What is the ABCD chart pattern and how is it useful?

What is the ABCD trading pattern?

The ABCD trading pattern is a trend that prices can take in the market, observable on charts. The sequence of events follows a particular harmonic pattern in market movement that can be helpful to traders in attempting to predict future price swings.

The harmonic pattern of movement can apply in different market conditions that follow both bullish and bearish swings. With us, you can use the ABCD pattern trading to speculate on the movement of different foreign exchange (forex) pairs by selling one currency while simultaneously buying another.

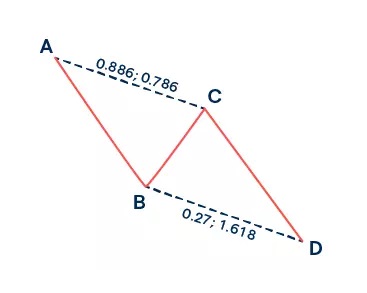

The harmonic pattern develops at any period over time, and you can follow the behavior of the market by observing price charts. The sequence follows the pattern below:

- The stock represents a price high, then falls

- Is a move lower from A

- The stock price moves higher from B but falls short of A

- The stock price drops lower than B

It’s important to remember that you shouldn’t rely solely on the ABCD pattern or any singular technical analysis tool; these analyses can help traders make bullish or bearish trade decisions for themselves.

How to trade or invest using the ABCD pattern

To trade using the ABCD pattern you can identify the indicators, check the forex market rates and then set your trading alerts. Remember that the chart pattern develops across different timeframes, and you might consider observing charts over the short, medium and long term as part of your research.

Before you get started, it’s important to note that the pattern can manifest on both bullish and bearish trajectories, depending on trader’s entry point.

- Decide how you'd like to trade forex

- Choose your preferred market

- Create an account or practice on a demo

- Set your trade size and manage your risk

- Open your position and monitor your trade

Spot the indicators

Identifying the indicator on a price chart is the first step to opening your position. Multiday charts generally offer insight into the behavior of forex markets over an extended period of time. You can use a daily, hourly or minute-by-minute chart when looking for the ABCD pattern, but keep in mind that many traders will stick with a time horizon compatible with their goals; for example, a trader looking to hold for days and maybe weeks might want to look for the ABCD pattern in a daily chart instead of a minute chart.

Once you have a chart type coinciding with your goals, you can look for ABCD patterns using the above tactic for bullish or bearish signals.

Set trading alerts

You can set trading alerts to receive a notification when the market conditions change from the A leg of the cycle so that you don’t miss an opportunity to take a position. Remember that you shouldn’t rely on signals and alerts to inform you of how your trade is going – it’s your responsibility to monitor your position.

Take a position

Depending on the trajectory of the swing, you’ll choose a point of entry ( C ) after the price breaks lower from the high. Remember to take suitable steps to manage your risk, like setting up a stop order to help potentially limit your loss; though stop orders can help with risk management, they do not guarantee loss prevention at the given order price.

Prepare for the exit point

You need to anticipate the final leg (D) of the cycle. This is when the price movement comes close or breaks the risk level you set. You can exit your position by sending an order opposite to your entry, depending on whether it was a bullish or bearish ABCD pattern.

An example of trade using the ABCD pattern

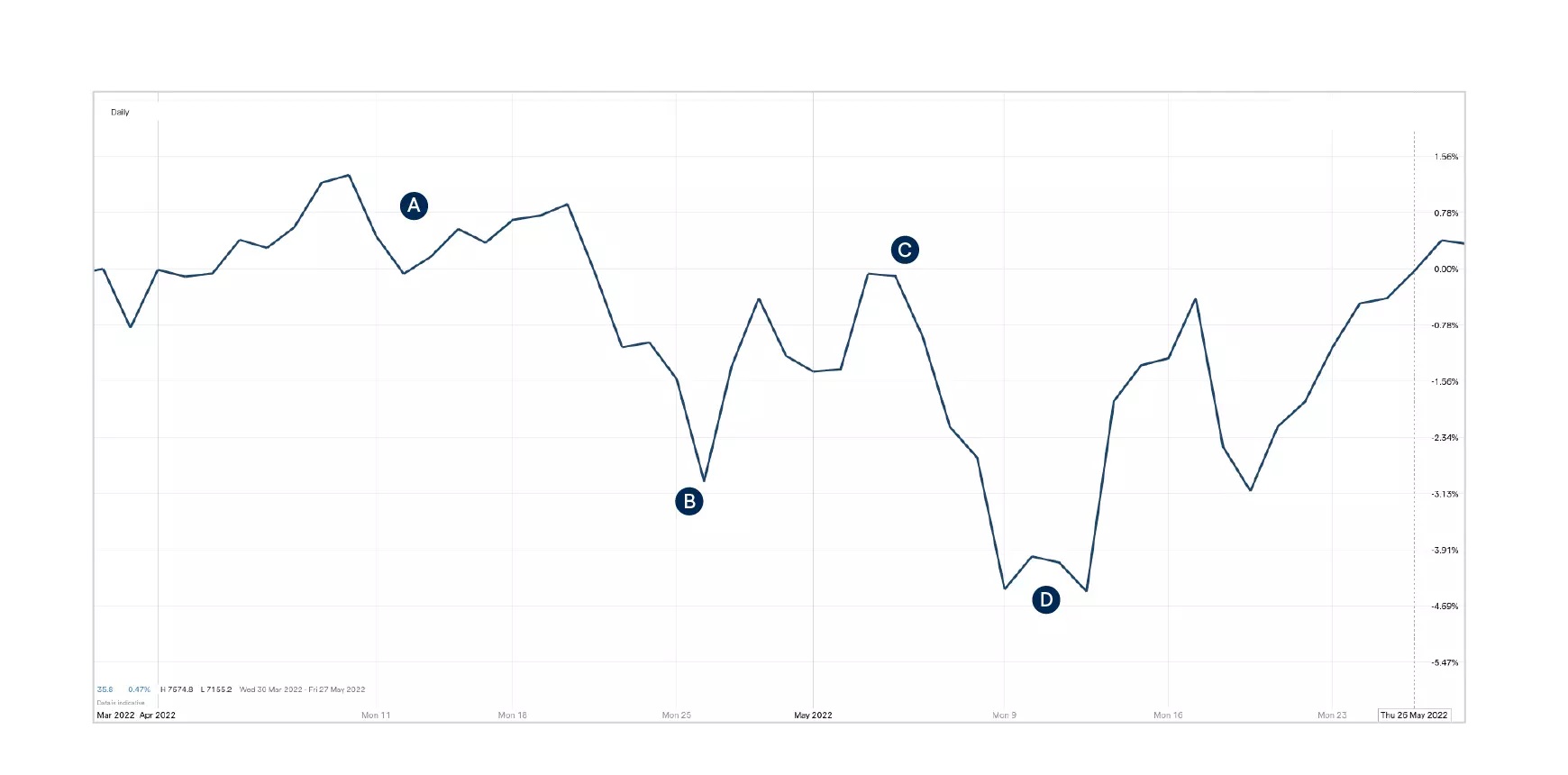

A recent example that displayed the progression of the ABCD pattern is the British pound versus the US dollar (GBP/USD).

Following the initial drop from point A to B, the price rebounded to point C. Point C is a lower high than point A. The move from point C to point D provides another move lower with point D being lower low than point B.

Traders of the harmonic pattern might look for price reversal at point D, to trade with the expectation of a short-term rebound in the market, or they could have taken a short position from point C if they expected this lower high would not hold.

Common mistakes in ABCD pattern trading

There are common mistakes that people make when trying to gain exposure to a market using ABCD pattern trading. These could include:

- Taking a position too early and the level has not yet been consolidated

- Assuming there’s an ABCD pattern where there isn’t one

- Low volume when the pattern is forming

- Holding your position too long without setting up suitable risk levels and missing the exit point

Before you implement the strategy, you should familiarize yourself with resources on how ABCD patterns work.

What is the ABCD trading pattern summed up

- An ABCD trading pattern forms when there’s a trend that prices follow in the market, making the harmonic pattern noticeable on charts

- You can use the pattern to discover the entry and exit points in a market whether its bearish or bullish

- You might consider conducting research and support for the ABCD trading pattern using technical or fundamental analysis

- It’s important to do your due diligence on how ABCD pattern works so that you avoid common mistakes

- You can trade forex pairs using the ABCD chart pattern

This information has been prepared by tastyfx, a trading name of tastyfx LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. tastyfx accepts no responsibility for any use that may be made of these comments and for any consequences that result. See our Summary Conflicts Policy, available on our website.