What is Autochartist and how to use it?

Streamline your trading with Autochartist, an automated market analysis tool that identifies chart patterns and key price levels, offering real-time alerts and insights to enhance your trading strategy.

What is Autochartist and how to use it?

Autochartist is a market analysis tool that provides traders with automated technical analysis of financial markets. Designed to streamline the trading process, Autochartist offers real-time alerts and comprehensive analysis, helping traders identify potential opportunities and make informed decisions with ease. Whether you're a beginner or an experienced trader, Autochartist provides valuable insights into market dynamics, enhancing your trading strategy and efficiency.

What is autochartist?

Autochartist is a leading technical analysis tool that empowers traders by automating the detection of chart patterns, Fibonacci sequences, and key price levels across various financial markets. It identifies trading opportunities by scanning markets for chart patterns, such as triangles, wedges, and channels, as well as Fibonacci patterns and key support and resistance levels. Autochartist offers real-time alerts and analysis, helping traders make informed decisions by highlighting emerging patterns and potential price movements. It also includes features like volatility analysis and performance statistics, which assist traders in assessing market conditions and refining their trading strategies. Overall, the Autochartist trading tool aims to enhance trading efficiency by providing actionable insights based on technical analysis.

Autochartist benefits

Autochartist offers numerous advantages to traders seeking to enhance their market analysis and trading strategies. One of its best benefits is the automation of technical analysis, saving traders significant time by automatically detecting and analyzing patterns like triangles, wedges, and Fibonacci retracements. This feature allows traders to focus more on strategic decision-making rather than manual chart scanning. Additionally, Autochartist provides real-time alerts for emerging and completed patterns, ensuring traders can act promptly on potential trading opportunities. The tool also offers volatility analysis, which helps traders understand potential market risks and set appropriate stop-loss and take-profit levels. Furthermore, its backtesting capabilities enable traders to evaluate the historical performance of patterns, refining their strategies based on past data. These benefits collectively make Autochartist a valuable asset for traders aiming to improve their trading style and decision-making process.

Autochartist key features

Autochartist is a powerful tool that automates technical analysis to enhance trading efficiency and decision-making. It offers a suite of features designed to identify potential trading opportunities across various markets, empowering both novice and experienced traders to make informed choices.

1) Pattern Recognition

Autochartist excels at pattern recognition, automatically scanning the markets for chart patterns like triangles, flags, and head-and-shoulders through algorithms. It identifies both emerging and completed patterns, providing traders with actionable insights into potential price movements.

2) Fibonacci Pattern Identification

This feature detects key Fibonacci levels, such as retracements and extensions, helping traders identify potential support and resistance zones. It enhances trading strategies by incorporating these mathematical levels into market analysis.

3) Volatility Analysis

Autochartist offers volatility and fundamental analysis to help traders assess market movements and risk. By understanding expected price ranges, breakouts, and volatility, traders can make informed decisions about setting stop-loss and take-profit levels.

4) Real-Time Alerts

The tool provides real-time notifications for identified currency pair patterns and key levels, ensuring traders are notified instantly of potential trading opportunities. This feature allows for timely responses to market conditions.

5) Performance Statistics

Autochartist supplies performance statistics that evaluate the historical success of patterns, allowing traders to gauge the reliability of certain patterns and refine their strategies accordingly.

6) Integration with Trading Platforms

Autochartist integrates seamlessly with many day trading platforms, offering a user-friendly interface that allows traders to access its features directly from their brokerage accounts, streamlining the workflow.

These features collectively make Autochartist a robust tool in forex trading for those looking to enhance their market analysis and trading strategies.

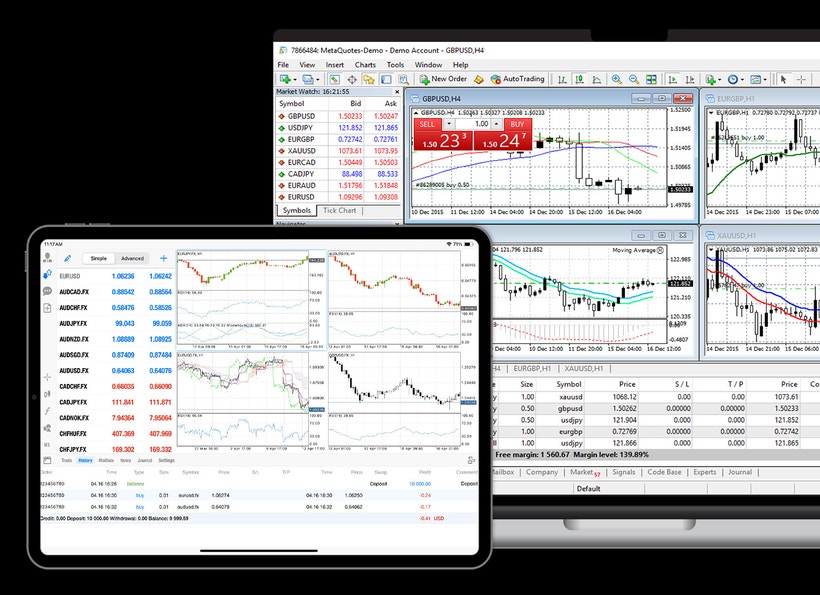

How to use autochartist on MT4

Before you use Autochartist, you’ll need to make a tastyfx trading account and download MetaTrader 4. The steps to do this are explained below:

1. Create a live tastyfx account

For a demo MT4 account, visit our MT4 demo account creation page

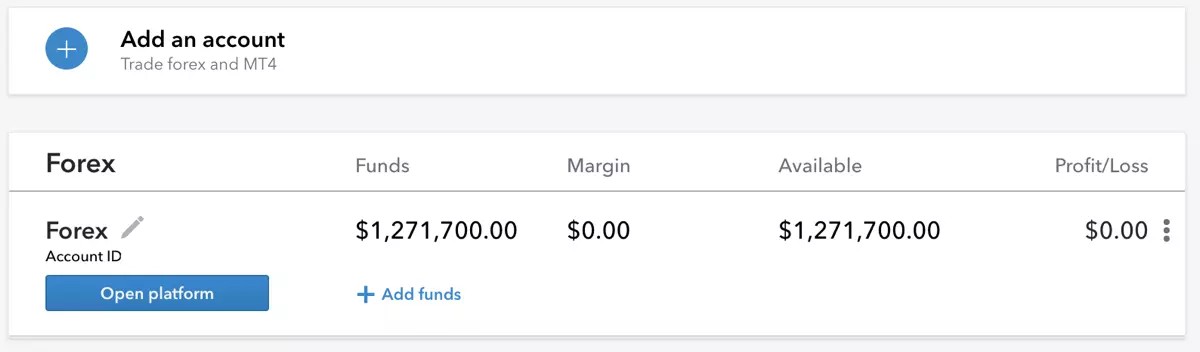

2. Once you have an account, visit your ‘My tastyfx’ dashboard

3. Click on ‘add an account’ at the bottom right of the screen

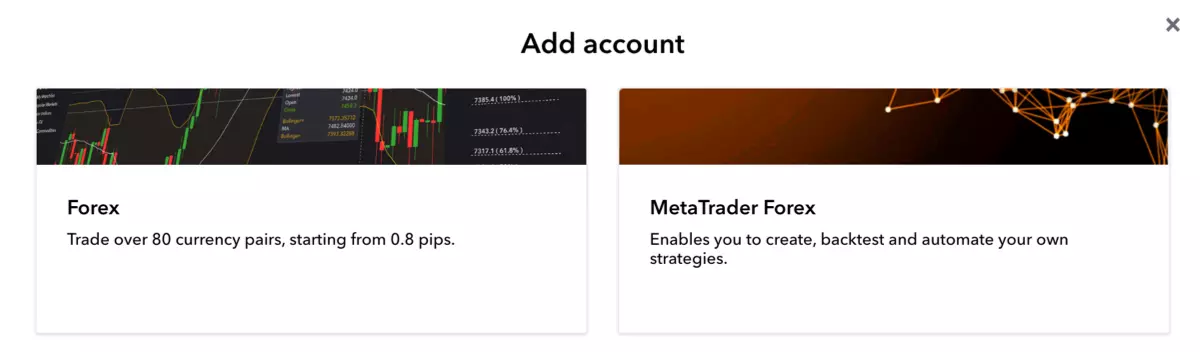

4. Select an MT4 forex account

5. Follow the on-screen prompts to complete the download process

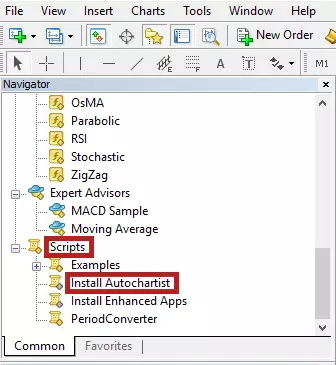

Once you have created a tastyfx account and downloaded MT4, open the platform and log in. The Autochartist plugin can be found within MT4 by going to the ‘navigator’ window and clicking on ‘scripts’.

To effectively use Autochartist, follow these key steps:

1. Set Your Preferences and Alerts:

Customize Autochartist settings according to your trading strategy. Select the markets, instruments, and timeframes you wish to analyze, and set up alerts for specific patterns or price levels.

2. Analyze Patterns and Markets:

Utilize Autochartist to automatically scan for chart patterns, Fibonacci retracements, and key support and resistance zones. Review the identified patterns and analyze them for potential trading opportunities.

3. Utilize Volatility Analysis:

Leverage the volatility analysis feature to understand market risks and set suitable stop-loss and take-profit levels. This helps in managing trades according to market conditions.

4. Implement Trades Based on Insights:

Make informed trading decisions based on Autochartist's alerts and analysis. Use the insights provided to place trades within MT4, aligning them with your risk management strategies.

By following these steps, traders can harness the power of Autochartist to enhance their technical analysis, improve trading efficiency, and better navigate the financial markets.