Why are major currency pairs popular in forex trading?

Major currency pairs dominate forex trading due to high liquidity, stability, and rich economic data, offering efficient trade execution and analysis insights.

Why Are Major Currency Pairs Popular in Forex Trading?

Major currency pairs are popular in forex trading because of their tendency to remain highly liquid, which helps with quick trade execution and tight spreads, reducing transaction costs. They also tend to be more stable and predictable, backed by the strongest and largest economies like the US, Eurozone, Canada, and Japan, which provide abundant economic data for analysis. These pairs often exhibit clear technical patterns, making them ideal for both fundamental and technical analysis. Their influence on global trade further enhances their appeal to traders seeking reliable opportunities.

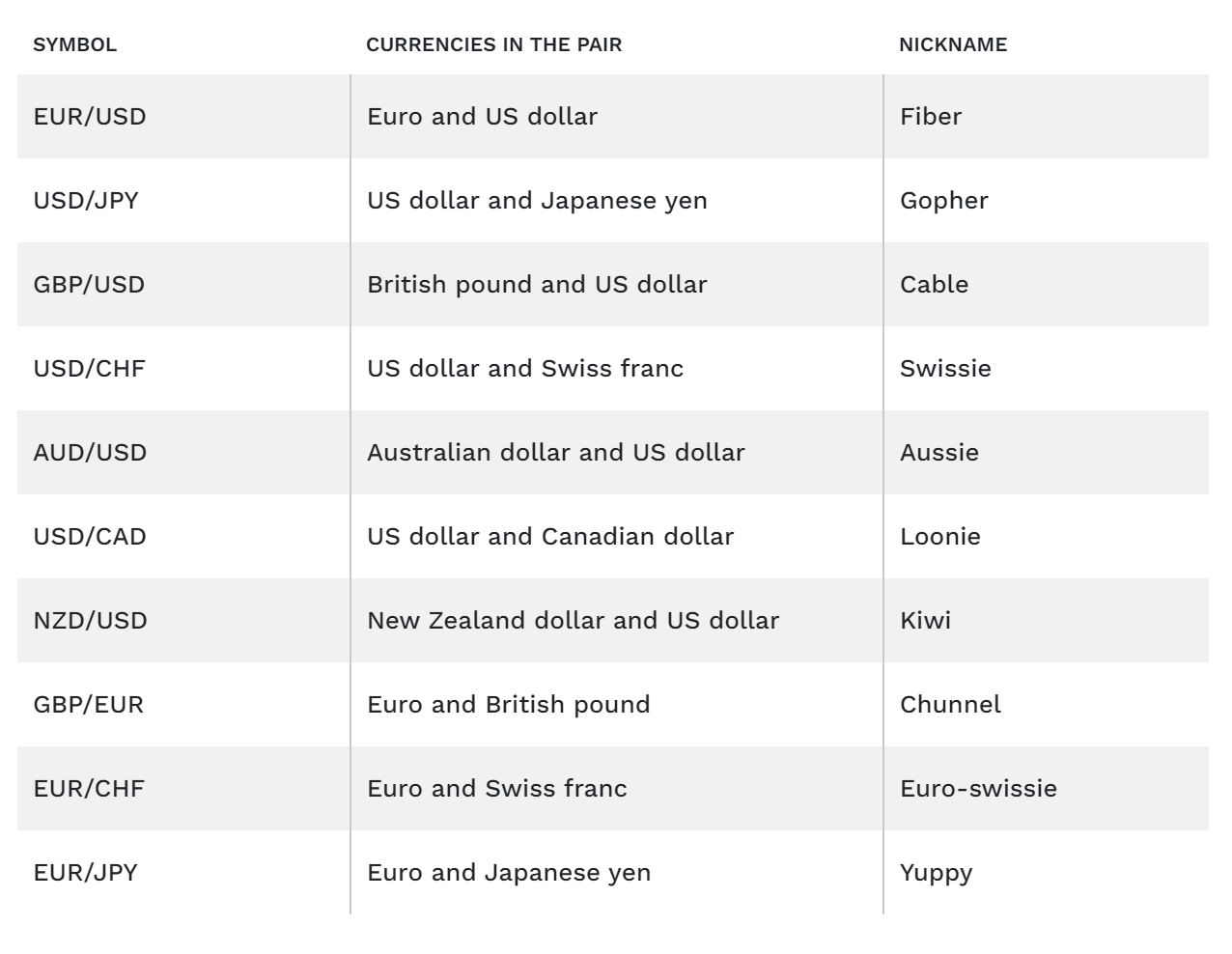

What are the major forex pairs?

In the expansive world of forex trading, major currency pairs stand out as the most influential and most traded currency pairs. These pairs consist of the most economically significant and widely recognized currencies globally, such as the US dollar, euro, and Japanese yen.

Why trade major forex pairs?

Major currency pairs are particularly popular in forex trading for several reasons:

- Liquidity: Major pairs involve the most traded currencies globally, such as the US dollar, euro, Japanese yen, and British pound. During times of normal market activity, this high level of trading activity ensures the most liquidity, facilitating quick and efficient trade execution with minimal price fluctuations, even for large transactions.

Open an account - Tight Spreads: Due to their liquidity, major currency pairs typically have tighter spreads, which means lower transaction costs for traders. This makes them attractive for both retail and institutional traders looking to minimize costs.

- Market Stability: Major currency pairs are often perceived as more stable compared to exotic or minor pairs. For example, the US dollar is widely regarded as a safe haven currency due to its typical stability. The economies behind these currencies are generally more developed, providing a degree of predictability and consistency in economic data and policy.

- Economic Data Availability: Major pairs are supported by a wealth of economic data and news, making it easier for traders to perform fundamental analysis. Economic indicators such as GDP, employment rates, and inflation are regularly published and widely covered by the media.

- Technical Analysis: Due to the extensive trading history and high volume, major currency pairs often exhibit well-defined technical patterns, making them suitable for technical analysis in currency trading. Trends and price movements can be more predictable, aiding forex traders in making informed decisions.

- Global Economic Influence: The economies behind major currency pairs, like the US and the Eurozone, have a significant impact on global trade. This influence means that changes in these currencies often reflect broader economic conditions, providing valuable insights for traders.

These factors make major currency pairs a staple in forex trading, attracting a wide array of participants from around the world aiming to capitalize on the opportunities they offer.

In conclusion, major currency pairs remain a cornerstone of the foreign exchange market due to their liquidity, stability, and the wealth of economic data supporting them. These factors make them an attractive choice for traders seeking efficient trade execution and reliable insights from both technical and fundamental analysis. By leveraging the strategic advantages these pairs offer and following a disciplined trading approach, as outlined in our guide, traders can effectively navigate the forex market to capitalize on opportunities within these dominant currency pairs. Whether you're a newcomer or an experienced trader, understanding and trading major forex pairs can provide valuable opportunities and insights into the global economic landscape.

Trading forex requires an account with a forex provider like tastyfx. Many traders also watch major forex pairs like EUR/USD and USD/JPY for potential opportunities based on economic events such as inflation releases or interest rate decisions. Economic events can produce more volatility for forex pairs, which can mean greater potential profits and losses as risks can increase at these times.

Your profit or loss is calculated according to your full position size. Leverage will magnify both your profits and losses. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them. Trade using money you’re comfortable losing. Past performance is not indicative of future results.