HOW TO PAPER TRADE & BACKTEST ON TRADINGVIEW

TradingView’s Paper Trading and Replay capabilities let traders test strategies before putting them into play in the live market.

WHAT IS PAPER TRADING ON TRADINGVIEW

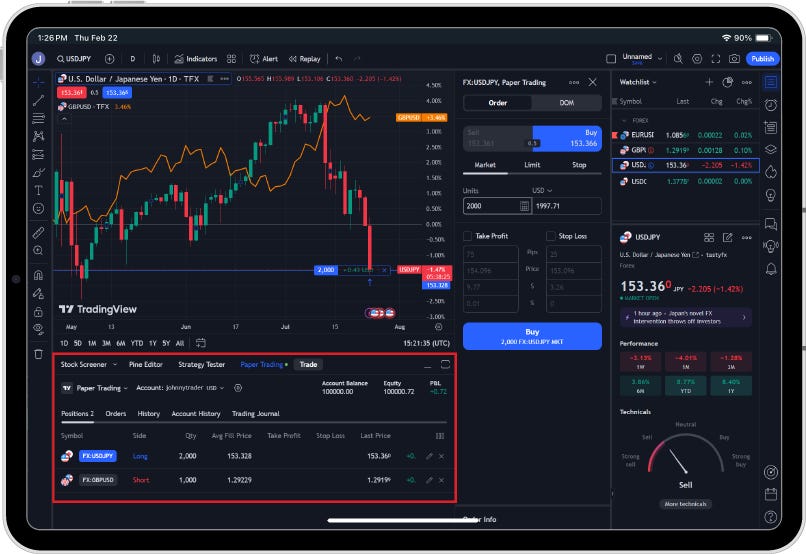

Paper Trading is TradingView’s version of demo or simulated trading; it allows new traders to test technology and markets before committing to a new trading environment or strategy. You can use TradingView’s Paper Trading by creating an account with TradingView and then selecting the ‘Paper Trading’ option under the ‘Trading Panel’ tab on the bottom of the platform.

Is paper trading good or bad?

Paper trading, or demo trading, can help those new to markets or a specific trading technology get comfortable before committing real capital and risk. It can also help more advanced traders test new strategies before adding them to their portfolio.

However, paper trading can cause paralysis that keeps some potential traders stuck in the simulated environment without ever taking their hard work to live markets. While this is not a bad thing for those not seeking to take risk, it can prove less helpful and a waste of time for those driven to trying their ideas with real trading.

HOW TO BACKTEST WITH TRADINGVIEW REPLAY

TradingView’s Replay functionality allows users to watch historical price movements happen over and over as if they were taking place live. Traders can use Replay to backtest strategies by overlaying the indicator or study they wish to test and then playing back the price action in a market to see if historical case studies confirm or deny their strategy.

You can test multiple time intervals, indicators, and markets using Replay, but keep in mind that historical success does not guarantee future profits. Also, TradingView reserves Replay for Essential, Plus, or Premium plan members, so Basic members cannot backtest trading strategies with Replay.

FREQUENTLY ASKED QUESTIONS

While more analysis and research often helps traders map a course of action for their strategies, backtesting should only be seen as one of many tools helpful to the potential success of a trader.

Though simulated trading environments like TradingView’s Paper Trading are now very similar to the real thing, live trading can bring unanticipated dynamics such as emotions, volatility, and trade costs that the demo trader has not accounted for.

This can create large discrepancies between demo trading success and the potential of profits in the live market.

Curve fitting in trading occurs when you take historical price action and fit the data to whatever strategy would have been profitable. Traders will cycle through the hundreds of technical and fundamental analyses at their disposal looking for the few strategies that would have worked in the past to attempt to predict the future.

Successful traders often research strategies and test them looking for a solid set of ideas and mechanics that they know will not always guarantee them profits.

OPEN AN ACCOUNT NOW

A huge range of forex pairs with low spreads and fast, reliable execution

Trade on our award-winning trading app1 available on iOS and Android

24/5 Support from people who know forex

OPEN AN ACCOUNT NOW

A huge range of forex pairs with low spreads and fast, reliable execution

Trade on our award-winning trading app1 available on iOS and Android

24/5 Support from people who know forex

1 #1 US Broker was awarded to tastyfx on January 27, 2026 during the ForexBrokers.com 2026 Annual Awards. #1 Overall Broker, #1 Mobile App, #1 Trust Score, and #1 Web Platform are accolades presented to IG, parent company of tastyfx during the same review. Accolades were awarded by the ForexBrokers.com research team based on demonstrated excellence in categories considered important to investors, traders, and consumers. Click here to learn about how they rate brokers.

.jpg?format=pjpg&auto=webp&quality=90&width=365&disable=upscale)