currency. It is even smaller than a micro lot and is typically used by traders who want to trade the smallest possible amounts, often for practice, testing strategies, or when trading with very limited capital. Nano lots provide maximum precision and control over trade sizes and risk, allowing traders to minimize potential losses while they learn or experiment with trading strategies.

How to calculate lot sizes in forex trading

Calculating lot sizes in forex trading involves determining the amount of currency units you wish to trade. Here's a structured approach to doing so:

1. Understand Lot Size Types:

Standard Lot: 100,000 units of the base currency.

Mini Lot: 10,000 units of the base currency.

Micro Lot: 1,000 units of the base currency.

Nano Lot: 100 units of the base currency.

2. Determine Your Risk Tolerance:

Define how much of your account balance you are willing to risk on a single trade. A common rule of thumb is not to risk more than 1-2% of your account balance on a single trade.

3. Calculate Pip Value:

Determine the pip value for the currency pair you are trading. Pip value can be calculated using the formula:

Pip Value = (One Pip/Exchange Rate) × Lot Size

4. Use Leverage Wisely:

Leverage allows you to control a larger position with a smaller amount of money. Be mindful of leverage as it magnifies both potential profits and losses.

5. Determine Lot Size Based on Risk:

Calculate the appropriate lot size that aligns with your risk tolerance using the following steps:

- Determine the stop-loss level in pips.

- Calculate the dollar amount you are willing to lose (risk).

- Use the formula: Lot Size = (Risk Amount/Stop-Loss in Pips × Pip Value)

By following these steps, you can determine the appropriate lot size for your trades in forex, ensuring alignment with your trading strategy and risk management plan.

How to select lot size in forex

When selecting a lot size in forex trading, several factors need to be considered:

1. Available Capital:

Standard Lots: Suitable for those with significant capital. Requires a higher initial margin, but trades also have higher pip values, leading to larger potential profits or losses.

Mini, Micro and Nano Lots: Ideal for individuals with less capital. These allow trading with less risk exposure despite volatility and more granularity in position sizing

2. Trading Strategy:

Scalping: Involves many small trades throughout a day. Smaller lot sizes like mini or micro are often preferred due to the short nature of trades and reduced risk per trade.

Swing/Position Trading: Typically accommodates larger lot sizes, as trades are held over longer periods, allowing for potential larger moves.

3. Time Horizon:

Short Term: Day traders might prefer micro or mini lots to manage risk over numerous trades.

Long Term: Position traders might choose larger lots, aligning with their larger time frames and potentially greater capital.

4. Risk Tolerance:

Your risk tolerance dictates how much you are willing to risk per trade. Typically, it's recommended not to risk more than 1-2% of your capital on a single trade.

5. Leverage:

Understanding leverage is crucial when it comes to foreign exchange. Higher leverage allows controlling larger positions with smaller capital, but it also increases risk. Therefore, aligning leverage with appropriate lot sizes can mitigate excessive exposure.

Pros and Cons of Each Lot Type

Standard Lots:

Pros: Larger potential gains; suitable for experienced traders with substantial capital.

Cons: Higher risk exposure and requires more capital or higher leverage

Mini Lots:

Pros: Balances risk and reward; allows flexibility in managing trades.

Cons: Smaller profit potential compared to standard lots

Micro and Nano Lots:

Pros: Lowest level of risk, allowing beginners to start with minimal exposure; precise control over trades.

Cons: Smaller returns, which may not suit those seeking larger gains

Selecting the appropriate lot size is a balance between your financial capacity, risk tolerance, and trading strategy. It's important to align your lot size with your overall trading plan to manage exposure and optimize potential returns

What is a pip in forex trading?

When you trade forex, a pip is the smallest price movement that a currency pair can make in the market. For most pairs, a pip is 0.0001 or the fourth decimal place, while for those involving the Japanese Yen, it's 0.01 or the second decimal place. Pip movement is crucial for forex traders when it comes to measuring price changes, calculating profits and losses, and setting orders, providing a standardized unit of measure across the forex market.

What is leverage in forex trading?

Leverage in forex trading is a tool that allows traders to control a larger position with a smaller amount of capital. It amplifies both potential profits and losses, by using borrowed funds from the broker, enabling traders to open larger positions than their account balance would typically allow.

Selecting the appropriate lot size is fundamental to successful forex trading, acting as a crucial determinant of both potential risks and rewards. As we have explored, the choice of standard, mini, micro, or nano lots depends significantly on a trader's available capital, strategic approach, time horizon, and risk tolerance. By aligning the lot size with one's trading strategy and leveraging the tools at one's disposal effectively, traders can not only manage their exposure but also enhance their potential returns. Understanding the dynamics of lot sizes, alongside concepts like pip values and leverage, equips traders with the knowledge to navigate the forex market more confidently and strategically.