Will US dollar continue to rise? Depends on bonds...

Data current as of 2/14/2024

Key points

- Dollar hit new highs year-to-date

- USD strength coming from rising yields

- USD still far from parity in against the euro

- Fewer rate cuts projected in 2024

- 58% of EUR/USD traders are long

USD/JPY hits 150.00

In recent market developments, the US dollar (USD) has surged to new highs for the year, with an impressive rally against the Japanese yen (JPY), where the USD/JPY pair soared past the 150.00 mark. This level has not been seen since November, with the 30-year high resting at approximately 151.50. The force behind the greenback's strength can be largely attributed to the climbing yields in the United States.

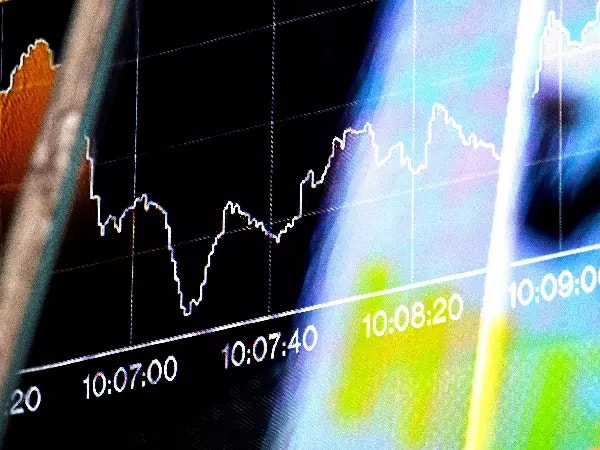

10-years on the rise

The yields on 10-year US Treasury notes, which often serve as a benchmark for global finance, have risen sharply. This uptick came on the heels of hotter-than-expected inflation data, which has subsequently dampened the market's anticipation of rate cuts by the Federal Reserve. Traders and investors alike are now contemplating a critical question: could the US dollar ascend to new historic highs?

EUR/USD still far from lows

The performance of the US dollar has been notably strong against other major currency pairs, including the euro (EUR), hitting 1.0700 midweek. Despite the bullish trend, it's worth noting that sentiment among traders is often two-sided. For instance, 58% of those trading EUR/USD at tastyfx are positioned long, betting on the euro's strength. This demonstrates a significant belief in the potential for the euro to rally despite the dollar's current dominance.

Much of this momentum hinges on the Federal Reserve's monetary policy decisions. If the Fed opts to maintain rates, and the eurozone cuts rates first, the dollar could continue its upward trajectory.

What's in store for interest rates in 2024

Currently, interest rate futures (CME FedWatch tool) are suggesting a more reserved outlook, with projections indicating only four 25 basis point cuts in 2024. This is a conservative stance compared to previous expectations, which reflects a market that is bracing for a more hawkish Fed in the face of persistent inflation.

How to trade US dollar

- Open an account to get started, or practice on a demo account

- Choose your forex trading platform

- Open, monitor, and close positions on USD pairs

Trading forex requires an account with a forex provider like tastyfx. Many traders also watch major forex pairs like EUR/USD and USD/JPY for potential opportunities based on economic events such as inflation releases or interest rate decisions. Economic events can produce more volatility for forex pairs, which can mean greater potential profits and losses as risks can increase at these times.

You can help develop your forex trading strategies using resources like tastyfx’s YouTube channel. Once your strategy is developed, you can follow the above steps to opening an account and getting started trading forex.

Your profit or loss is calculated according to your full position size. Leverage will magnify both your profits and losses. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them. Trade using money you’re comfortable losing.

This information has been prepared by tastyfx, a trading name of tastyfx LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. tastyfx accepts no responsibility for any use that may be made of these comments and for any consequences that result. See our Summary Conflicts Policy, available on our website.