Will the Japanese yen collapse?

Japanese yen price history

Weakness in the Japanese yen is reaching historic levels across major currency pairs including USD/JPY, EUR/JPY, and GBP/JPY. The US dollar has risen above 144.00 against the yen this week, which aside from a run late last year, is the highest since 1998. EUR/JPY and GBP, though, are already through highs not seen since 2008 and 2015, respectively.

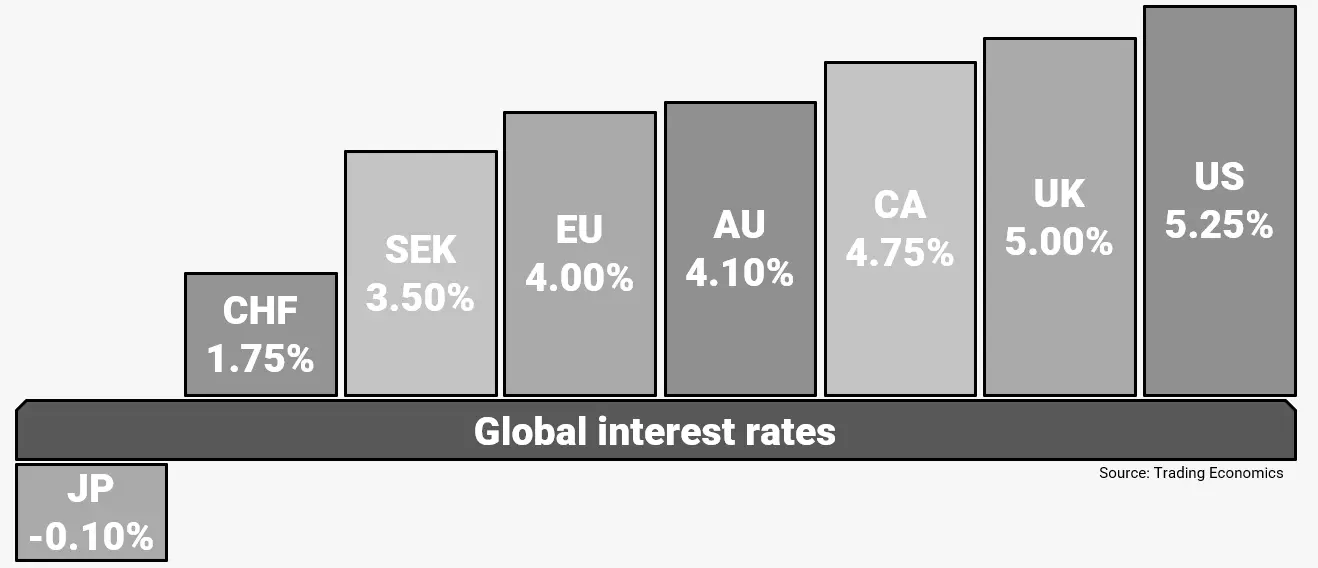

Interest rate movements

A driver of the recent observed yen prices are the wide rate differentials between the Bank of Japan and other central banks. Shown below, Japanese rates remain negative while western countries continue to raise rates in effort to combat inflation. Looking forward, there is room for relief in the yen if the Bank of Japan decides to raise rates or other banks reverse course. However, it is still possible to see a further divergence of rates and continued price extremes that increase the possibility of a collapse for the yen altogether.

Client sentiment

Looking at tastyfx client sentiment, it is clear traders are anticipating a reversion to the mean across yen pairs. Over 70% of clients with open positions are short in all three pairs discussed. Traders will look for strength in Japan from data such as June consumer confidence and May unemployment rate are released this week.

How to trade USD/JPY

- Open an account to get started, or practice on a demo account

- Choose your forex trading platform

- Open, monitor, and close positions on USD/JPY

Trading forex requires an account with a forex provider like tastyfx. USD/JPY can be found in tastyfx's platform under the 'Major' pairs tab. Many traders also watch major forex pairs like GBP/USD and AUD/USD for potential opportunities based on economic events such as inflation releases or interest rate decisions. Economic events can produce more volatility for forex pairs, which can mean greater potential profits and losses as risks can increase at these times.

You can help develop your forex trading strategies using resources like tastyfx’s YouTube channel. Once your strategy is developed, you can follow the above steps to opening an account and getting started trading forex.

Your profit or loss is calculated according to your full position size. Leverage will magnify both your profits and losses. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them. Trade using money you’re comfortable losing.

This information has been prepared by tastyfx, a trading name of tastyfx LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. tastyfx accepts no responsibility for any use that may be made of these comments and for any consequences that result. See our Summary Conflicts Policy, available on our website.