What's better to invest in: stock, crypto, or forex market?

Investment types ranging all the way from stocks and bonds to foreign exchange (forex) and cryptocurrencies share an essential commonality: a theoretical 50% chance of appreciating. Whether you’re buying Apple stock (AAPL) or a dollar-yen forex pair (USD/JPY), you want it to move higher and have around a 50-50 chance of it doing so. (tastyfx only offers forex products.)

Investments can differ in the amount they might move for or against you, measured using volatility, and by how much they diversify your portfolio from other investments, measured using correlation.

Investing in the stock market: volatility and correlation

Stock markets generally carry a moderate amount of volatility, and thus potential risk/return to investors, compared to more volatile cryptocurrencies and less volatile forex markets. Given a S&P 500 Implied Volatility Index (VIX) price of 18.1,* investors can project the stock market benchmark S&P 500 to move in a +/-18.1% range over the next year with about 68.3% likelihood (the VIX calculation derives an annualized, one standard deviation projection from S&P 500 options prices – one standard deviation calculations produce a range of potential values with 68.3% likelihood an event will conclude in said range).

Single stocks can move by a greater degree given their specific risk – risks such as earnings that affect one or a handful of stocks and not the market at large. Also, single stocks and stock-based indices as well as exchange-traded funds (ETFs) tend to carry a high positive correlation, which can translate to a lack of diversification even for investments spread across numerous stock markets; that is, when stocks move far in a direction, they all tend to move in that direction.

Investing in the crypto market: volatility and correlation

Crypto markets can hold a high amount of volatility, and thus potential risk/return to investors, compared to the generally less volatile stock and forex markets. Given a Bitcoin Volatility Index (BVIN) price of 67.9,† investors can project the crypto market benchmark Bitcoin to move in a +/-67.9% range over the next year with about 68.3% likelihood.

Investment in the crypto market cannot be reduced to a risk-reward metric given the relative newness of the asset class and lack of historical data around it, but a current volatility of almost 100% infers a potential to either double or fall to near-zero for crypto investments. Not to mention that cryptocurrencies with smaller market capitalizations than Bitcoin can move with an even greater volatility. Finally, the crypto market has been highly correlated to the stock market in recent trade, which can result in little diversification for those investing in the stock and crypto market.

Investing in the forex market: volatility and correlation

Forex markets can carry a moderate amount of volatility, and thus potential risk/return to investors, similar to stock markets. Given a Euro Currency Volatility Index (EVZ) price of 8.1,‡ investors can project the forex market benchmark EUR/USD to move in a +/-8.1% range over the next year with about 68.3% likelihood.

While other major pairs such as GBP/USD or USD/JPY can move more or less than EUR/USD, they only tend to do so by a few percentage points. Also, the forex market has been largely uncorrelated to the stock market in last decade, which can result in diversification for those investing in the stock and forex market.

Margin requirements

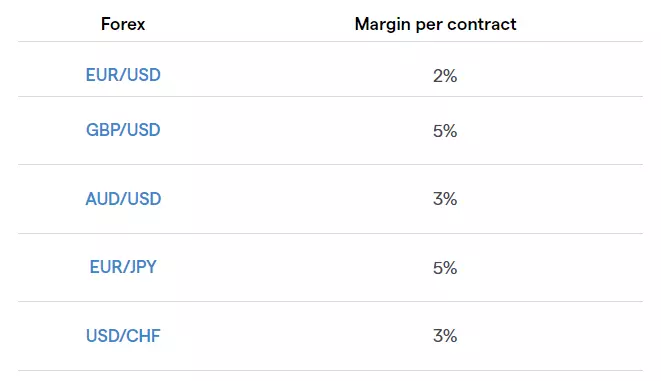

Most crypto and stock markets require 50-100% in margin, which means that investors must pay $50-100 for every $100 worth of crypto or stock investment. Forex markets can require less margin given their less volatile nature, and this reduced margin requirement may produce gains or losses exceeding the margin amount. For example, the margin requirement for EUR/USD is just 2% at tastyfx currently, translating to just $2 for every $100 in EUR/USD investment.**

How to invest in forex

- Choose the forex market you’d like to trade

- Open an account to get started, or practice on a demo account

- Choose your forex trading platform

- Open, monitor, and close positions

Investing in forex markets requires an account with a forex provider like tastyfx and a strategy. Most strategies applicable to trading in other markets can be used to trade forex as well, including technical and fundamental analysis.

Once your strategy is developed, you can follow the above steps to opening an account and getting started trading forex.

Your profit or loss is calculated according to your full position size. Leverage will magnify both your profits and losses. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them. Trade using money you’re comfortable losing.

*Price as of 4/25/23 (Source: https://www.cboe.com)

†Price as of 4/25/23 (Source: https://www.cryptocompare.com/indices/bvin/)

‡Price as of 4/25/23 (Source: https://finance.yahoo.com/quote/%5EEVZ/history?p=%5EEVZ)

**Margin per contract taken from tastyfx (Source: https://www.tastyfx.com/pricing/margin-rates/)

This information has been prepared by tastyfx, a trading name of tastyfx LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. tastyfx accepts no responsibility for any use that may be made of these comments and for any consequences that result. See our Summary Conflicts Policy, available on our website.