What safe-haven assets to watch if the S&P 500 crashes

Discover how bonds, gold, USD, JPY, and CHF could perform as investor anxiety increases in turbulent markets.

Key points

- US stocks have moved sharply off of all-time highs

- VIX, a common fear-gauge, has spiked in tandem with the stock downturn

- Traditional safe-haven assets have been positively correlated to US stocks in recent months, causing uncertainty as to where investors will flock to if stocks continue lower

S&P 500 catches fear tone at all-time highs

Despite the S&P 500 reaching all-time highs, recent market dynamics have prompted a spike in volatility due to global economic concerns and major earnings announcements. This has caused a sudden drop off of highs as traders speculate whether this is a slight correction or a warning of further decline.

VIX volatility index nears 20.00

The VIX, a measure often referred to as the "fear gauge" for the stock market, is approaching a critical level of 20.00, indicating heightened market anxiety. This increase reflects broader uncertainties and the potential for more significant market adjustments in US stocks.

Are bonds and gold safe haven assets?

Traditionally, bonds and gold are viewed as safe havens during market turmoil. However, their effectiveness can vary with the economic context. Presently, their correlation with the stock market complicates their reliability as safe havens. Gold recently hit new all-time highs around the same time as US stocks, causing hesitation around their historically inverse correlation.

JPY and CHF currencies are flight to quality

The Japanese yen and Swiss franc have historically acted as reliable safe havens during periods of financial stress, often appreciating when other markets falter. Some of the main factors behind this trend include economic and political stability, as well as high liquidity. These currencies may offer alternatives for investors seeking stability in current market conditions. However, Japanese yen is currently near 30-year lows against the US dollar as their economy struggles to grow sustainably post-pandemic. It is yet to be seen if this historic weakness will deter investors from moving into JPY in times of uncertainty, or if traders begin rotating into the yen given its precedent to bounce back.

Is US dollar a flight to quality?

The US dollar's role as a safe haven can be ambiguous, influenced by its performance relative to other currencies. While the dollar can rally in bearish markets, its safe haven status depends on the specific dynamics of each economic scenario. At present, the dollar remains near its highs, surging year-to-date against almost all major currencies. With the current election cycle almost at its climax as well, it is possible foreign investors refrain from pouring into USD until after the dust settles in November.

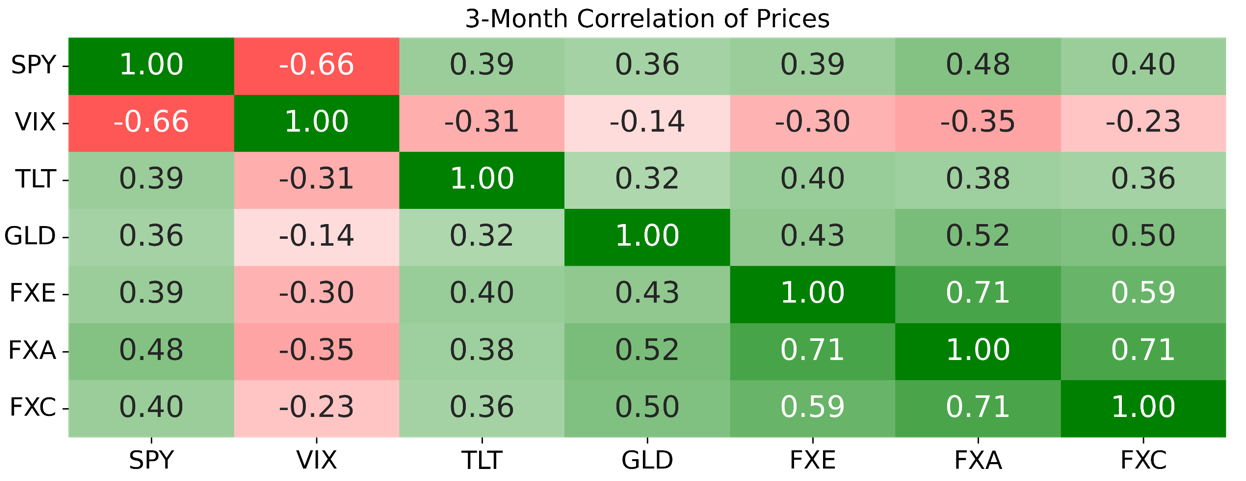

Safe haven correlations

Analyzing the S&P 500 and its correlation with various financial assets over the past three months, it's clear that traditional market assumptions often require reevaluation. Notably, the VIX, or "fear gauge," exhibits a significant negative correlation of -0.66 with the S&P 500, moving inversely to stock prices. More surprisingly, assets traditionally seen as safe havens, like bonds and gold, show positive correlations with the stock market, challenging their conventional roles. Likewise, major currencies including the Euro, Australian dollar, and Canadian dollar, also move in sync with US stocks. The Australian dollar in particular appears linked to stock market fluctuations over this time horizon. This insight would point towards US dollar as a possible hedge to US stocks, differing in effectiveness depending on the cross-currency. These findings highlight the complex interplay in financial markets and suggest that safe haven assets may not always behave predictably, necessitating a more sophisticated approach to financial analysis.

How to trade US dollar

- Open an account to get started, or practice on a demo account

- Choose your forex trading platform

- Open, monitor, and close positions on USD pairs

Trading forex requires an account with a forex provider like tastyfx. Many traders also watch major forex pairs like EUR/USD and USD/JPY for potential opportunities based on economic events such as inflation releases or interest rate decisions. Economic events can produce more volatility for forex pairs, which can mean greater potential profits and losses as risks can increase at these times.

You can help develop your forex trading strategies using resources like tastyfx’s YouTube channel. Our curated playlists can help you stay up to date on current markets and understanding key terms. Once your strategy is developed, you can follow the above steps to opening an account and getting started trading forex.

Your profit or loss is calculated according to your full position size. Leverage will magnify both your profits and losses. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them. Trade using money you’re comfortable losing.